The price of Bitcoin has just struck a 5-month high. A lot of the optimism centres around the possible approval of a Bitcoin ETF in the United States this year. But are the SEC really ready to approve one?

What’s happening to Bitcoin?

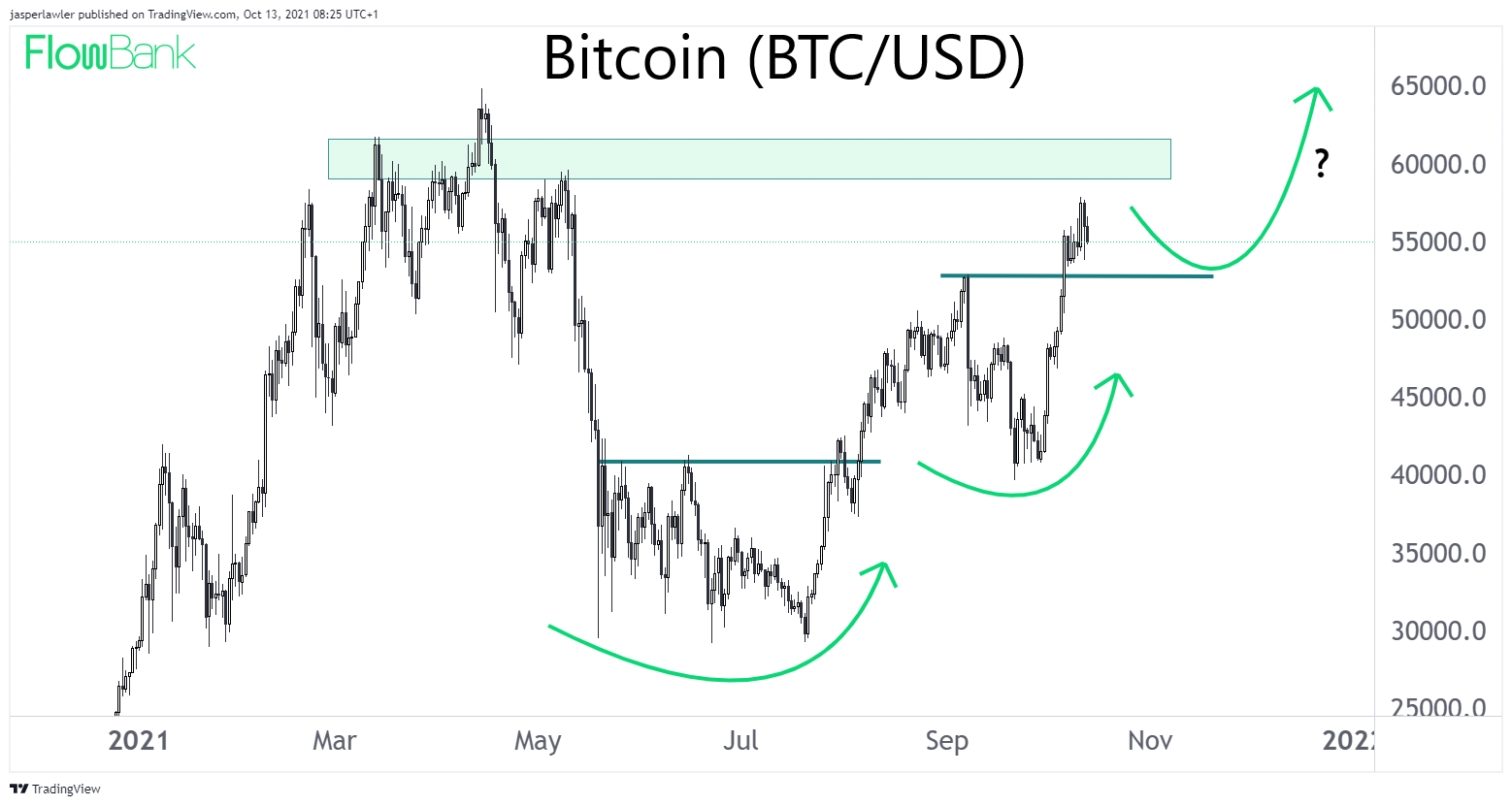

BTC/USD has risen 27% in the past two weeks to over $57,000 and its highest price level since May.

The largest cryptocurrency by market cap has snapped back furiously from a dip under $40,000 in late September, in part over expectation for the first US Bitcoin ETF.

At the same time Bitcoin recovered its $1 trillion market cap, which has become synonymous with positive sentiment in the crypto market.

BTC/USD daily candlestick chart

Source: @jasperlawler / TradingView

The price has been steadily unwinding the 50% haircut that took place in April through May and could be set for new all-time highs if the current momentum continues.

Why has the Bitcoin price been rising?

Confidence has returned to cryptocurrency markets with confidence seemingly concentrated towards Bitcoin rather than the wider altcoin space.

The best explanation for this renewed appetite for Bitcoin likely stems from the possible approval of a Bitcoin ETF in the United States, perhaps as soon as next month.

Reminder: What is a Bitcoin ETF? It is an exchange-traded fund, shortened to ETF. It is a type of investment fund that tracks the price of an underlying asset, such as a stock index or gold. A Bitcoin ETF would have Bitcoin as the underlying asset. ETFs are cheaper than mutual funds and trade on the stock exchange, making them more accessible to the wider investing public. It’s for this reason that a Bitcoin ETF has been so heavily associated with greater ‘Bitcoin adoption’ and by that virtue a higher Bitcoin price.

NOTE: Outside of the US, including in Switzerland, the EU and Canada, a number of Exchange-traded Bitcoin and other crypto asset products are already available. That includes ETPs from the likes of Coinshares as well as ETFs, closed-end funds and a crypto ETN. The FlowBank crypto-asset offering is best in class.

There are now several companies that have applied to the SEC for approval to offer a Bitcoin ETF in the United States. The SEC extended the deadline of four BTC ETFs for 45 days.

- The Global X Bitcoin Trust

- Valkyrie XBTO Bitcoin Futures Fund

- WisdomTree Bitcoin Trust

- Kryptoin Bitcoin ETF

In September, Van Eck’s physically-backed Bitcoin ETF was delayed for the second time this year until November 14.

Will the SEC approve a Bitcoin ETF in 2021?

The SEC is still kicking the can down the road by delaying all applications for a Bitcoin ETF. There are several reasons for this that centre around fear of market manipulation on unregulated cryptocurrency exchanges. But it appears to be headed in the direction of approval.

The SEC recently approved the Volt Crypto Industry Revolution and Tech ETF in the United States - which tracks a basket of stocks with high exposure to Bitcoin. SEC Chair Garry Gensler has hinted that a Bitcoin futures ETF might be the next baby step towards approval of a spot Bitcoin ETF backed by physical Bitcoin.

However, any approval happening this year has some big hurdles to jump, possibly setting up some disappointment in crypto markets. As we see it, the three big ones are:

- The SEC wants more regulatory control over Bitcoin before it approves a Bitcoin ETF, demonstrated by its recent threats against Coinbase and actions against Binance.

- There is still an unexplained discrepancy between Bitcoin prices and Bitcoin futures contracts.

- Regulators could wait to approve several Bitcoin ETFs at once to reduce the chance of any one fund getting too large.

Bitcoin analysis metrics

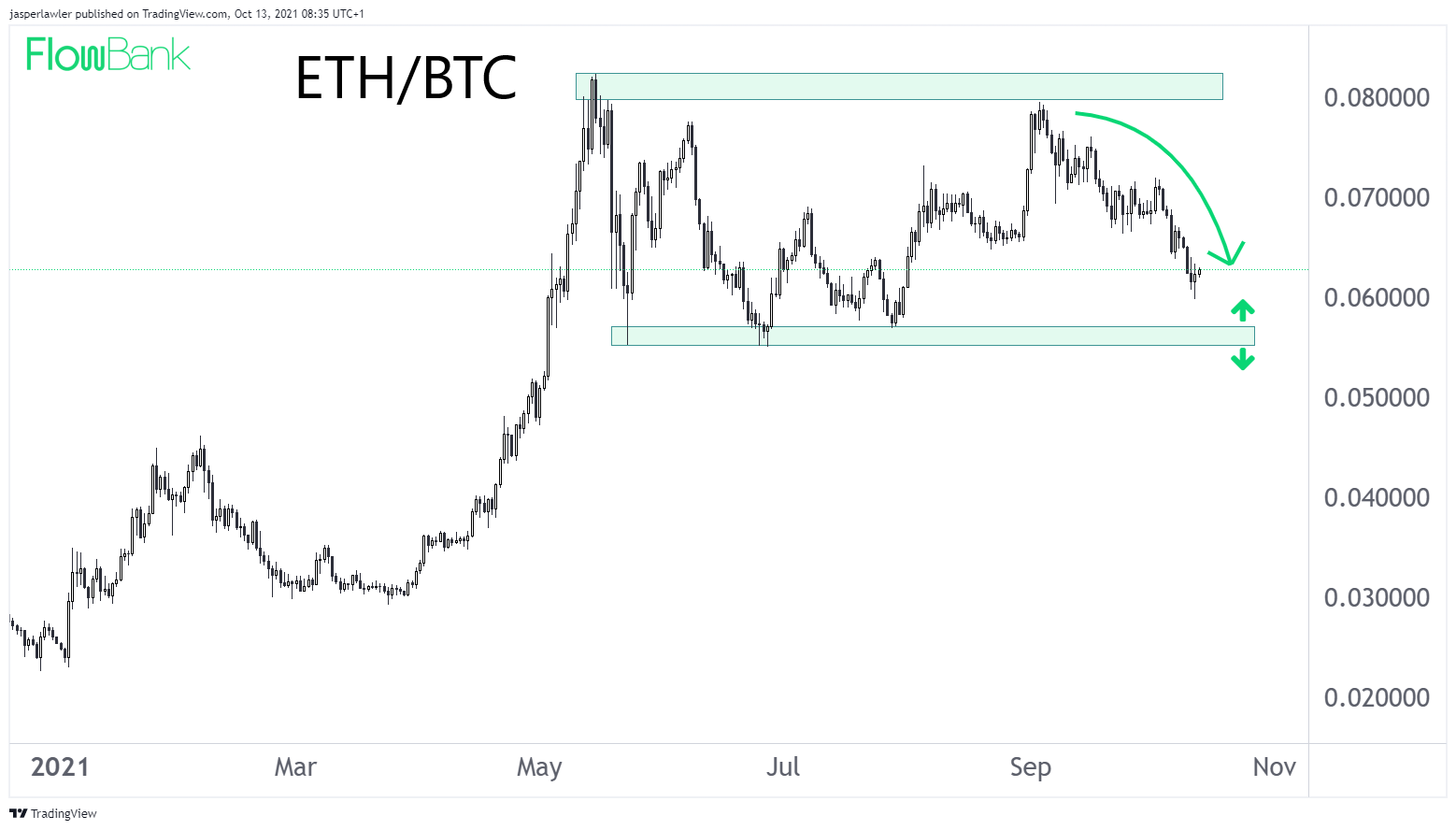

Underlying the strength in Bitcoin versus fiat currencies like the US dollar is also a return to relative strength versus other leading cryptocurrencies. A widely watched cryptocurrency cross, ETH/BTC has been falling, showing Bitcoin relative strength over the Ether token.

ETH/BTC has been caught in a horizontal trading range between 0.055 and 0.08 and is currently testing the bottom-half of the range.

ETH/BTC daily candlestick chart

Source: @jasperlawler / TradingView

The Bitcoin Hash rate has normalised since bottoming in July but has not yet recovered the peak near 200M. The Bitcoin network is not as big as it was, but should the price hit new ATHs, the hash rate would be expected to follow suit.

The ban on mining in China continues to hold back activity but the hash rate recovery shows miners are redeploying elsewhere, suggesting it needn’t be a long term issue for Bitcoin.

Bitcoin Hash rate

Source: Bitinfocharts

The flows into cryptocurrency exchanges has chopped above and below the zero level throughout the Bitcoin price pullback over the past few months. As price has broken out in the last week, flows to exchanges have turned positive again.

Bitcoin net exchange flows

Source: Coinmarketcap / Intotheblock

The takeaways for Bitcoin

- Bitcoin is back in a bull market after the recent price surge.

- The SEC looks closer to approving a Bitcoin EFT but enthusiasm for it happening this year might be misplaced

- Metrics including the hash rate, exchange flows and altcoin cross rates seem supportive

How to trade Bitcoin ETFs

As a reminder, there are Bitcoin Exchange-traded products already available outside of the United States. You can find more information about the several cryptocurrency assets offered by FlowBank on the FlowBank website or by contacting customer support.