Pfizer is in the news lately because of the vaccine. What does Pfizer focus on, and how are they performing ?

A background on Pfizer; who is Pfizer?

Pfizer (PFE) has been in the news lately because of the covid-19 vaccine solution. I thought I would give it a go and explore it with you in more depth. Hopefully at the end of this we will both have a better grasp of the firm’s overall performance and activity. Pfizer is a large-cap firm that focuses on biopharmaceutical development, drugs for oncology, rare disease, infection and immunology, infectious disease, and more. Pfizer's HQ is located in New York. Incorporated in 1942, it currently employs about 88,300 people. Today its opening market price is $37.83.

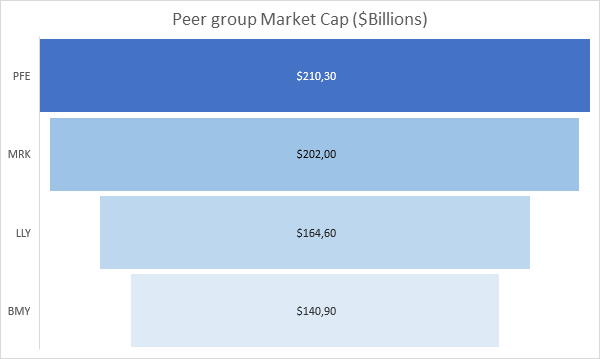

Pfizer is the leader, but faces a competitive industry:

The health-care and pharmaceutical sector is large, but to make this more simple, the top peers are Merck & Co Inc (MRK), Eli Lilly and Co (LLY), and Bristol-Myers Squibb Co (BMY), and not to mention, the Swiss giant Novartis. Pfizer stands above its peers, but clearly the competition remains at its heel, as you can see on the graph below. However, the difference between Pfizer and close second MRK, is large. A close $8B which in billions, represents a large sum.

source: BoA Global

PFE’s stock performing price since March has been very closely-tied to BMY and MRK, while LLY stands tall above the rest with a much more impressive run not only since April, but this month especially:

From top to bottom: LLY, PFE, BMY, MRK. (https://www.tradingview.com/)

From top to bottom: LLY, PFE, BMY, MRK. (https://www.tradingview.com/)Compared to Nasdaq's large cap pharmaceutical index, Pfizer stock performing has stayed above the mean and pulled the average upwards, at least since December 7th. The general trend however since earlier this month has been a decrease in the index, and to which extent PFE has had an effect is perhaps another article all together.

PFE vs. large cap pharmaceutical sector (Nasdaq index) - source: https://www.tradingview.com/

PFE vs. large cap pharmaceutical sector (Nasdaq index) - source: https://www.tradingview.com/ Where does Pfizer’s revenue come from?

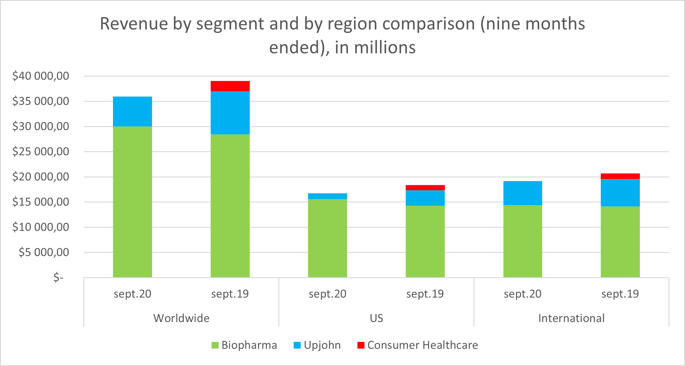

Looking at the latest quarter, PFE derives a large amount of its revenue from its biopharma practice and a significant amount from its Upjohn division. Upjohn was a subsidiary of Pfizer which merged in November 2020 with Mylan to form Viatris, but it still figured in the September 10-Q. There have been some pretty rough operational performance results concerning Pfizer’s subsidiary firms--bad demand in China, Japan, Brazil and Europe, to supply chain hiccups have weighted PFE down. The overall trend below shows a large decrease in Consumer Healthcare, a decrease in Upjohn, but a slight improvement in their Biopharma division. Upjohn gone from a divestiture means 20% of Pfizer’s revenue is vanishing with it. However Pfizer made $12B in proceeds from this sale to Viatris which slightly deleverages Pfizer.

Revenues were down for the third quarter of 2020 by $549M due to Covid-19. Disruptions to wellness visits from patients to their primary care physicians, and planned surgeries as well as changes in patterns for certain big hit products have led to lower revenues in Q3 2020. Pfizer was hindered by a decrease in emerging markets demand, reflected in its operational dip, and they have suffered losses on foreign exchange considering a weakening US dollar.

What risks does Pfizer face?

- Disruptions in the relationships between PFE and third-party suppliers.

- If competition builds better product, better vaccine.

- Risks related to the availability of raw materials.

- Challenges related to the BNT162 mRNA vaccine’s ultra low temperature storage and distribution requirements.

- Risk of not being able to recoup the R&D expenses from having developed the vaccine.

- Weakened diversification in therapeutics from Upjohn sale.

Is Pfizer threatened by the substitute products out there?

Pfizer sells lots of products and owns a lot of companies that distribute their outputs. The list includes, Prevnar 13, Ibrance, Xeljanz, Lipitorm, Lyrica, Enbrel, Chantix, Sutent, the famous Viagra (actually showing a +1% change in revenue), and many more. Pfizer declares competition as the rational for its subsidiaries’ poor performance in exactly six accounts in its last 10-Q. While Pfizer is divesting away from its consumer health business, it still has a very diverse portfolio. Overall, as we will see below, Pfizer is a profitable company and while it is challenged by the others it remains the captain of the ship.

Pfizer’s Q3 2020 fundamentals and financial performance:

Operating income, the profit after a company pays its operating costs, was positive at $3.38B, which Pfizer will most likely pour into dividends since it’s recent M&A activity with Upjohn seems to be the end of the road this year for further moves. Revenue has been relatively steady in the past three years which says a lot about the consistency of business operations. Earnings have been consistently hitting the estimated marks for the past three quarters of 2020. Pfizer has a higher P/E ratio than the industry average, but falls short of MRK and LLY, where LLY seems to take quite the lead. A high P/E ratio suggests investors are willing to pay a premium to own the stock. Pfizer dividend yields are roughly 4% of the current stock price which is 1.5% higher than the average industry dividend yield (not bad at all).

Pfizer's downsides:

- If the company continues to play in the M&A space it could overleverage itself and de-prioritize its other commercial goals.

- R&D cost cutting and uncertainty regarding profits from the vaccine could slow down its progress and growth.

- Merck’s pipeline pneumococcal vaccine could take market share away from Prevnar 13 if the next generation vaccine fails.

- Many of PFE’s late-stage pipeline drugs are going into saturated markets which could hinder gains.

Pfizer's upsides:

- Pfizer’s competitive position in the market, it’s overall low industry risk and its relatively good cash flow and leverage levels could serve it well coming into the next year.

- Liquidity is impressive and PFE could take a big market shock successfully.

- Success with cardiovascular drug Vyndaqel could be a game changer in the rare disease area.

- Cashflows are strong and dividend yields are attractive for shareholding.

- Selling off Upjohn frees PFE up to innovate further.

In the news

- DOW JONES: PFE to complete first covid-19 vaccine shipments to US; to deploy two million shots by the end of next week and two million after that, and so on. The second round of shipments of the vaccine will occur today in the US with 2.9 million vaccines being deployed.

- A woman in Alaska was hospitalized after receiving the shot due to an allergic reaction. She recovered after an anaphylactic shot but was someone with no history of allergic reactions. Similar allergic reactions occurred in the UK.

- 3,019 people were reported to have passed away from covid-19 yesterday in the US, the third largest daily figure.

Sources:

BoA Global research

Morningstar report

S&P Global, ratings direct report