Read the 10 stories to remember from the first quarter of 2021.

As of the end of March, the total crypto market capitalization posts new all-time high above $1.9 trillion, the equivalent of Apple or Saudi Aramco and as much as the aggregate market capitalization of US banks. Below, you will find the top 10 stories to remember from an extraordinary first quarter for cryptoassets.

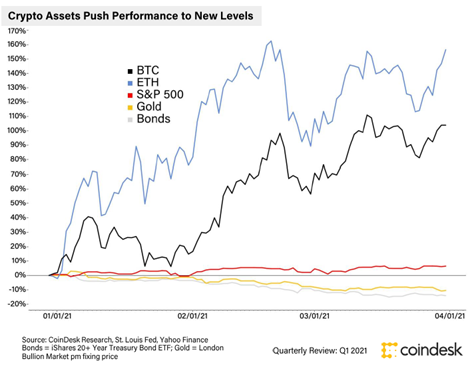

Story #1: Massive Outperformance of bitcoin (BTC) and ether (ETH) relative to more traditional assets.

Bitcoin’s total market value passed $1 trillion this quarter, making it an asset class worth looing at for many of the large institutions who previously ignored it because its market was too small.

While Bitcoin (BTC) massively outperformed traditional asset classes with a +100% gain, Ether (ETC) did even better with a 162% gain. Ethereum’s technology road map continued to progress and support for Ethereum 2.0 can be seen in the strong growth in value staked on the Beacon Chain (more on this on story #9). A surge in activity on decentralized applications (story #9) and the frenzy around NFTs (see story #10) also gave a strong boost to ETH activity and Ethereum awareness.

Coming back to Bitcoin, we note that the 90-day correlation between BTC and both Gold and S&P 500 has been declining, reverting to a 0-0.2 range in Q1. It reached a peak of almost 0.6 with Gold in March 2020 and 0.4 with S&P 500 in November 2020. BTC-US dollar correlation remained at negative levels.

The macro backdrop of massive liquidity injections hitting financial markets and the real economy is increasing inflation fears while many investors believe that we are in the midst of a global currency debasement. This context – in addition to other factors mentioned below - remains favorable to Bitcoin and cryptocurrencies.

Chart: Q1 performance of Bitcoin and Ether vs. traditional asset classes (source: Coindesk)

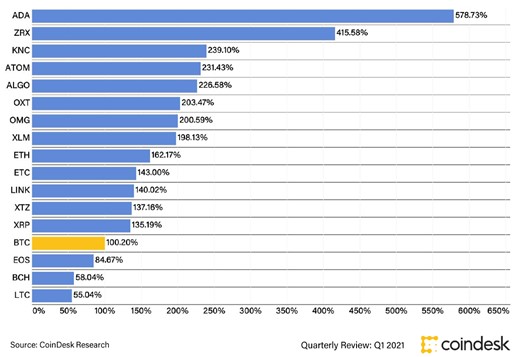

Story #2: Astonishing returns from a handful of smaller crypto assets.

Many altcoins did even better than ether and bitcoin. ADA Cardano is the best performer with a staggering +579% performance.

Chart: Best performing cryptocurrencies in Q1 (source: Coindesk)

A consequence of this outperformance by many altcoins is that Bitcoin’s market dominance has been falling recently. After starting the year at 12-month high, bitcoin as a percentage of total market cap resumed its downward trend, falling below 60%. This means that the crypto industry is more diversified, which is a healthy sign as more unique investment opportunities emerge.

Looking at the breakdown by volume, Bitcoin market dominance is steady at 73%.

As of the end of the quarter, bitcoin and ether were trading very close to their all-time high. This is not the case for all cryptocurrencies. The disappointing performance came from Ripple XRP. At $0.60, XRP is still 80% away from its January 2018 all-time high ($3.40). XRP is currently facing a lawsuit from the U.S SEC.

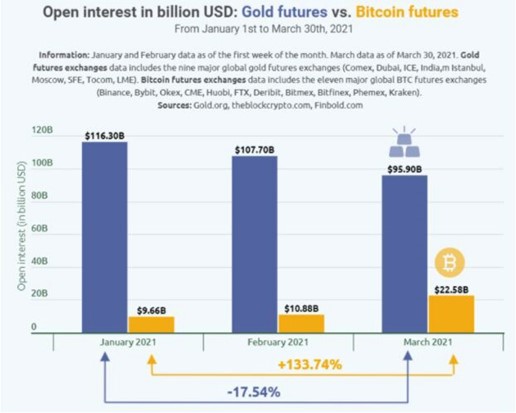

Story #3: A jump in BTC futures & options volume. The launch of Ether futures on the CME.

Open interest in Bitcoin futures at the end of Q1 was almost 350% higher than a year ago.

It is interesting to note that in terms of open interest, Gold Futures are down -17% year-to-date while Bitcoin Futures are up + 133%.

Chart: Best performing cryptocurrencies in Q1 (source: theblockcrypto.com)

As with BTC futures, options trading volumes also reached all-time highs during Q1.

The ETH market continued its process of maturation with the launch of ether futures on the CME.

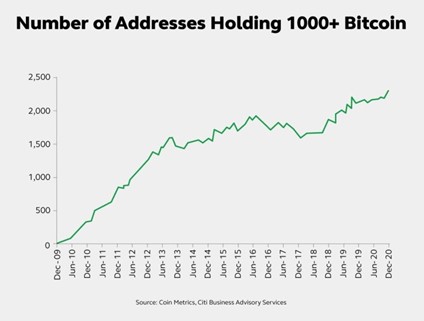

Story #4: Bitcoin “fundamentals” continue to improve.

The fundamental dynamics seem different this time around compared to the last cycles.

First, we note that Bitcoin supply just keeps drying up as “whales” (individuals or entities that hold large amounts of bitcoin) are moving their bitcoins from exchanges into cold wallets.

There is thus a major supply / demand imbalance in the making, with roughly ~2.4M Bitcoin left on exchanges and ~46M Millionaires in the world. Will this create a supply shock?

Chart: Bitcoin price (in grey) versus BTC Balance left on Exchanges (source: Glassnode)

We also note that the number of address keeps growing. This is also the case for big wallets as shown on the chart below.

Chart: Number of Addresses Holding 1000+ Bitcoin (source: www.coinmetrics)

Another key indicator to follow on Bitcoin is the hashrate – which refers to the total combined computational power that is being used to mine and process transactions on a Proof-of-Work blockchain.

BTC hashrate reaches all-time highs at the end of Q1 at 164 million terahashes per second versus 135 million at the end of 2020. This implies greater security as the more computing power involved, the more difficult it would be to manipulate the blockchain to reverse or alter the transactions. This is confirmed by the Network Difficulty which keeps increasing.

It also implies greater optimism among the miners as it represents capital investment in computing power. We note that Bitcoin miner revenues hit an all-time high at $64 million per day at the end of the quarter compared with $33 million per day at the end of 2020 (source: www.blockchain.com). During Q1, the stocks of Mining companies such as MARA Digital Holdings Inc (MARA) or Riot Blockchain (RIOT) have skyrocketed, up between 3x and 5x .

The massive electricity consumption by mining companies is increasingly being criticized as some media and investors highlighted that Bitcoin consumes more electricity than Argentina while others said they will only buy bitcoin mined with clean energy.

Story #5: Consolidation of institutional involvement

Microstrategy (MSTR) is becoming the pioneer of bitcoin “on balance sheet involvement”. The cash-rich software company ran by Michael Saylor keeps accumulating bitcoin on its balance sheet – they now own 91,579 bitcoins for an estimated market value of $5.4 billion (versus a market cap of $6.9 billion for MSTR).

New names joined the move initiated by Michael Saylor – the most emblematic one being Tesla. As of the end of February, Elon Musk confirmed that Tesla purchased about $ 1.5 billion in bitcoin in January and expects to start accepting it as a payment in the future. Tesla has made roughly $1 billion in paper profits from its investment into bitcoin, according to Daniel Ives, analyst at Wedbush Securities.

In Asia, Smartphone manufacturer Meitu is also investing part of its corporate balance sheet into bitcoins.

In a continuation of its plans to more thoroughly encourage the use of cryptocurrency, online payments giant PayPal (PYPL) has announced that it will allow users to pay in bitcoin (BTC) and other leading assets upon checkout with various vendors. PayPal has been signaling a support for bitcoin for several months. In October 2020, the company announced that it was planning to offer increasing support for crypto assets to roll out gradually, with CEO Jim Schulman claiming that PayPal is “eager to work with central banks and regulators around the world” to support the movement.

At the end of February, Square (SQ) announced the purchase of another $170 million worth of bitcoins. They saw 1 million users buy bitcoin for first time during January’s upswing, according to their CFO.

Well know traditional financial institutions also announced plans to roll out crypto services as the institutional surge of Q4 continued.

Goldman Sachs is relaunching its crypto trading desk and will start offering crypto exposure to its private wealth clients. BNY Mellon and Deutsche Bank will offer crypto custody. A handful of European private banks started offering cryptocurrency services, including in Switzerland.

Blackrock authorized two of its largest funds to invest in BTC futures.

We also note that Crypto market infrastructure companies completed impressive raises and even announced plans to go public at hefty valuations. This is the case of crypto exchange Coinbase which plans to go public on April 14th through direct listing. The company market value is estimated at $90 billion on private markets.

Story #6: The emergence of retail investors as a market driver.

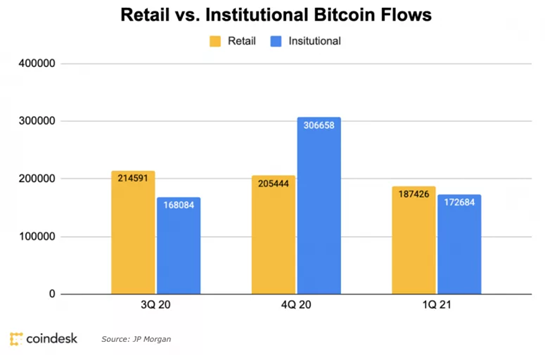

While institutional interest for bitcoin remains strong, retail investors have outpaced institutions in Q1 – a trend reversal versus Q4 2020.

According to a report by JPMorgan, retail investors have purchased over 187,000 bitcoins in Q1 (as of mid-March), compared to roughly 172,684 by institutional investors.

Chart: Retail vs. Institutional Bitcoin Flows (source: Coindesk, JP Morgan)

Glassnode highlighted a dichotomy between long-term bitcoin HODLers (the crypto investors who buy and hold their positions regardless of price) and newer ones. Indeed, longer-term 3+ year HODLers have continued to accumulate Bitcoins while newer HODLers in the last 6-12 months have sold into the recent rally.

Story #7: The launch of products tradeable on traditional exchanges – ETCs, ETFs, etc.

Q1 saw the successful launch of 3 bitcoin ETFs on the Toronto Stock Exchange. The BTCC one saw 23 consecutive days of inflows (as of the end of March), which is unprecedented for a new launch, even in the U.S.

As these ETFs charge much more reasonable fees than Trusts do, the OTC price of Grayscale’s bitcoin trust now trades at a discount to NAV.

These 2 factors are increasing pressure on the SEC to approve a US-traded bitcoin ETF (see the list of reported filling on the table below). The nominated Chairman of the SEC Gary Gensler is familiar with crypto assets and could be of great help.

Table: The race to the (US listed) ETF (source: Eric Balchunas, Bloomberg)

The quarter saw the launch of several ETH investment products and applications for the first North American ETH ETFs.

We also note a surge in the number of ETPs (Exchange traded products) giving exposure to cryptocurrencies. In Switzerland, investors can trade on the SIX ETPs offered by 21shares.com on several baskets of cryptocurrencies, Bitcoin (long and short), Ethereum, Binance, Polkadot, Ripple, Tezos, etc. Same story with Coinshares (Bitcoin and Ether).

Story #8: Stablecoins still making inroads; Governments are preparing their CDBCs.

Stablecoins allow for borderless transfers of tokens representing fiat currencies. The largest is USDT (tether). Stablecoins are still making inroads into financial applications. In March, Visa processed a stablecoin payment on Ethereum. Innovation in stablecoin technology and processes continues to advance.

Tether grew from under $20 billion to over $40 billion over the quarter while USDC, as USD backed Ethereum-based token managed by a US-based consortium went from under $3 billion issued to over $10 billion.

A number of central banks around the world — including Japan, the U.K., Sweden and Switzerland — are exploring issuing their own digital currencies.

During the first quarter, The Bank of Japan launched the first phase of a feasibility study for its central bank digital currency (CBDC). Japan took the first step in a year-long study of a digital yen. In this initial phase, which the bank describes as the “Proof of Concept (PoC)” phase, the BoJ will test its digital currency “as a payment instrument such as issuance, distribution, and redemption.” If by next March, the bank is convinced a CBDC makes sense, it will pilot one. Japan’s regional rival, China, has more concrete plans. China aims to be a global blockchain superpower, and its national digital currency is part of that plan. But if China really wants to achieve its global ambitions it will need help from other countries. To that end, China has been quietly testing pilot digital currency trading platforms in different nations as well as setting up a legal framework for CBDCs with global financial regulators. For the digital yuan to achieve global adoption, China would thus need to work with trading partners or regional financial hubs to have a platform where the digital yuan is technically, legally and financially interoperable with other countries’ digital currencies.

Eight Thai banks and two Hong Kong banks, including HSBC, participated in the Note project and tested the feasibility of digital currency-based transactions between Thailand and Hong Kong, according to its white paper. According to a Feb. 23 statement by HKMA, the digital currency arm of People’s Bank of China and the Central Bank of the United Arab Emirates (UAE) have joined the second phase of this project and it has been renamed as the Multiple Central Bank Digital Currency (m-CBDC) Bridge (source: Coindesk).

Story #9: The growth of DeFi applications and staking

Decentralized finance (DeFi) are financial services that are run by smart contracts on protocols, rather than centralized entities. Most DeFi applications are built on top of Ethereum for its network effects and programing flexibility. The main types of DeFi apps include lending services, trading marketplaces and wrapped bitcoin (enables bitcoin holders to enjoy Ethereum’s functionality and yields).

One of the most popular metrics used to measure DeFi growth is the Total value locked, which represents the dollar value of crypto AuM using DeFi apps.

The top 3 decentralized apps in terms of value locked in smart contracts are MakerDAO, Compound and Aave. The value held on these 3 almost tripled in Q1 to an all-time high of almost $30 billion.

Decentralized Exchanged (DEXes) continue to grow in popularity on the Ethereum network. Trading volume in Q1 was more than 3x that of Q4 2020.

Staking has become the most popular medium of passive income for millions of users worldwide. The extensive use of staking on the Ethereum blockchain is the main reason behind the popularity of this financial service. The concept of ‘Lock, earn and earn more’ is followed by Ethereum 2 also. It has a more efficient security mechanism named Proof of Stake that has increased the transaction productivity exponentially.

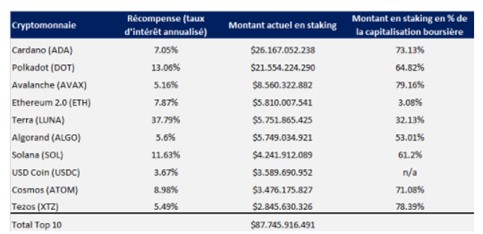

The Staking rewards website lists no less than 164 cryptocurrencies offering staking related rewards with interest ranging from 2% to 463%. The top 10 cryptocurrencies offering staking represent a cumulative amount of $87 billion as shown in the table below.

Table: The Top 10 cryptocurrencies with the most staking money (Source: Staking rewards)

Story #10: The NFT mania

The explosion in interest in non-fungible tokens (NFTs) from investors, celebrities and the general public caught everyone by surprise in Q1 2021.

NFT is short for "Non-Fungible-Token", and it is essentially a special token with a unique ID that is impossible to replicate. They are used to create a verified ownership of a digital asset in the worlds of crypto art, crypto collectibles, and all sorts of other crypto assets.

The token is, like cryptocurrencies, part of the blockchain, a permanent ledger accessible to anyone with a computer and internet. The non-fungible aspect of the asset means that each NFT is totally unique. Two people could buy NFTs for the same price, but it does not mean that they are interchangeable. One NFT could be an illustration made by a famous artist, whereas another may be an exclusive song by a musician.

The volume of NFT transactions increased from $9.2M in December to $226M in March, eclipsing all other innovation growth in the crypto industry.

While NFTs already caught some attention in 2020, we are entering new levels in 2021: Cryptokitties, one of the earliest applications of NFTs, generated almost half a million dollars in sales in a single week. NBA Top Shot, the digital blockchain-based platform for officially licensed NBA highlights collectibles known as Moments, has officially eclipsed over $205 million USD in total sales since it first went live less than six months ago. Mark Cuban and other celebrities are starting to get interested in the market and an increasing number of online auctions are taking place.

With all their possible uses, it seems that NFTs are here to stay, not only for their initial trading and gambling use, but also for the many applications such as digital art, music, ticketing, collectibles, gaming, etc. One of the latest developments for NFTs is their marriage with decentralized finance (DeFi), with new projects such as NFTi seeing the light. NFTi allows borrowers to post digital items as collateral.

Picture: The NBA’s Top Shot product is a blockchain-based trading card system that has generated over $230 in gross sales. The system works like trading cards, only with NBA highlights and digital artwork.

Source: Coindesk, blockchain.com, Coinmetrics, Glassnode, Bloomberg, JP Morgan