Recent market activity shows there has been a shift in power in financial markets for the first time from powerful institutions towards individuals. A new model of hedge fund could be the next step

How hedge funds work

Have you ever heard of an “idea dinner”? It sounds like something you would read on BBCFood.com when unsure what to eat on a Thursday night. But it is quite different.

At an idea dinner is where powerful and well-connected investors - loosely known as hedge fund managers - will meet privately at a fancy restaurant, often in New York or London and talk about investments. Each person in attendance will bring one idea on a trade in stocks, bonds, currencies, or other assets to share with the other diners.

OK “Sharing is caring” but what is different here is that these investors control millions if not billions of dollars in capital.

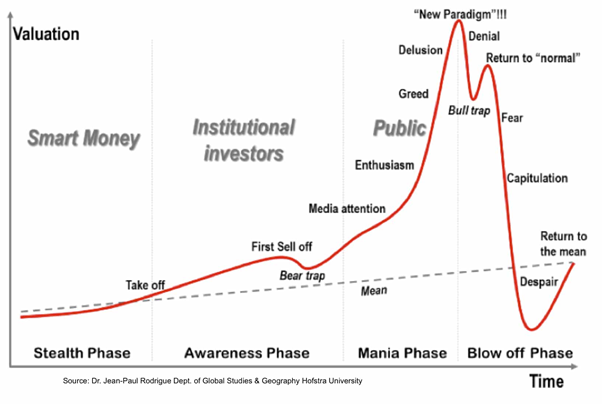

Step 1. If they agree on an idea and go away and act on it, that could quite easily be enough to move the market in the right direction.

Step 2. In the City and on Wall Street word travels fast and other in-the-know hedge funds and investors get into the same trade, understanding the buying power that is behind it.

Step 3. When the price begins to move, savvy individual traders will get in and try to ride the trend.

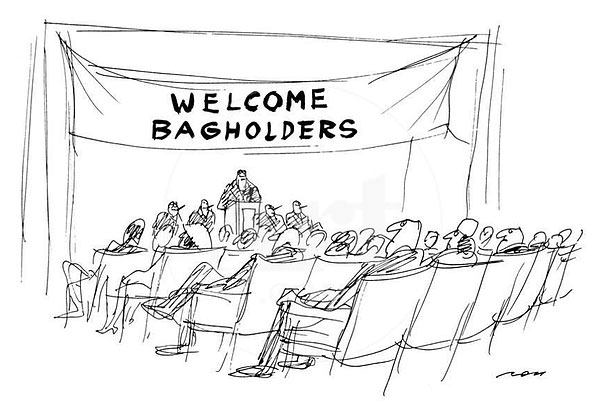

Step 3. Finally what’s left are known as the ‘bag holders’ - the 'out-of-the-know' mom n’ pop investors who get into the trade when it is already well away from the entry point of the idea dinner attendees. The hedge funds distribute their holdings at a tidy profit, while the rest scramble to get out as the price rolls over. The last to get in are normally the last to get out - holding the bag of losses.

It is quite easy to make the case that the above scenario is not ‘fair’ to all investors. However, life is not fair. The view of any investor that understands how the system works is that if you time it right, you can still participate. It is these waves of buying and selling in markets that provide bountiful opportunities to profit.

But according to the sub-Reddit r/WallStreetBets, this view is for the “Boomers” - they want equal opportunity for all. The moves in GME stock is them taking action to get it.

Technology and knowledge is power

The internet in so many areas of life is empowering individuals that were once kept separate, in the dark and unable to afford access.

Because of the internet, ordinary people have the same access to information as organised capital and institutions. You can now google something that might have once only been available by going to a select library or knowing the right person. The internet is also the driving force behind online brokers being able to offer very affordable investing and trading and in more advanced instruments like options trading.

Online forums like Reddit give the individual investor an opportunity to not operate in a vacuum like in the past but to share this information and share ideas. The upvoting system for posts in Reddit is perfect for filtering out the chuff and bringing the best ideas to the forefront.

The short squeeze was genius

Squeezing a stock with a 140% short interest is a fantastic trade. What company deserves all its shares and more being used to bet against it? It’s an unsustainable position and it is a classic hedge fund trade to squeeze it. The squeeze has no root in fundamentals and does not need to. It is simply using the publicly available information about how the stock has been traded to make a trade.

What is needed to make this trade?

- The knowledge of short interest (SI) in a stock - this is available from multiple online services

- The buying power to pull it off. This became possible thanks to individual investors pooling their resources to share and fund an idea (just like the idea dinner)

Not every Reddit user is an investing genius of course but in r/WallStreetBets there is lots of good fundamental research and technical analysis that can easily match the ideas proposed in sell-side research by “professionals”. Equally there are some really silly ideas in WallStreetBets that defy any logic and the same exact thing can be said of sell side analysts who often follow the herd like sheep under one narrative that quite often turns out to be wrong.

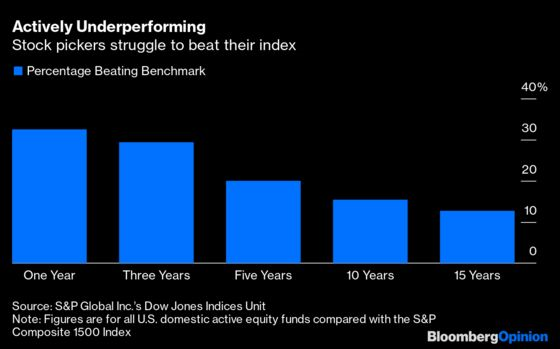

There are genius professional investors out there - we all know the names - Warren Buffett, Ray Dalio and more recently Kathy Wood. But it is quite easy to make the case that most professional investors are not geniuses - just look at the data tracking how many active managers outperformed their benchmark in recent years.

On top of that, many of the investment managers that are outperforming their benchmark are piggybacking on other hedge fund managers' ideas - or simply riding the momentum of the market. For example, the FAANG group of tech stocks have done well for years. Simply buying into an already working idea has made many professional investors (as well as retail investors) very wealthy.

The decentralised hedge fund

Put all that together - with the same information available - the same technology - the same pricing - and with the same analytical and idea generating capacity - one can (and I am) make the case that online chatrooms full of retail investors can function in just the same way as a hedge fund, or even a group of hedge funds.

In a decentralised hedge fund, no manager is necessary, only the technology infrastructure and the participation - just like in a blockchain where no one location is needed to store Bitcoin.

How would this decentralised hedge fund be made? Over to you...