It was not an easy year for a company focused on serving restaurants, but it seems like they managed to pull it off, and with grace. How?

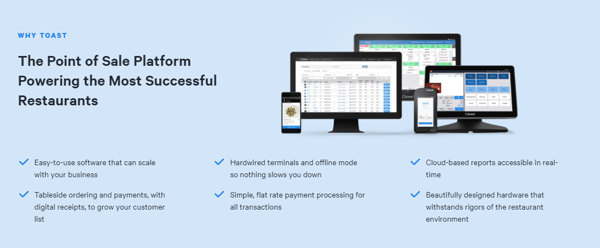

What is Toast?

What a crispy name for a company! Toast makes both the hardware and software to facilitate payments and management in restaurants. The payment solution is meant to be faster and simple. No more waiting 10 minutes for a paper check, then 10 more minutes before he gets the card machine, taking 30 minutes of time between the time you decided to leave and the time you are actually leaving.

They offer hardware like point of sales – the screen the employee types on at the counter – and card machines, as well as digital services such as online ordering, payroll, team, and stock management. It is an all in one solution for restaurant to handle their daily payments and operations.

Source: Toast website

Good COVID-19 moments

Toast's sales surged in 2019 as tens of thousands of restaurants registered for their services. The solution was perfectly fitted to restaurant businesses and benefited from an outstanding popularity.

However, this glory was short-lived, as when the lockdown arrived in March, the company lost 80% of its restaurants sales, which forced them to lay off over half of their employees in April - or around 1'300 jobs.

“This is a massive disruption that hit the industry virtually overnight,” said Chris Comparato, the company’s CEO. “Many restaurants that have temporarily closed may never reopen.”

Everything was set, Toast was doomed to be one of the biggest looser of the pandemic. However, the company did what they had to do to keep thriving. Dining-in is out of the equation, let's focus on take-out (it seemed trendy).

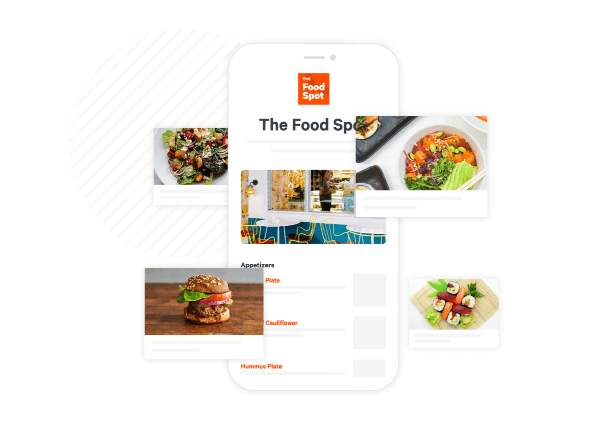

They completely pivoted their mission and activities, adding many pandemic friendly services such as delivery, online ordering, settling up attractive online menus, electronic gift cards, and even loans to restaurants working only on cash. They even made a gesture and offered customers on month free of charge, aware of the fact that most were short on cash.

The best thing is the valuation of the company. It was valued at 4.9B in February, now it is worth around 8 billion. Quite a move indeed for having gone through a pandemic killing 80% of your day-to-day business.

Source: Toast website

Source: Toast website

The excellent steak knife vs. the Swiss army knife

Toast's biggest competitor is Square, the payment solutions which we covered in this article. There is one big difference: Square does it all. And I mean, all. When you have a look at their website, they're covering all types of businesses: restaurants sure, but also cafes, bookshops, gyms, nightclubs, clothing stores, electronics, you name it, they have it. Not only that, but they also offer peer to peer payments, trading, cryptocurrency, and many more services to their users.

On the other hand, when you look at the types of businesses that Toast covers, you get types of... restaurants. Sushi’s, steakhouse, Chinese, American Diner, bakeries, fast foods. Their sole focus is to serve businesses serving food, and nothing else.

One thing is for sure: Toast offers a Swiss Army Knife solution for restaurant at least, but it is not able to cover other demands. While this might hurt them in terms of market share vs. competitors attacking every segment, this is also the opportunity to focus on one specific segment and to serve it with an unmatched quality. Sales report, inventory management, the company offers everything that a restaurant can dream of. Basically, they are an excellent cutting knife, as they do one thing very well: restaurants. But can they survive vs. a Swiss army knife like Square that does everything? Let’s face it, it’s great to be able to do it all, but when you eat a good Ribeye, nothing is ever going to replace a solid steak knife.

The takeaway

Adaptability is the most important skill in business, and sometimes, you also need to make some sacrifices to stay afloat. Toast understood this and managed. In fact, its rebound was so rapid that some investors even value it higher than 8 billion and many see it as a potential IPO for 2021. We should also note that since things started to look brighter, they hired back some employees they had to lay off.

Businesses now want Swiss army knives: all-inclusive solution without having to search for providers for individual operation procedures. Toast satisfies this demand for restaurant. Will it be enough vs. do-it-all's like Square?

Sources:

“Pop collars, pop stocks” — Abercrombie’s dirty secret. The Dow’s thirty-thow. Toast’s $8B steak knife., in Snacks Daily Podcast

Dine-tech startup Toast pulls off a pandemic pivot (and nearly doubles in value), in Robinhood Snacks

Second Share Purchase Deal Values POS Startup Toast At $8B, in PYMNTS

Restaurant Tech Firm Toast Reaches $8bn Valuation After Cutting Staff, in Red Herring

Restaurant management platform Toast cuts 50% of staff, in TechCrunch