Lithium demand has been increasing as the future of electric cars batteries relies in part on this chemical element. In this article, FlowBank answers your questions on the Lithium ecosystem and future:

Key takeaways:

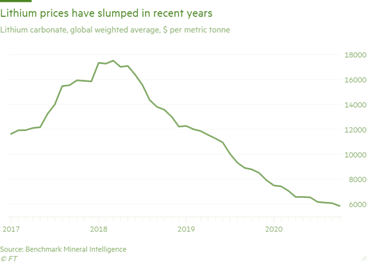

- Lithium prices have been pushed to lower levels each year since a high in 2018 due to an oversupply based on unmet expectations from EV production

- This price is now low enough in Australia for some pundits to suggest an inflection point back upwards as demand for lithium batteries continues to surge

- Australia, followed by Argentina and Chile, are the biggest producers of lithium, and they will seek to remain top players through increased mining projects

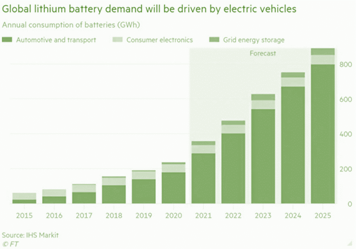

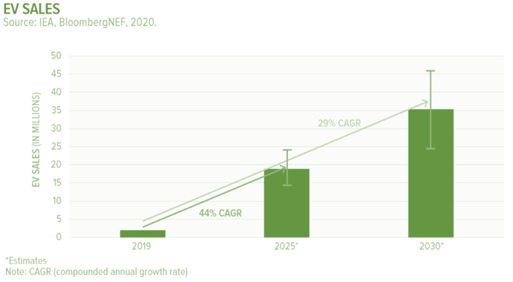

- EV industry is beginning its ascent to new heights, with a CAGR of 44% expected for 2025 according to IEA and BloombergNEF.

- China is projected to become the largest player in EV sales and could see its domestic prices raise enough for it to turn to Australian and Latin American lithium imports in the future.

Lithium element and usage

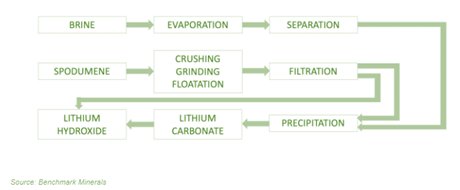

Lithium is a metal, and the lightest of the solid elements. Lithium metal can be drawn into wire and rolled into sheets and is softer than lead but harder than the other alkali metals. The metal is soft, white, and lustrous, and its major commercial form is lithium carbonate which is produced from ores or brines by process visualized below. Lithium is used as an active element in the removal of impurities of metals like iron, nickel, copper, and zinc and to make polymers (plastics).

Because of its light weight and large electrochemical potential, lithium serves as the negative electrode in lithium primary batteries. Starting in the early 1990s, Lithium became a big part of electric vehicles, for power storage, as well as for cell phone and camera batteries. As of late, the utility of Lithium has transitioned away from glass and ceramics and towards batteries. In fact, in 2020, in the US, 65% of lithium was used for batteries, and only 18% for glass and ceramic.

Lithium carbonate and hydroxide are the two compounds that compose most of the battery production with carbonate making up the bulk of usage. Let us talk about production:

Lithium Production

Here is a rundown of the production process from Brine or Spodumene (mines and pools) to the final Lithium carbonate or hydroxide product:

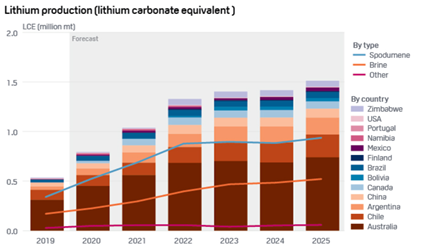

Worldwide lithium production in 2019 decreased by 19% to 77,000 tons of lithium content from 95,000 tons a year earlier. This cut was in response to an oversupply which increased the pressure on already low level prices. Consumption was lower than anticipated by the industry because of China scaling back their subsidies on EV, consumers reducing inventories and, electric vehicle sale volumes being under par. However, in 2020, global consumption of lithium increased by 18% showing the path for more come.

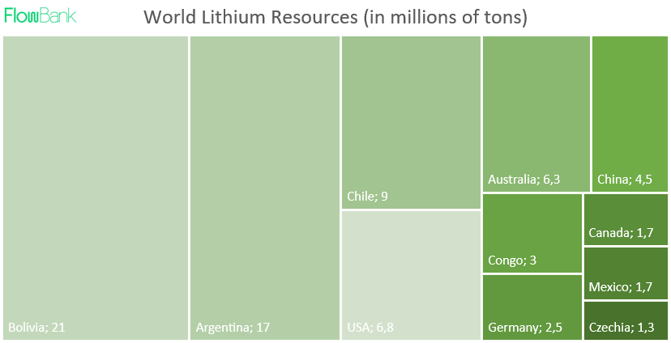

Australia is home to the majority of spodumene (hard rock) mines, and brine production is concentrated in South America, mainly Chile, Bolivia, and Argentina. Hard rock mines in Australia have shorter project lead times of 3 to 5 years in contrast to the 7 years needed with brine. New mines and increased production as of late, have generated a glut of material to market thus pressuring prices downwards thus alarming miners not to produce more. In terms of world resources of lithium see the graph below for last year’s lithium reserve levels:

The graphic below by S&P Global illustrates better than words the division by type of mining by country in a forecast for lithium production into 2025. Clearly, Australia, Chile, and Argentina top the rankings with China trailing only slightly behind and promising an increasing production each year until 2025.

Lithium Supply and Pricing

Supply of Lithium until 2025 is set to grow with the projected increase of mines and demand from the growing EV industry. Australia will maintain its position as production leader and could ramp up its production to over 400,000 mt LCE by 2025, while South America is preparing for a growth of over 200%. Lithium prices have been in a rut as of the past three years in part because of this aforementioned oversupply, but some pundits say that prices may have hit a bottom especially for large producers like Australia. Prices last month were $6000 a metric tonne, down from 2018 levels of $17,000 per metric tonne.

EV and Lithium Market Outlook

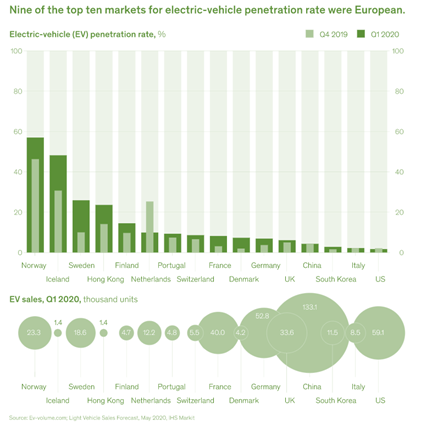

Nowadays, lithium companies and electric vehicles come hand in hand, and China is a rising champion in both fields (mostly EV). China’s electric vehicle sales could reach 1.8 million units in 2021, up 40% from 2020, and according to the China Association of Automobile Manufacturers, aggregate car sales between now and 2025 could be 30 million, with 6 million EV units in 2025. China’s lithium carbonate process will also rise in 2021 as demand rises from EV sales, and a price surge has already occurred this month with a jump to a 16-month high. Price of domestic Chinese lithium carbonate could increase by 20 to 30% in 2021. This domestic surge in lithium prices could urge China to trade with larger and thus cheaper producers such as neighboring Australia.

Regarding the oversupply and thus low price of Lithium, some analysts believe a demand surge might catch up soon, as suggested by lithium prices slowly moving up earlier this year. Global adoption for EV has increased with sales skyrocketing 43% YoY to a total of 3.24 million cars sold. Europe was the main driver in this growth surpassing China for the first time in five years. CAGR for EV Sales could be set to 44% by 2025 and 29% by 2030 as seen below:

In Norway, there were more electric vehicles sold than regular gas cars. BloombergNEF forecasts nearly 26 million EVs will be sold annually by 2030 and Nissan chief believes the global auto industry will be made up of 40% battery technology vehicles by 2030. Governments are putting major pressure on reaching environmental objectives by 2030, the UK for example plans to invest nearly £3 billion in EV production in the next decade to achieve their pledge.

Which companies are involved in the Lithium ecosystem?

Here is a list of companies picked for their involvement in the lithium trade. These stocks should be studied independently to better understand what their current position is in the Lithium marketplace which has its caveats. Some could simply be speculative bets based on a false premise of positive forecasted demand for lithium batteries, so beware. Lithium is used in phones batteries so also look for companies who produce those types of goods. Keep an eye out also for trade conflicts between the US and China, and Biden’s administrative policies regarding EV sales, pollution, and restrictions.

Automotive Energy Supply Corporation, Panasonic Corporation, Samsung SDI Co. Ltd., LG Chem Power (LGCPI), LITEC Co., Ltd., A123 Systems, LLC., Toshiba Corporation, Hitachi Chemical Co., Ltd., China BAK Battery Co. Ltd., and GS Yuasa International Ltd. Albemarle, Sociedad Quimica y Minera, Tesla, Orocobre, Livent, Power Metals, Lithium Americas, Galaxy Resources, Pilbara, and Jiangxi Ganfeng.

Sources: