On Thursday, the US government faced lacklustre demand for its latest record auction of long-dated Treasury bonds, marking one of its first mis-steps in funding historic spending packages passed by US legislators since March. In this post, we highlight why this could be a moment of truth for the US Treasury market and what could be the ultimate consequences.

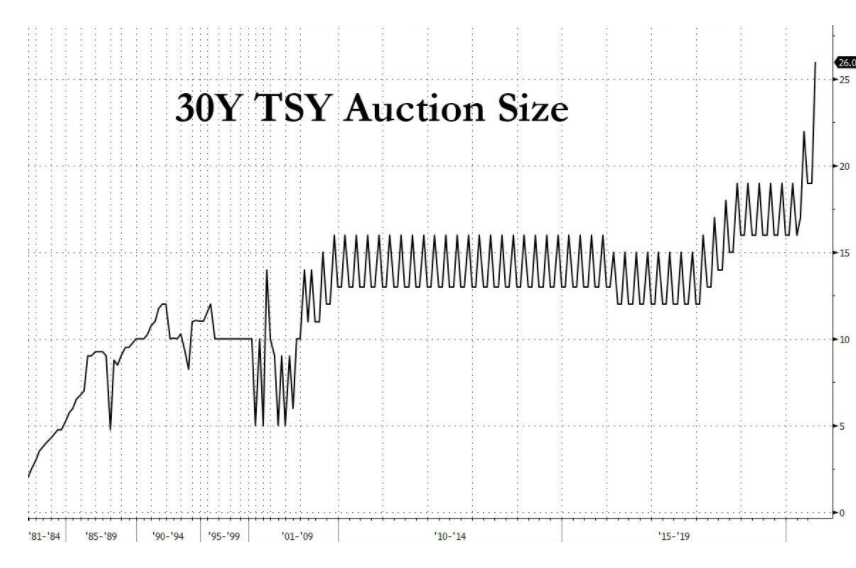

There was a moment of panic in markets yesterday when US 30 year bond auction result came out. After the stellar, record-sized 3Y and 10Y auctions earlier this week, the Treasury concluded the refunding week with another record auction, this time in the form of an all time high $26BN in 30Y bonds (see chart below - source: Bloomberg).

This was without doubt the ugliest 30Y auction in years. Investors submitted bids for 2.14 times the amount on offer, the lowest bid-to-cover ratio for 30-year bonds since July 2019.

The disappointing result caused a sell-off in the Treasury market and long-dated Treasuries sold off at a faster pace than short-dated notes, sending yields higher. The bonds were sold at a yield of 1.4 per cent, more than 0.02 percentage points above market expectations at the time of the auction deadline (see chart below - source: FT).

As highlighted by Ritesh Jain (www.worldoutofwhack.com), if US treasuries gives market related yields at auction then the yields might ultimately blow out.

If US treasuries does not want to give higher cutoff yield then Fed will have to buy the bonds by capping the yield curve.

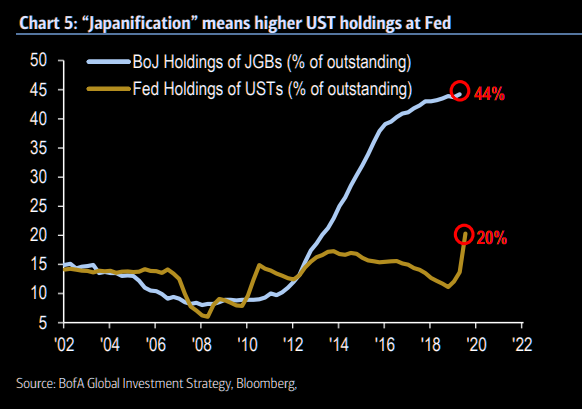

The good news is that the Fed still has ample room to do so, if "Japanification" is indeed the end game (see chart below courtesy of Crescat Capital).

However, in a scenario of yield curve control, one can expect the dollar to tank and...gold to shine.

Read ou next article: How to trade cannabis shares cfds