Definition: What is a call option?

Options are another way to express an opinion in financial markets, without day trading in the underlying asset.

A very quick example: If you think the price of gold will go higher, you could buy gold options instead of buying physical gold. Chamath bought call options in meme stock AMC instead of buying AMC stock to take advantage of the rising share price… more on that in a moment.

Call options can be bought or sold – normally on an options exchange. Buyers are known as call option holders and sellers are known as call option writers.

A call option seller gives the call option buyer the right, but not the obligation, to purchase an asset at a certain price and by a specific date, known as the strike price and expiry date, respectively.

Why use call options?

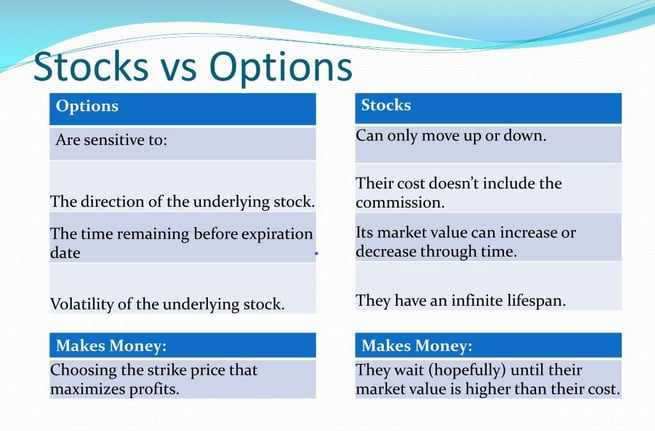

What is the incentive for an investor to own options instead of just buying the stock, or whatever the financial asset is underling the option? The main consideration is the timeframe for the trade and the potential risk: reward, as summarised in the below table.

How does a call option work?

Let’s discuss what it means to buy a call option and to sell a call option by elaborating on some of the options terminology just mentioned.

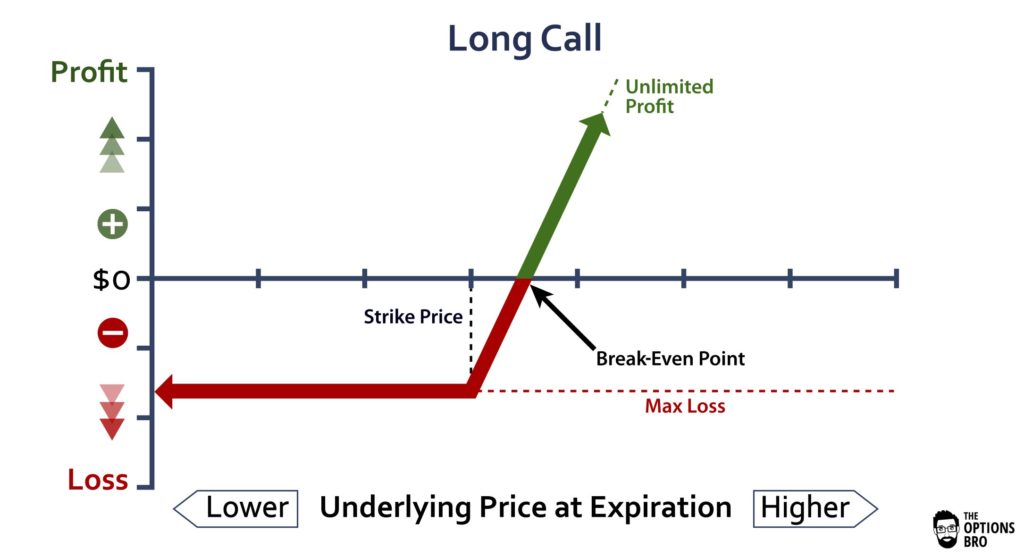

The call option buyer pays a fee known as the premium to the call option writer (seller). The premium is the most the writer can make on the trade. The premium is the most the buyer can lose on the trade.

What a call option buyer gets

So how do you profit from a call option? If you are buying an option, you hope the price of the asset will go above the strike price before the expiration date.

If it does, then the buyer can exercise the option to purchase the shares from the seller at the strike price – or sell the option contract to another options trader.

If the market price is at or below the strike price at the time of expiry, the call option will expire worthless and purchasing a call option on this occasion will have cost the buyer the amount of the premium. What is the maximum loss on a call option? For a buyer, it is the premium.

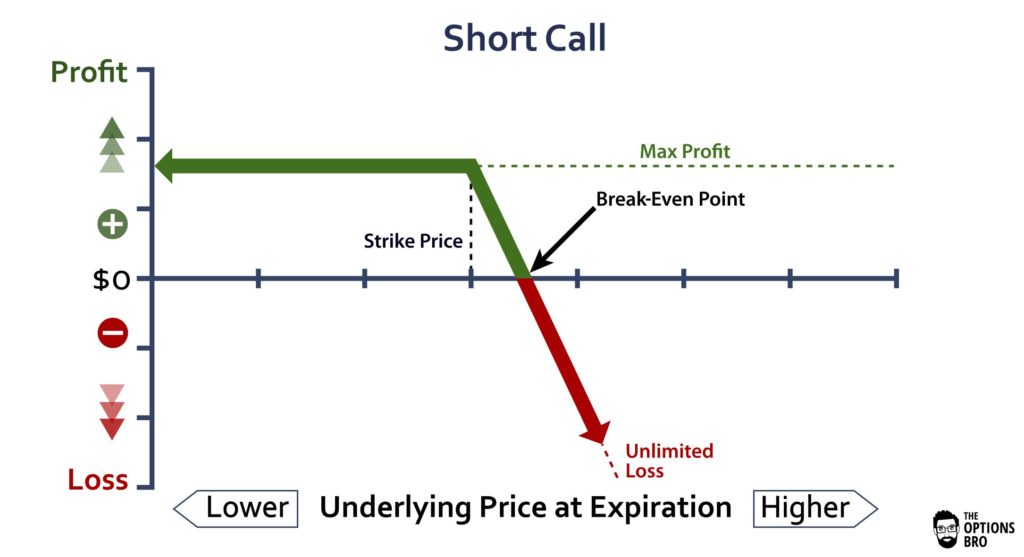

What a call option seller gets

Naturally, if you are selling an option, you want the opposite thing to happen to the buyer. As a call option writer, you want the market price of the asset to remain at or below the strike price when the options contract expires.

If this happens, you get your premium, which if you own the stock adds a nice little income to your position.

If however, the market price rises above the strike price, then the options seller is obligated to sell stock to the buyer. The seller will make a profit as long as the premium is greater than the difference between the market price and strike price. What is the maximum loss on a call option? For the seller it is theoretically infinite because the asset price could go up infinitely.

How much is a call option?

Each contract specifies the amount of a product the option represents.

Each stock option is for 100 shares of the underlying stock. FlowBank will quote the options price as its value per share.

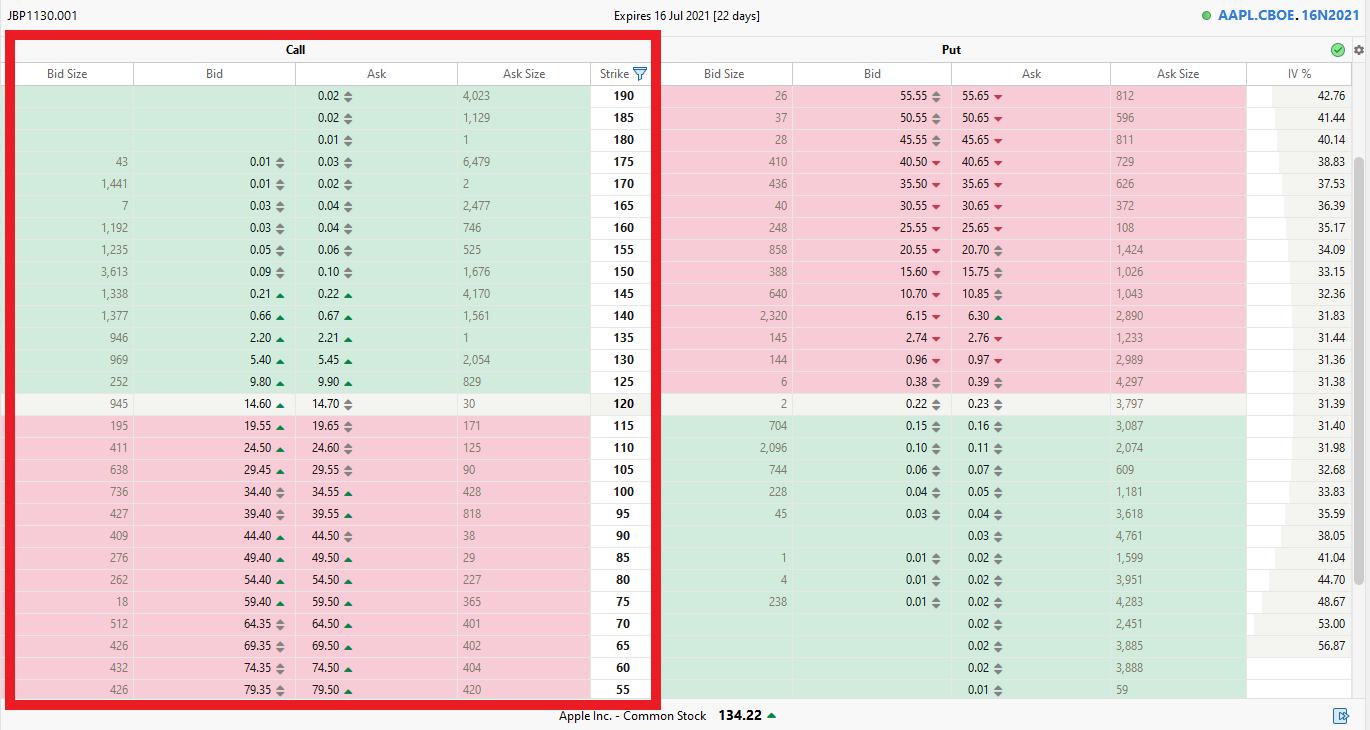

Source: FlowBank Pro Options Board

For example, a call option for Apple with a strike price of $120 shown above is priced at $16.60 to buy (the ask price)– the cost to purchase the option is 100 x $14.60 = $1,460 plus commission.

The options contract is traded in the secondary market, so its price fluctuates according to the price and volatility of the underlying market it is tied to.

How can I buy a call option?

Your first step is to register for an options trading account. FlowBank offers competitive commissions on call options and the security of a Swiss bank account.

What is a call option example? Chamath Palihapitiya

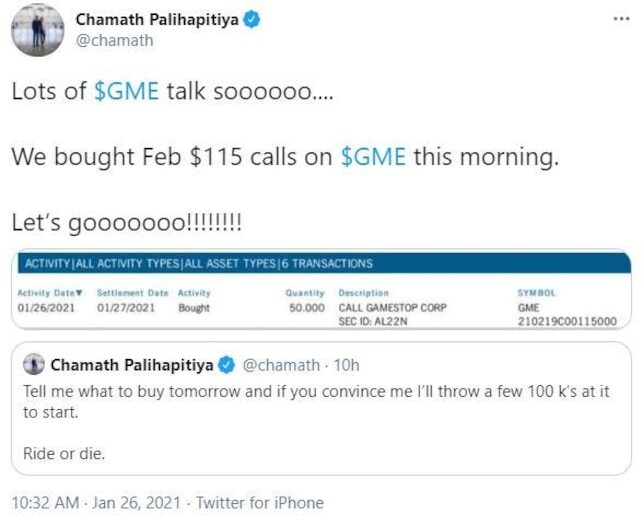

The start of 2021 saw a surge in some of the most speculative areas of the market, including cryptocurrencies and meme stocks like GameStop shares and AMC shares.At the height of the bullish sentiment, when the sub-Reddit r/WallStreetBets forum had started to come into mainstream attention, Chamath entered the fray.

After asking on Reddit what he should buy, Chamath announced he was buying February $115 calls on $GME the stock sticker for GameStop. At the time of buying, the calls were ‘out-of-the-money’ so the price would have to rise for him to turn a profit.

The screenshot attached to the tweet shows Chamath bought 50 call options in GameStop with a strike price of $115 and an expiration date of February 19. One contract of those options cost around $25 on January 26 when he bought them. The total purchase price of the options would then be around $125,000 (50 x 100 x $25).

To cover his $25 premium, GameStop would need to jump 60% to $140 for Palihapitiya's option bet to make a profit.

If GameStop is trading above $140 by February 19, Palihapitiya could exercise the call options upon expiry, allowing him to pay $575,000 for 5,000 shares of GameStop at $115 per share or he could sell the options contracts for a higher price than he paid for them, netting a profit either way.