Some of the strongest earnings growth that the world’s biggest companies are ever likely to see was not well-received by the market. How come? And what does it say about future stock performance?

As we come to the end of second-quarter earnings season (over 90% of S&P 500 companies have reported) – one of the biggest questions is – Why the soft reaction from the market to such good results?

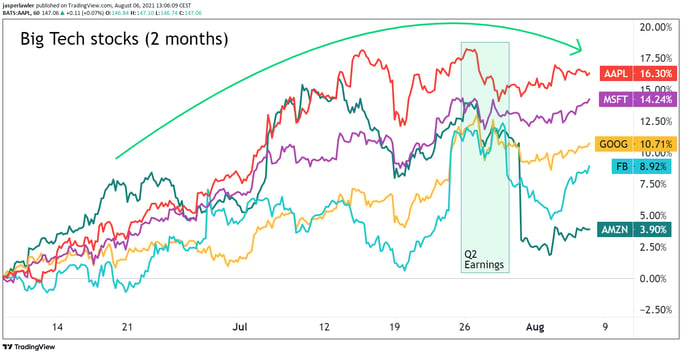

This is a phenomenon from across multiple sectors, but given its large weighting in US stock indices, perhaps the most important is what happened to big tech. When talking about ‘Big Tech’ we me mean the best known FAAMG stocks – Facebook, Apple, Amazon, Microsoft & Google (Alphabet)

What’s happening with Big Tech stocks?

All of the mega cap tech stocks under-reacted (most fell) on better-than-expected Q2 earnings results. The exception was Amazon that actually missed revenue expectations and Google, where shares rose slightly. As the chart below shows, the reaction to great earnings news came off the back of 2 months of solid gains.

Let’s examine some of the logic behind the share price declines after results

Why did the stocks fall after good earnings?

Some of these reasons explain anytime a stock drops after good results, others are specific to the circumstances.

1 Profit-taking

The simplest explanations are often the most overlooked. Tech stocks had a big run up before earnings, so some investors wanted to lock in the gains. The extra trading volume and higher liquidity during an earnings release give institutional investors a unique opportunity to sell some of their large positions. Another way of explaining this phenomenon is ‘buy the rumour and sell the news.’ Savvy investors bought the stocks because they saw the earnings beats coming in advance and sold them once their theory was proven correct.

2 As good as it gets

Earnings growth is calculated on a year-over-year basis – and a year ago we were in a government-mandated recession caused by lockdowns. Now we are in a recovery brought about by governments ending those lockdowns and stimulating the economy with extra spending. This is a very unique circumstance and had a uniquely negative then positive effect on company earnings growth. As the chart shows, the number of companies beating estimates normally tops out shortly after the recession ends.

The counterpoint to this argument could be that these companies have shown massive earnings growth that extends beyond the covid recession, likely making them more enduring. As a group these companies have doubled their earnings growth in the past two years and continue to dominate in their respective businesses.

3 Stay at home trade is over

It’s no secret that big multinationals whose businesses are digital or facilities the digital economy expanded their market share at the expense of small and medium businesses (SMEs) during the pandemic. When locked in their houses people were basically forced to use more technology to interact with the outside world. This had the effect of ‘pulling forward’ technology adoption that probably would have happened later on, say in 2022/23 into 2020/21.

Now that economies are re-opening, this affect goes into reverse – hence the ‘rotation to value’ that took place in the first quarter. Worries over the Delta variant and a slow reopening in Europe helped unwind the value trade in Q2 but it could be back in Q3.

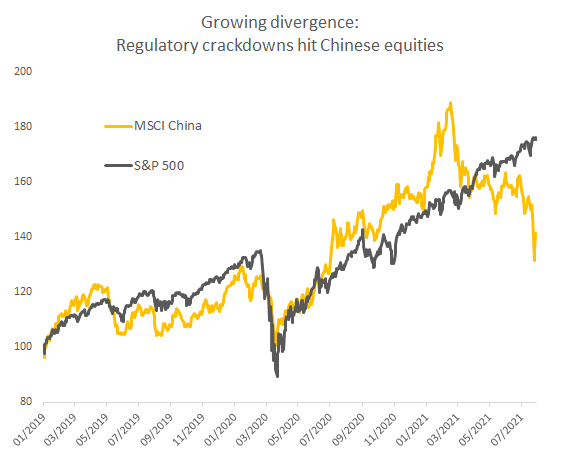

4 It’s China’s fault

Rapidly increasing regulatory risk in China has disproportionately hit technology companies. Casting a broad brush, you can say Beijing has seen the writing on the wall. US tech companies are now so powerful they can influence US elections, and the CCP saw Jack Ma and other tech billionaires in the same light.

This affects US tech stocks in two ways – part 1 is the direct affect on any business they have in China and the increased chance of it being regulated away. That risk was always there but it has intensified. Part 2 is that the anti-tech monopoly ideas spread across the pacific back to Washington DC and US tech faces greater break-up risk.

5 Summer blues

The end of Q2 earnings season takes us right into what is typically a lull in trading activity during the summer when people are away from the markets on holiday. The lighter liquidity can mean extra short-term volatility, though typically big trends are not established. Some investors choose to exit positions or rotate into lower value opportunities during this period.

6 Company specifics

If you look hard enough you can find things to not like from each other big tech earnings reports. The chip shortage could prove to be a problem for iPhone sales, just as Apple readies a new model in September. Facebook keeps offering weak forward guidance (and easily beating it later). Alphabet and Facebook have the rather cyclical advertising market to contend with. The reason Alphabet broke ranks and rose after its results was the high dependency on travel in Google search advertising.

What next for Big Tech?

For long term investors there are really two guiding principles for investing in these big technology companies- earnings and valuations.

Earnings: The cash generation at these companies is truly historic and shows no sign of abating. The digitalisation of the economy, which has accelerated since the pandemic re-enforces the structural changes these companies are helping to fashion. Big Tech firms avoided maturing into slower growth dividend-payers because of their ability to spread and capture new growing fields of technology, such as cloud computing.

Valuations: The effect of shares declining after strong earnings has been to reduce P/E ratios BUT historically high P/Es pose a long-term risk. Central banks have kept borrowing rates artificially low and forced conservative savers into investments they might never otherwise have taken. That includes owning the biggest company stocks as well as index funds that are dominated by these same stocks. If interest rates ever do normalise (or even look like they could normalise like we saw with the brief bond freak-out in Q1) these tech stocks could be some of the hardest hit.