With mortgage interest rates starting to creep back up, and home prices outstripping inflation, housing demand appears to be unwavering as buyer traffic continues to see momentum. One things is sure, there's a housing shortage in the U.S. Can homebuilders benefit from this?

Key takeaways

- Shortages of wood have resulted in longer build times, squeezed timelines, but mainly, in more expensive homes.

- A standard, newly built home in the U.S. market is now 61% more expensive than 2019 levels.

- Lumber has soared mainly from a rise in demand from stay-at-home orders—furniture, remodeling, and repairs—and new house sales.

- In recent months, homebuilders broke through former ceilings after more than a decade of muffling performances.

- There are three reasons the real estate market boom is not in a bubble.

The big picture

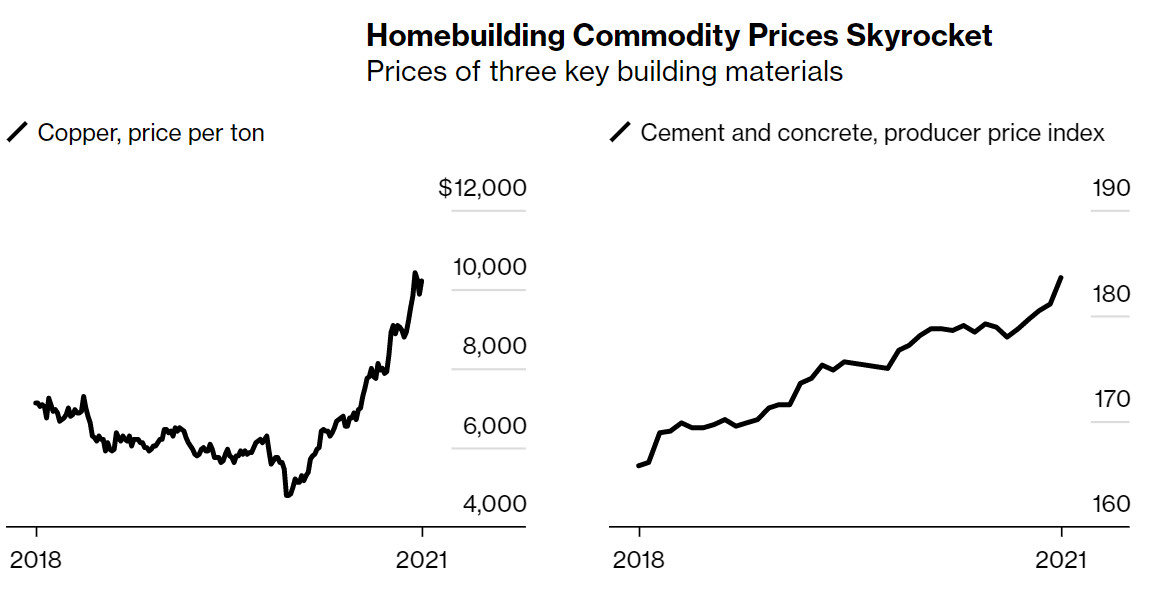

Home builders are in an enviable place because millions of millennials are starting to enter their prime home buying years. Mortgage rates remain at near all-time lows and a stimulus package has bolstered consumer savings. However, would be sellers are timid to offer their assets pushing down the supply of available houses relative to the demand. Furthermore, the last decade has seen a slowdown in the number of houses being built. This has cornered buyers into the newly-constructed home market. This is good news for home builders but, home builders have also seen a surge in the price of inputs—metals, semiconductors, lumber etc. Shortage of wood have resulted in longer build times, squeezed timelines, but mainly, in more expensive homes.

The investment question is therefore, how long can home builders pass down the cost to consumers before having to haircut their margins?

The rising cost of homes

The skyrocketing costs for several key building materials are largely behind the dramatic increase in U.S. home prices. The builder’s selling price index in Boise, Idaho is up 58% between 2020 and now. But this figure makes complete sense when looking at the blueprint of a house. The foundation needs concrete slabs and the walls needs oriented strand boards (wood) all of which have seen prices soar. Then, you need roof trusses, drywall, plumbing, HVAC, electricity, paint, and appliances. These all need raw materials like steel, plastics, and copper. Storms and power outages have slowed down the production of some of the items which has further added pressure on homebuilders having to meet certain contract requirements. Ultimately, buyers are bearing the cost. A standard, newly built home in the U.S. market is now 61% more expensive than 2019 levels.

Lumber pulling an Icarus?

Will we finally see relief on the lumber front? According to Bloomberg, the cost of lumber has quadrupled from 2019 levels, and seen its cost in new home building rise 262% over 2020. As a reminder, lumber has been soaring because of a rise in demand from stay-at-home orders, things like Ikea furniture, and housing-specific demand like remodeling, and repairs. It is not specifically an inflation issue.

Wood demand shot up in the summer of the pandemic. In Autumn 2020, homebuilders cranked up construction. By December, single family housing starts rose to highest levels since 2006. This is directly correlated to low mortgages from low interest rates. Wood mills capacity got overwhelmed, and home builders bought a bunch of inventory in case of a runout. While wood product companies wanted to build more mills, it’s a two-year process which is a bit late. Producers wanted to increase output, but it was hard to hire new workers because there were less blue-collar workers, and free money didn’t help.

Today wood prices are falling, despite futures remaining nearly three times what is typical for this time of year. The main explanation is an increased production of wood. Also, more workers taking jobs, temporary shutdowns of petrochemical plants needed for plywood production getting resolved, and mortgage originations falling from falling demand, see graph from WSJ below. Possible losers in this situation are UWM Holdings, Rocket Cos, loanDepot and Home Point Capital as gains on sales of mortgage loans are declining. Furthermore, we have interest rates set to rise in 2022-2023 which means less mortgage loans.

Playing the rising home prices with...

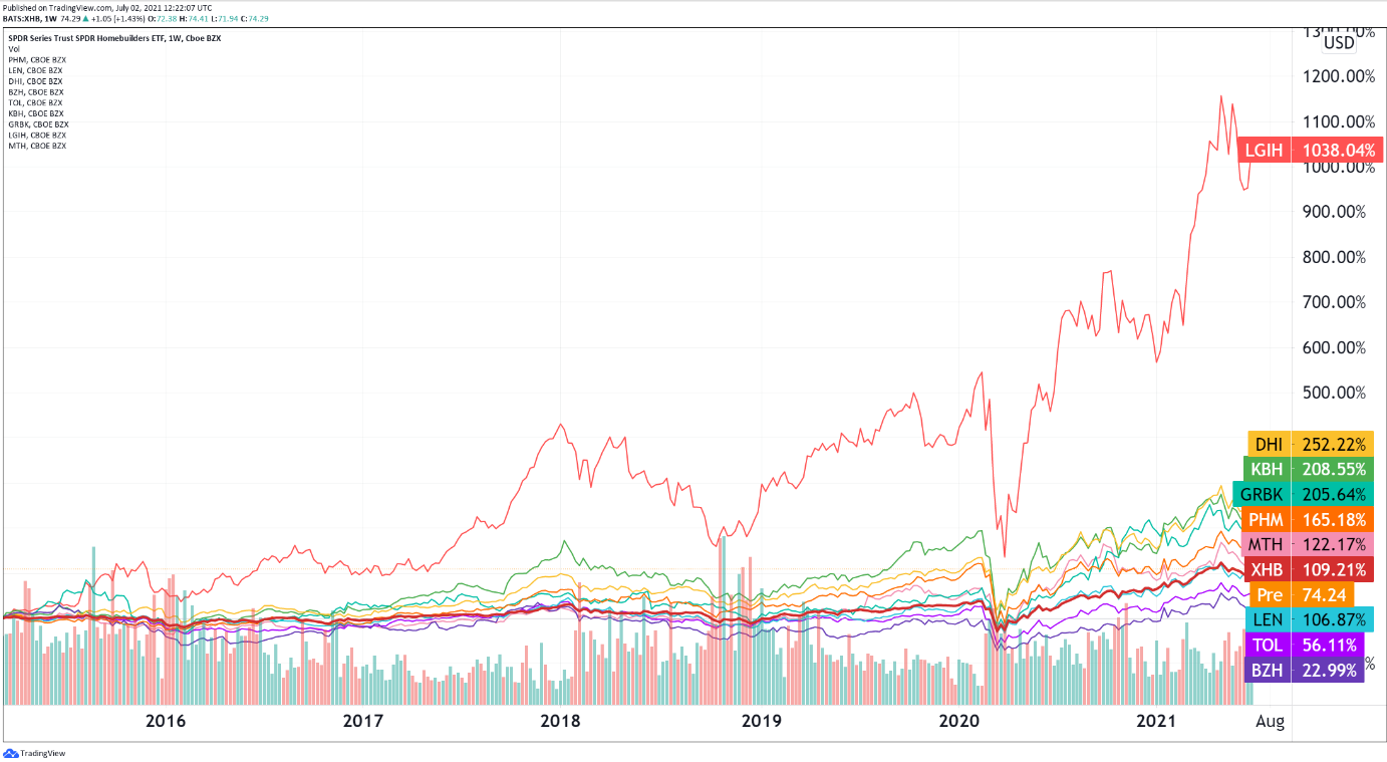

…homebuilder stocks. The Homebuilders ETF (XHB) is a good place to start—it debuted on the market in 2006—at a time where Homebuilders were high—but then 2008 tilted everything south, and since then, homebuilders have struggled to get back above their 2006 highs. However, in recent months, homebuilders broke through former ceilings after more than a decade of muffling performances. With this trend reversal, would it be possible to expect more to come?

Goldman Sachs equity research indicates that not all home builder stocks are going to be outperformers in H2. For example, they switched their rating from buy to neutral, yesterday, on PulteGroup (PHM). Their reason? Strength in demand is already priced in... Pulte’s stock fell 2% as a result. But Pulte shares are up 26% YTD, falling behind homebuilder rivals, Lennar, Horton, Beazer Homes and Toll Brothers. While Pulte has outperformed KB Home by 22%, Goldman Sachs suggest a buy rating on KB Home, and the same is said of the former three outfits.

But some analysts say focus on entry-level starter properties, the smaller-end home builders because that is where the shortage demand is hottest. Green Brick Partners, LGI Homes and Meritage all operate well within these parks. Sales and closings are seeing clear momentum with LGI Homes for example reporting home closings growth of 57% in May. While home builders seem to be highly leveraged on average, they also have strong balance sheets that could alleviate debt related concerns.

A real estate bubble? Let's explore this further...

With all these pushes and pulls, one might astutely recognize the inherent risk involved in the home builder stock game. What if supply shocks sustain? What of this slowing demand for new houses? Don’t lower prices mean home builders charge less and thus see lower margins? But, now that we see a falling price of lumber as one indicator of a transitionary inflation phenomenon, maybe we should not stress the inflation and real estate market bubble thesis. In fact, the U.S. is not in a real estate bubble, suggests Forbes column writer Raul Elizalde.

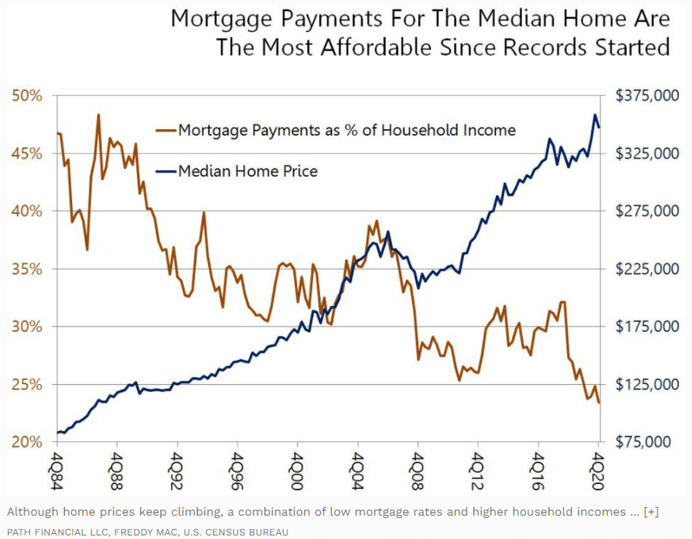

There are three reasons the real estate market boom is not a bubble. The first is that there is no credit boom because banks have rigorous lending standards for mortgage lending now. The second and most relevant to home builder stocks is the home shortage in the US. Construction collapsed in 2008 and the levels are not even back near trend yet. A third reason is that homes are more affordable than ever with median home prices rising, but mortgage payment falling.