In this blog post, learn how to replicate one of the most successful hedge fund in the world by using low-cost ETFs.

The story

Raymond Thomas Dalio is an American billionaire hedge fund manager and philanthropist who has served as co-chief investment officer of Bridgewater Associates since 1985. He founded Bridgewater in 1975 in New York.

Bridgewater Associates is a global macro hedge fund firm. It uses quantitative investment methods to identify new investments while avoiding unrealistic historical models. Its goal is to structure portfolios with uncorrelated investment returns based on risk allocations rather than asset allocations.

While Bridgewater Associates is one of the best performing hedge funds in the world, his portfolio strategy has not always been very accessible by the public. However, a few investment strategists have created some asset allocation models to replicate the strategy by using low-cost ETFs. In a nutshell, the strategic asset allocation is designed in such a way that it balances the percentage of risk rather than the percentage of money to each asset. The biggest challenge is in sticking with the allocation as the years go and by each asset performs differently.

The website www.lazyportfolioetf.com attempts to replicate the strategy through a 100% ETF asset allocation strategy. The strategy is named the "Ray Dalio All Weather Portfolio"

Please find below some details.

Strategic Asset Allocation and ETFs

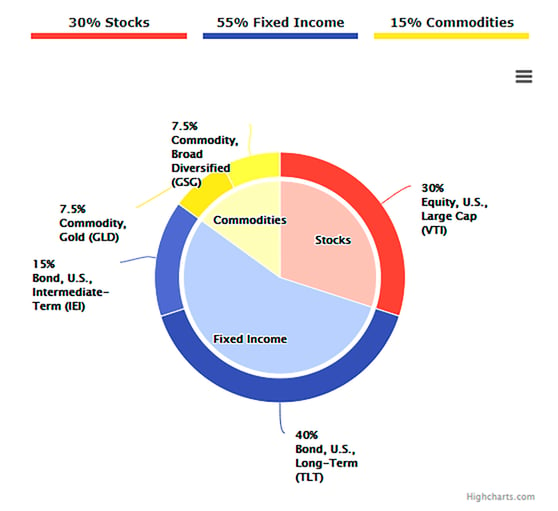

The Ray Dalio All Weather Portfolio is exposed for 30% on the Stock Market, 55% in Fixed Income and for 15% on Commodities. It's a Medium Risk portfolio and it can be replicated with 5 ETFs.

The portfolio has the following strategic asset allocation:

The Ray Dalio All Weather Portfolio can be replicated with the following ETFs:

The Ray Dalio All Weather Portfolio: ETF allocation and returns

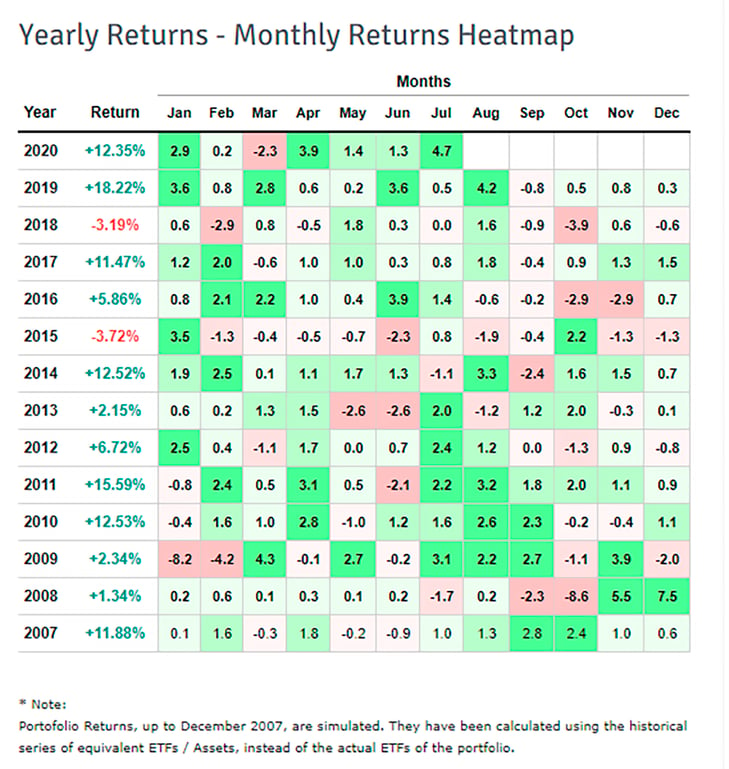

In the last 10 years, the portfolio obtained a 8.11% compound annual return, with a 5.73% standard deviation.

In 2020, the portfolio is up +12.35% as of the end of July.

See below monthly returns since 2007 (past returns are not indicate of future performance) .

Final words

While some hedge funds are not investable by the majority of investors, it is possible to replicate to some extent their strategy through a liquid, low-cost portfolio. However, one should expect to face higher volatility while incurring some other risks (e.g counterparty).