Ray Dalio, notable for founding Bridgewater Associates, the most prominent hedge fund worldwide, is renowned as a self-made billionaire with an intriguing approach to investment strategy. His prowess in finance and investment has been instrumental in his ascension to the pinnacle of global wealth, with Dalio's unique philosophies about risk management and market predictions guiding his successes. This examination will delve into Dalio's strategic vision, evaluating the efficacy of his approach and contrasting it with other prevalent investment strategies.

In addition, we will assess his market predictions' accuracy and their consequential impact on his investment tactics in the face of shifting economic and market landscapes. As with any strategy, Dalio's approach has encountered challenges and criticisms, which we will analyze to understand why it might not be delivering the expected returns in the current market conditions.

Our objective is to offer a comprehensive view of Dalio's investment strategy, placing it in the broader context of global finance and investment.

Contents: What is Ray Dalio’s Investing Strategy? And Why Isn’t It Working?

- Introduction: Who is Ray Dalio?

- What is the Bridgewater investment strategy?

- Pure Alpha

- All Weather

- Dalio's Approach to Risk Management

- Dalio’s Holy Grail: Diversification & Correlation

- An Overview of Bridgewater’s Performance

- Sounds good, what happened?

- Dalio's Market Predictions and Their Accuracy

- The Impact of Economic and Market Changes on Dalio's Strategy

- Analysis: Why Dalio's Strategy Might Not be Working Now

- Comparison with Other Investment Strategies

- Conclusion

Introduction: Who is Ray Dalio?

Ray Dalio is an American billionaire investor, philanthropist, and author. He is best known as the founder, co-chairman, and co-chief investment officer of one of the world's largest hedge funds, Bridgewater Associates. Since its founding in 1975, Bridgewater Associates has grown into a global macro investment firm with around $138 billion in assets under management. Dalio's investment philosophy is often described as a reflection of his personal ethos and strategy for life, which he outlined in his best-selling book "Principles".

What is the Bridgewater investment strategy?

Ray Dalio and Bridgewater have pioneered various investment strategies - and even advised the US government on the adoption of inflation-indexed bonds.

Broadly speaking Ray Dalio is ‘macro investor’. That means he makes his investment based on a view about the economy. That is opposed to, for example being a stock picker, i.e. somebody who chooses companies to investment in.

Bridgewater has two main investing strategies, which have taken the form of its main funds - the ‘Pure Alpha’ and the ‘All Weather’. In order of chronology:

1. Pure Alpha

Pure Alpha makes directional bets on various markets including stocks, bonds, commodities and currencies by predicting macroeconomic trends with the help of computer models and algorithms.

This same description can be applied to many modern-day ‘macro’ hedge funds but Ray Dalio was one of the first to strongly adopt computer modelling to verify his ideas about the way the economy functions and asset prices respond.

An example trade might be on the exchange rate between the US dollar and the Japanese yen. Based on his team’s belief that interest rates in the United States will rise faster than in Japan, Bridgewater might take a long position in USD/JPY in the spot forex market or in currency futures.

Dalio has since famously created the below YouTube video to explain his concept of the ‘economic machine’ that is the foundation of the Pure Alpha bets. The video breaks down economic concepts like credit, deficits and interest rates, allowing viewers to learn the basic driving forces behind the economy, how economic policies work and why economic cycles occur.

2. All Weather

This is the granddaddy of ‘risk parity’ (or ‘balanced beta’) investing. The concept is to allocate assets within the portfolio in a more balanced way in order to balance risk.

So rather than making directional bets like the Pure Alpha strategy, All Weather is an active asset allocation strategy. Bridgewater will adjust the weighting of its portfolio in different asset classes depending on the economic environment but the idea is that it can survive in any environment.

Bob Prince Co-CIO with Ray Dalio at Bridgewater explains the difference with traditional portfolio construction:

The traditional approach to asset allocation tolerates higher short-term risk through a concentration of risk in equities in order to generate higher longer-term returns.”

He adds: “The long-term risk of holding a portfolio that is concentrated in equities, or in any other asset for that matter, is much greater than most investors realize and, in reality, too great for them to bear.”

To paraphrase Bob, Bridgewater doesn’t adhere to the ‘buy and hold’ idea that over the long term stock markets always go up and will give you a higher risk-adjusted return than other investments like government bonds or money market funds.

Rather than being like traditional pension funds that put 90% of the portfolio into equities, or even the 60/40 balanced portfolio - the All Weather fund changes the balance among equities, bonds, currencies and commodities according to the risk of each asset class and the economic environment.

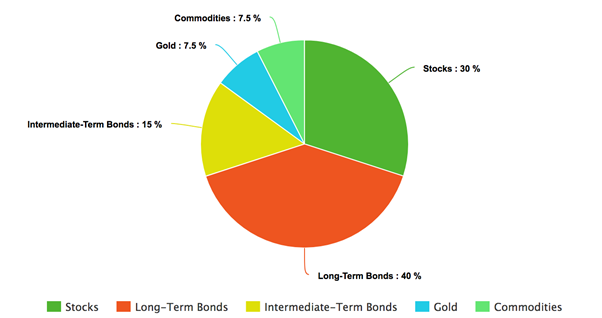

Bridgewater funds are only open to large institutional investors but self-help guru Tony Robbins asked for Ray Dalio’s help in constructing a simple version of the All-Weather funds using ETFs and other widely available investing products that any investor can replicate - and it looks as follows:

Dalio's Approach to Risk Management

Ray Dalio's approach to risk management is based on a deep understanding of the financial markets, the economy, and human behavior. His approach is centered around three main principles:

- Diversification: Dalio is a strong advocate of diversifying investments across different asset classes and geographical regions to reduce risk.

- Understanding the economic and market cycle: Dalio's investment decisions are often guided by his interpretation of where we are in the economic cycle, based on a series of economic indicators. He calls this his "economic machine".

- Stress testing: This involves testing the portfolio against potential adverse market scenarios to ensure it can withstand market shocks.

Dalio’s Holy Grail: Diversification & Correlation

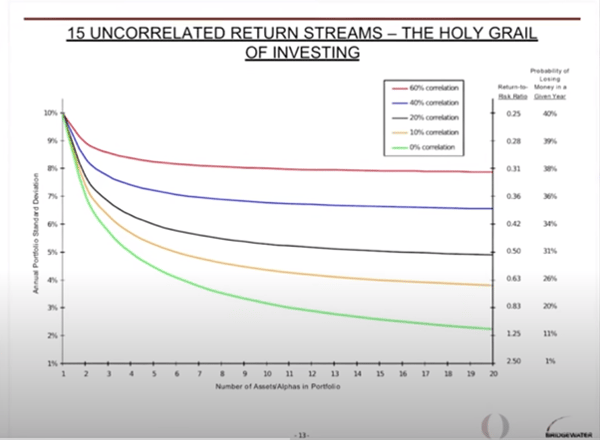

Ray Dalio describes his guiding concept behind his investing is as making use of diversification with uncorrelated assets to lower the amount of risk he takes to make a certain return. His idea is to find “15 or 20 good uncorrelated return streams.”

Ray Dalio told Investopedia that

“A lot of people think the most important thing you can do is find the best investments, that’s important but there is no great best one investment."

Adding “You can improve your return to risk: ratio by a factor of five.. you can’t pick any investments that are five times as good individually.”

The following chart from Bridgewater visualises this concept of contrasting expected return, risk and the number of assets with specific levels of correlation.

An Overview of Bridgewater’s Performance

Bridgewater Associates has consistently delivered strong performance over the years, making it one of the most successful hedge funds in the world. The firm's flagship fund, Pure Alpha, has generated an annualized return of 12% since its inception in 1989, significantly outperforming the S&P 500. However, it is worth noting that Bridgewater's performance can fluctuate greatly from year to year due to its focus on macroeconomic trends and its use of leverage.

Sounds good, what happened?

In a sentence, the coronavirus and a stock market boom.

Dalio told the Financial Times that

"We did not know how to navigate the virus and chose not to because we didn't think we had an edge in trading it… so, we stayed in our positions and in retrospect we should have cut all risk."

In essence, Dalio’s ‘economic machine’ was thrown out of the window when the pandemic arrived because nothing like it has ever happened before. The economic models and algorithms for the economy that Bridgewater uses to make its investment decisions had no ‘virus’ input so the outputs produced no useful result.

In a different way, the All Weather portfolio is suffering similar problems to last year. 2019 was a banner year for the stock market. The S&P 500, America’s benchmark stock index rose 28.9% in its biggest one-year gain since 2013. This year equities plummeted in March but subsequently rallied thanks to a combination of central bank and government stimulus and supercharged retail trading activity.

2019 and 2020 (so far) were years when it paid to be heavily overweight equities, unlike the All Weather portfolio that is specifically designed to reduce the risk of putting too many of your eggs in the equity basket.

Dalio's Market Predictions and Their Accuracy

Ray Dalio, the founder of Bridgewater Associates, is renowned for his keen acumen and strategic market predictions. Over his career, Dalio has made some incredibly accurate predictions. The biggest of his career was perhaps foreseeing the 2008 financial crisis, a prediction that solidified his status as a leading global financial strategist.

However, like any investor, Dalio's forecasts are not always spot on. There have been instances where his predictions have missed their mark, leading to critique and losses. This serves as a reminder that even the most seasoned investors can make miscalculations, demonstrating the inherent risk within the financial markets.

The Impact of Economic and Market Changes on Dalio's Strategy

Dalio's investment strategy is heavily influenced by economic and market changes. His philosophy, known as 'risk parity', is designed to achieve balance in the portfolio by dividing resources equally amongst various uncorrelated assets. This strategy is highly sensitive to market changes and economic shifts.

When there are changes in the economy such as inflation, recession, or growth, Dalio adjusts his strategy accordingly. For instance, during periods of economic growth, he might lean towards riskier assets, while in times of economic downturn, he might advocate for more defensive, lower-risk investments.

Analysis: Why Dalio's Strategy Might Not be Working Now

In recent years, some critics have suggested that Dalio's strategy might not be as effective as it once was. There are a number of factors that could contribute to this. First, the unprecedented levels of central bank intervention and the low-interest-rate environment could make it challenging for the risk parity strategy to deliver the same levels of return. Also, the increasing unpredictability and volatility of the market could pose challenges to Dalio's approach.

Finally, the advent of new financial technologies and investment strategies might also be outpacing Dalio's more traditional approach. However, it's worth noting that while the strategy might face challenges, it does not necessarily mean it's obsolete.

Comparison with Other Investment Strategies

Dalio's risk parity strategy differs considerably from other popular investment strategies. For example, the modern portfolio theory focuses on maximizing returns for a given level of risk by diversifying across different asset classes. On the other hand, value investing, popularized by Warren Buffet, involves buying securities that appear underpriced by some form of fundamental analysis.

While these strategies have their own advantages and have been successful for many investors, Dalio's strategy lays emphasis on achieving balance and reducing risk through allocation of equal resources amongst various uncorrelated assets.

Conclusion

Bridgewater will likely not be the biggest hedge fund forever and a new investing legend will be born to dethrone Ray Dalio. BUT after 40 years of out-performance, it is likely too early to write him off because of the last two years.

The influence of macro economics will reassert itself over markets from the coronavirus and every bull market in stocks must come to an end - and that could be Ray’s time to shine again.