Risk management, highlighting the importance of strategic planning in finance and trading, is a critical process that ensures the mitigation of potential losses and maintenance of a desirable risk/reward ratio. Types of Trading Risks provide a comprehensive understanding of uncertainties involved in market, credit, liquidity, and operational risks. The Risk Analysis Methods chapter elaborates on techniques like Value at Risk (VaR), Scenario Analysis, and Stress Testing used to quantify and manage these risks.

The significance of careful Position Sizing to control loss per trade forms another crucial aspect of this topic. The book further explores the concept of Diversification in Trading, explaining how it mitigates risks and increases potential returns by spreading investments across various financial instruments.

Hedging Strategies provides insights into various techniques traders utilize to protect their assets from severe market fluctuations. Psychological Aspects of Risk Management delves into the psychological barriers that traders often face, such as fear and greed, and how to overcome them for efficient risk management. Finally, Using Risk Management Tools explains the role of modern technologies, such as AI and machine learning, in foreseeing risks and managing them efficiently. Hence, this comprehensive guide offers an in-depth understanding of risk management in trading, helping traders make informed decisions and maintain financial stability.

Contents: Trading Risk Management

- Leveraged products

- Types of Trading Risks

- Risk Analysis Methods

- Trade size

- The 1% Rule

- Stop loss & Take Profit

- Position Sizing

- Diversification in Trading

- Risk Reward Ratio

- Hedging Strategies

- Psychological Aspects of Risk Management

- Using Risk Management Tools

- Conclusion

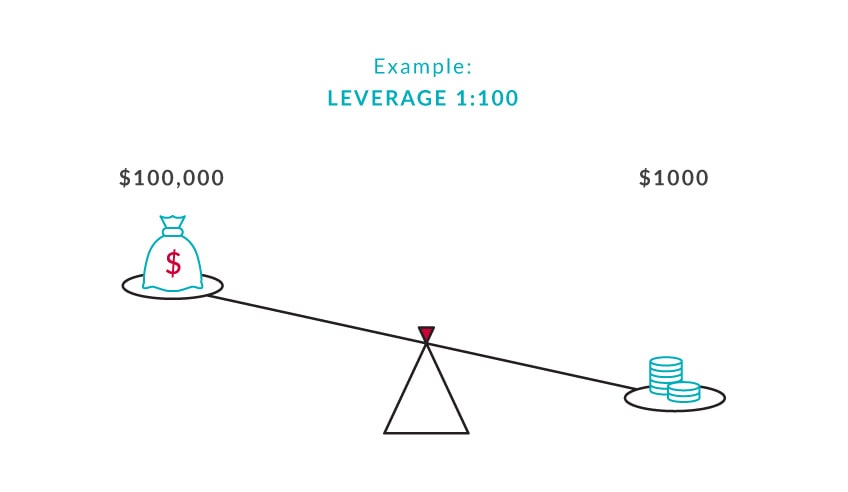

Leveraged products

Trading is risky that is how it offers a high potential reward. This is especially true when using leveraged products. Using leverage means you don’t put forward the full amount of the value of the trade in order to open or run the position. Instead you put forward a small percentage of the value of the trade, called margin.

For example, if the Swiss SMI index has a margin of 5%, you only put forward 5% of the value of the entire trade to open the position. The profits you make relate to the full position size, as do the losses. Using a small deposit, you have access to large profits or losses. This means that it is extremely important to keep control of any losses or you could blow your account very quickly.

Risk management is one of the three central pillars to trading, along with strategy and psychology. Even if you have the best trading strategy (day trading, swing trading...) in the word, perfect trading psychology, without solid risk management losses will start to build up. We know that it is impossible to win every trade, so it is important to keep those trades that are losers under control. This can be done using various risk management tools.

Types of Trading Risks

Trading risks are inherent in the financial markets. Identifying and understanding them is crucial for successful trading. These risks include:

- Market risk: This is the risk of investments declining in value due to economic developments or other events that affect the entire market.

- Credit risk: The risk that a borrower will not repay a loan and the lender will lose the principal of the loan or the interest associated with it.

- Liquidity risk: The risk of not being able to buy or sell investments quickly for a price that closely reflects the true underlying value.

Risk Analysis Methods

Risk analysis in trading involves using different methods to understand potential risks and their impact. Some common methods include:

- Value at Risk (VaR): This method estimates the maximum potential loss of an investment over a specified period and at a given confidence level.

- Stress Testing: This involves testing the portfolio's performance under extreme market conditions.

- Scenario Analysis: This involves predicting changes in the value of the portfolio in different hypothetical market conditions.

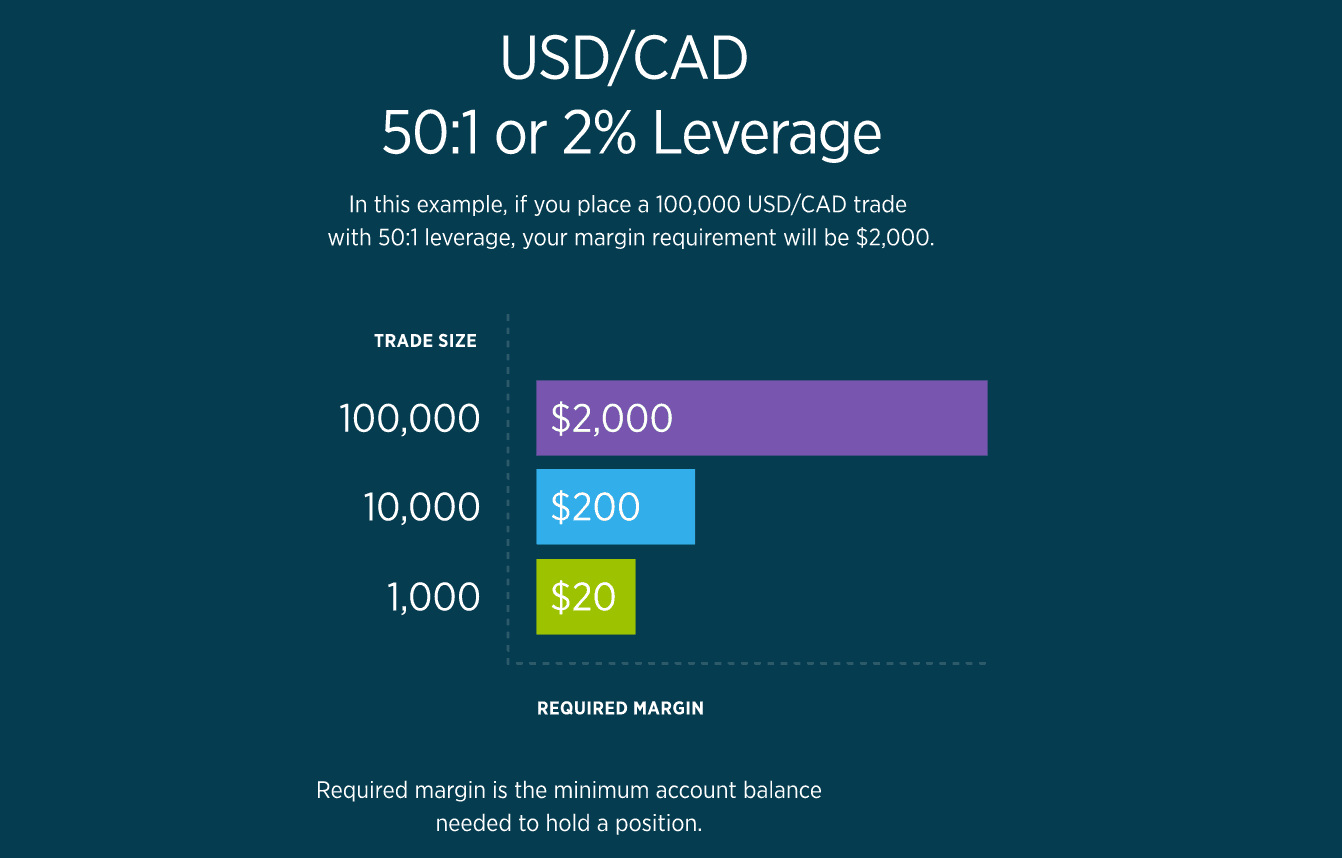

Trade size

(source: FXposts.com)

Placing a sensible sized trade in relation to the funds that you have available on your account is the first step towards implementing a sound risk management strategy.

Let’s consider this through an example. You have EUR 10,000 on your account. You open a leveraged trade worth EUR 187,500.

Assuming a margin requirement for a DAX 30 trade is 5%. This means that you must have 5% of EUR 187,500 in your account to open the trade (not including trading costs).

5% x EUR 187,500 = EUR 9375.

If you have EUR 10,000 in your account and EUR 9375 is being used as a deposit to open a position, there is very little room for that trade to move before you will have used your available funds and the position closed by the margin closeout policy.

Let’s consider another example. You have CHF 10,000 in your account and you open a position on the SMI index valued at CHF 37,500. The margin requirement is CHF 1875.

If you have CHF 10,000 on your account and you use CHF 1875 as margin you are giving your trade more room to develop and you will be able to choose where to place the stop loss, rather than the trade being closed out owing to the margin closeout policy.

The 1% Rule

Successful traders don’t look to risk any more than 1% - 2% of their account on any trade. So, if you have CHF 10,000 on your account and you are risking 1% - 2% this means that you are looking to risk CHF 100 - 200 per trade. By taking small risks you will not blow your account up with one or two losing trades. Taking additional risk can be dangerous and detrimental to your long term profits. Part of being a good market strategist is to be disciplined and stay cold with numbers.

As mentioned, it is impossible to win every trade but if the ones that lose are only 1% -2% of the account, then the account has much higher probability of surviving. The 1% rule can be adhered through careful consideration of trade size and the use of a stop loss.

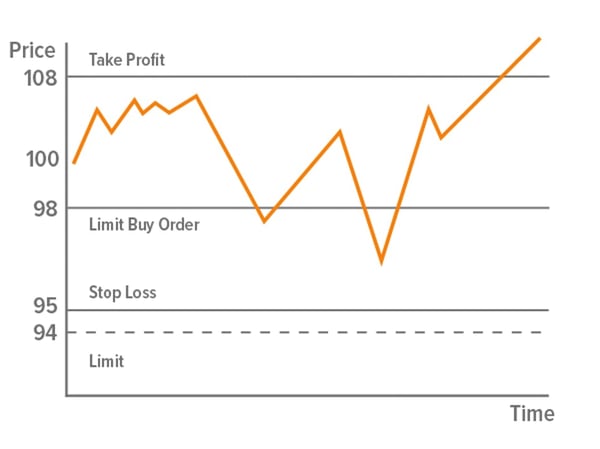

Stop loss & Take Profit

(source: Wikifolio.com)

(source: Wikifolio.com)

A stop loss is an order which closes out your trade when the market price moves beyond a pre-selected level.

For example, your open a buy trade on GBP/USD at $1.2400. You decide to put a stop loss at $1.2300. Should the price of GBP/USD drop to $1.2300 the stop loss order will close it out at the first traded price at or below $1.23.

Using a stop loss, a trader decides how much risk they are prepared to take on and helps you set a pre-specified risk/reward ratio: you know in advance how much you could win and how much you could lose. Effectively placing stop losses is key. This is best done using the structure of the market rather than just deciding that a stop loss should be 50 points away. Popular methods for deciding on stop loss placement include using support and resistance, moving averages or Fibonacci retracement.

Take Profit orders which will close the trade at a profit. If you are long a market, the limit order will be placed above the trade price. If you are short a market, the limit will be below the trade price. Again, best way to decide where to place a profit taker is using the market structure. Planning this level in advance prevents emotions from creeping into the trade and will make you set an optimal risk/reward ratio.

Position Sizing

Position sizing refers to the process of determining the size of a position within your portfolio, or essentially, the number of units of a security to buy or sell. It plays a critical role in risk management, as the size of your position can significantly amplify or reduce your potential risk and return.

- Fixed Position Size: This method involves trading a set number of units every time. While it's straightforward, it may not be optimal for managing risk.

- Percent Risk: This method involves risking a predetermined percentage of your trading capital on each trade. This ensures that you never risk more than you're comfortable with losing on a single trade.

- Percent Volatility: This method adjusts the trade size based on the security's volatility. A more volatile security would lead to a smaller position, while a less volatile security would lead to a larger position.

Diversification in Trading

Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. It aims to maximize returns by investing in different areas that would each react differently to the same event. The rationale behind this technique contends that a portfolio of different kinds of investments will yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Diversification straddles the proverbial line between caution and calculated risk. Even though it might reduce the risk of catastrophic losses, it could also limit potential upside.

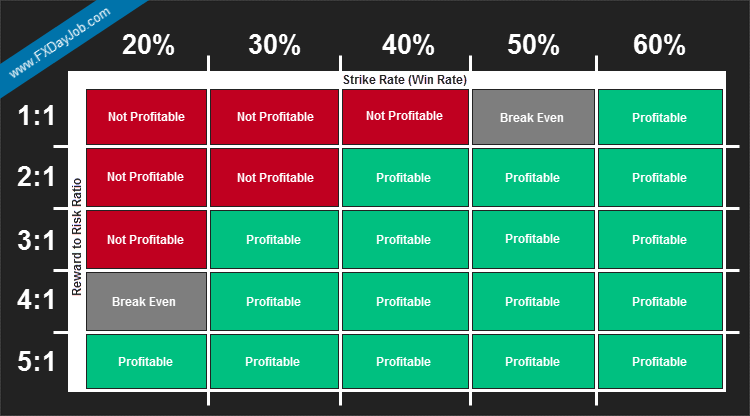

Risk Reward Ratio

(source: FXDayJob.com)

I've mentioned that setting decent risk/reward ratio was important, but what does this mean exactly? Once you know where your stop loss and Take Profit will be placed, you can consider the risk reward ratio for the position. As a general rule, successful traders will not consider trades that have a risk reward ratio of less than 1:2, some will only go for trades with a risk reward ratio of 1:3.

This means that the potential reward of a trade much be at least double (1:2) if not treble (1:3) the expected risk. Should the trade not adhere to this rule then the trader simply doesn’t take the position. This is a rule which goes a long way towards preventing overtrading.

Hedging Strategies

Hedging is an investment strategy used to offset potential losses that may be incurred by other investments. In simple terms, hedging involves taking an opposite or neutralizing position in a related security.

- Direct Hedging: This involves taking the opposite position in the same security. For example, if you own shares of a company, you can short sell the same amount of shares. If the stock price falls, your short position will offset any losses from your owned shares.

- Indirect Hedging: This involves taking a position in a related security. For example, you could hedge a position in a company's stock by taking a position in a competitor's stock.

- Options Contracts: Options give you the right, but not the obligation, to buy or sell a security at a predetermined price within a certain timeframe. They can be used to hedge against potential losses.

Psychological Aspects of Risk Management

Traders must manage not only financial risk but also their emotional responses to the uncertainty and potential losses that trading involves. Fear and greed can significantly influence a trader's decision-making process. Understanding and managing these psychological aspects of risk management can be just as important as understanding the mathematical and analytical aspects.

Using Risk Management Tools

Several tools can assist traders in managing risk. These include stop-loss orders, which automatically sell a security when it reaches a certain price; limit orders, which only execute trades at certain prices; and various software tools that can automate risk management strategies.

- Stop-Loss Orders: This tool allows traders to limit their losses on a position. The order will automatically sell the security if its price drops to a certain level.

- Limit Orders: This tool enables traders to set a maximum or minimum price at which they are willing to buy or sell a security.

- Software Tools: Various software tools can measure and manage risk. These include portfolio management software, risk analytics tools, and automated trading systems.

Conclusion

Trading any market is risky, especially when using margined products. It is therefore extremely important to implement a solid trading risk management strategy.

In summary, remembering these four ideas will save a lot of trauma

1) trade size in relation to capital available on the account,

2) the use of stop loss and limit orders,

3) sticking to the 1% rule and

4) implementing a 1:2 or greater risk reward ratio.