There has been a burst of activity in Uranium stocks with double digit single day gains following a US bill that classified uranium alongside other minerals as vital to national security.

Must know

- Uranium companies like Cameco corp, Uranium Energy, Energy Fuels and ETF like North Shore Global Uranium Mining are seeing double digit gains this week.

- The US passed an updated version of the annual National Defense Authorisation Act that classified some rare minerals as vital to national security, meaning the US government might seek to stockpile them, creating extra demand

Even before the announcement, Uranium stocks had been breaking out of a 10-year downtrend- Other commodities like copper have been gaining this year amid demand from China and due to the search from investors for ESG investments that benefit from the coming ‘green revolution’.

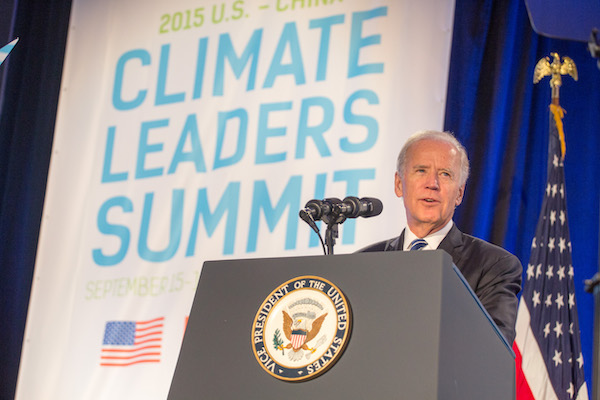

- Uranium is one of the principal materials used in Nuclear power, an industry which is expected to grow as economies, including the US under Joe Biden attempt to move to ‘net zero’ carbon emissions

What’s happening?

Uranium stocks have burst higher, jumping double digits on the chance that the US government will become a giant new buyer in the market for the commodity and offer support to the companies that produce it.

The Story

The story could be one of a uranium catch-up to the new commodity super cycle.

Uranium commodity futures as well as uranium stocks are latecomers to the huge commodity rally of the last month and indeed the last year. Gold stocks were the outperformers through to the summer. More recently cyclical industrial metals have taken off with copper prices now at a 7-year high and many copper mining stocks flying alongside it. Likewise with iron ore. Even commodity currencies are breaking out as we noted in our blog These days investors ‘dig’ commodity currencies

As the chart below shows, this situation has already started to change with some big moves higher in Uranium stocks in the last week pushing the Global X Uranium ETF above a down-sloping trendline and above its 200-week moving average.

ESG mania

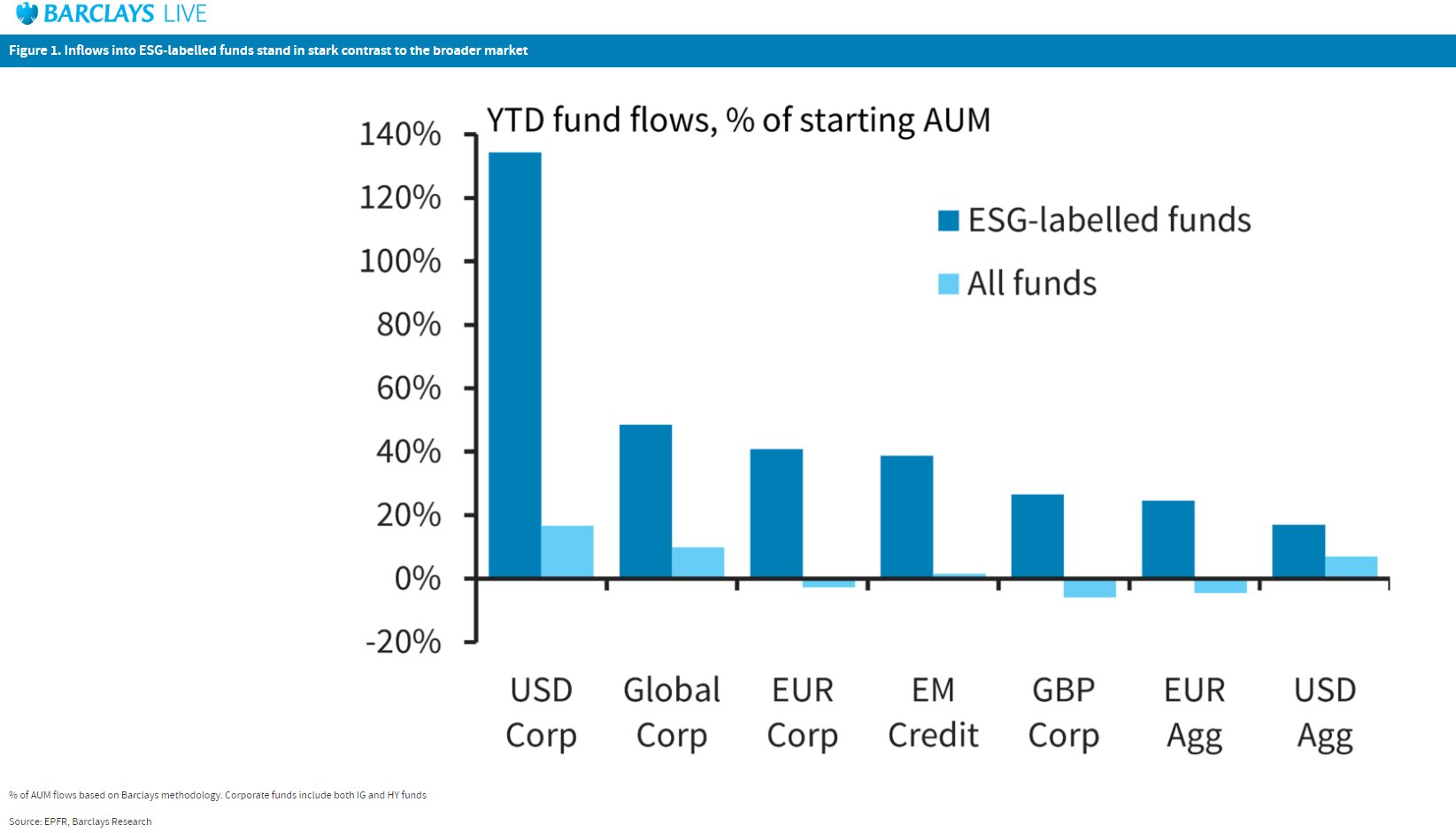

We have noted through various livewires that investors are flocking to Environmental / ESG funds. As Barclays noted ESG is “too trendy to ignore”.

However, as can be seen by the monumental performance of Tesla stock, there are limited spaces to pump ESG funds. Uranium may provide a new place.

While President Trump was a ‘clean coal’ guy, a President Biden looks much more like being a ‘nuclear guy’. Biden’s $2 trillion ‘Green new deal style’ infrastructure plan creates a new ARPA Agency for Climate that has put the development and deployment of advanced nuclear reactors as a priority, seeking to build them cheaper and faster through technical innovation. Biden’s push for clean energy involving the US likely signing back onto the Paris Climate accord will reduce competition from coal powered plants that will be phased out sooner, favouring ‘carbon-free’ nuclear power.

The US Senate Committee on Environment and Public Works just approved the American Nuclear Infrastructure Act designed to boost the US nuclear industry, establish a strategic Uranium Reserve, support enhancing the US nuclear fuel cycle and encourage US reactor exports worldwide.

As much investment is pouring into wind farms and solar panels, which have improved dramatically in efficiency in the last decade – the science shows that intermittent renewable are not able to provide the continuous 24/7 electricity needed by industry and the transition to electric vehicles.

In summary, ESG investment flows and a Biden administration that needs nuclear to go carbon neutral are positive forces for uranium demand. But the argument doesn’t stop there, many uranium mines have closed as the prices has declined over the past decade –a trend that has been exacerbated by the coronavirus pandemic. The uranium market is severely under-supplied.

Risks

This is a small space; the market cap of these companies is in the 100s of millions, with only Cameo investable many many big firms at around $5 billion. That means the share prices will be volatile. For the moment that volatility is helping the upside with double digit daily gains, but the same logic applies to the downside.

How to play it

Uranium stocks

| Stock | Ticker | Price | Market Cap |

| Cameco Corp | CCJ | 12.15 | 4.81 B |

| Energy Fuels inc | UUUU | 2.96 | 356.115 M |

| Uranium Energy corp | UEC | 1.43 | 282.M |

ETFs

North Shore Global Uranium Mining ETF (URNM)

Global X Uranium ETF (URA)