The reopening trade demand surge plus supply chain bottlenecks currently challenge the freight industry in several ways. What are the consequences of this pressure to expand quickly and how to play it?

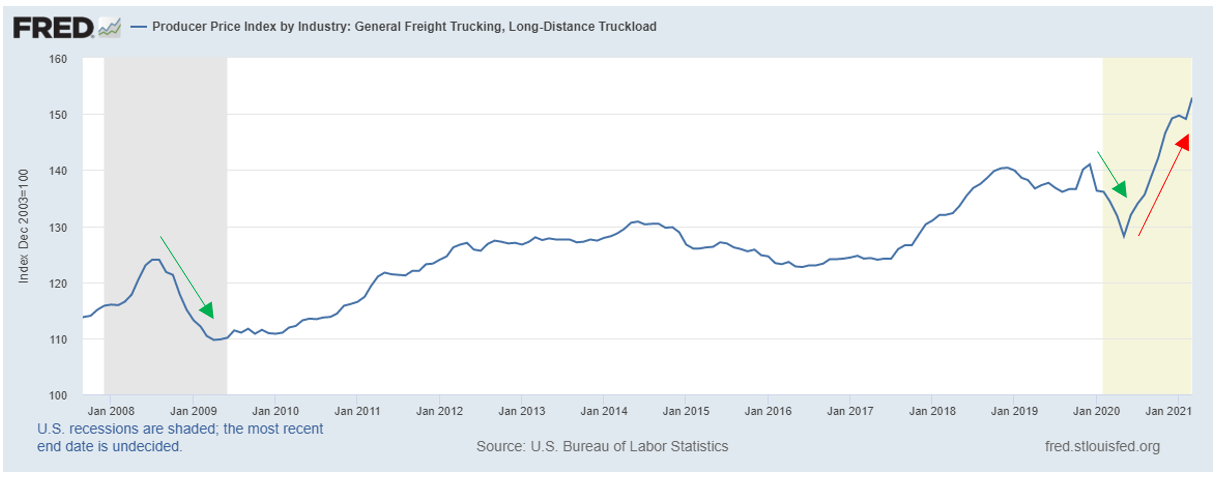

Soaring PPI in the freight and trucking industry despite pandemic-led recessionary period

The freight industry is in a pickle these days—low capacity, low inventory, soaring demand outlook, supply chain disruptions, and rising rates only add to the 1 million trucker shortage issue.

According to FRED data shown in the graph above, the producer price index for the general freight and trucking industry has been soaring since May 2020, but observe how much longer the fall in PPI was in 2008 versus the 2020 recession… This big picture phenomenon could be explained through a combination of unforeseen factors studied below.

Supply chain constraints in part related to port congestion, shipping rate price climbs, and demand expanding as economies reopen is putting pressure on an industry that is already experiencing a 1 million trucker shortage.

Consumers will most likely bear the bulk of this industry inflation as costs are passed on, enabling freight companies to bolster their bottom lines and earnings per share.

Market movers in the freight space

The main market movers in the freight space are the following: There is a boom in trade caused by the reopening of economies, which is clearly reported by freight industry professionals. An increasing demand for goods means more trucks to transport goods are needed, but since 25% of trucks are parked around the US because there are not enough qualified truckers, this puts pressure on deliverable timelines and, rates.

In addition, there are headwinds in the form of supply chains disruptions like port congestions, and container shortages making it harder to move goods around. Ideally, in this sort of demand shock environment, there should be more truckers and more trucks made available. However, these disruptions could be temporary and structural, meaning that in the medium term they could be fixed and stabilized.

Consequences of market movers on the freight industry:

Because of the reasons mentioned above, the following consequences arise; gas prices see upward pressure, shipping rates rise, labor costs rise, and consumers see higher prices.

Fuel could see further upward pressure in price not because of a shortage in fuel, but because of a shortage in truckers. Most of the fuel used to drive our cars are transported by trucks from source to customer access point.

With less truckers able to move fuel quickly, it becomes a supply-side pressure that could see a demand and supply mismatch at the station. With stations not getting filled up quickly enough, prices could rise. This could be good news for gas companies like Chevron, Exxon, and Shell.

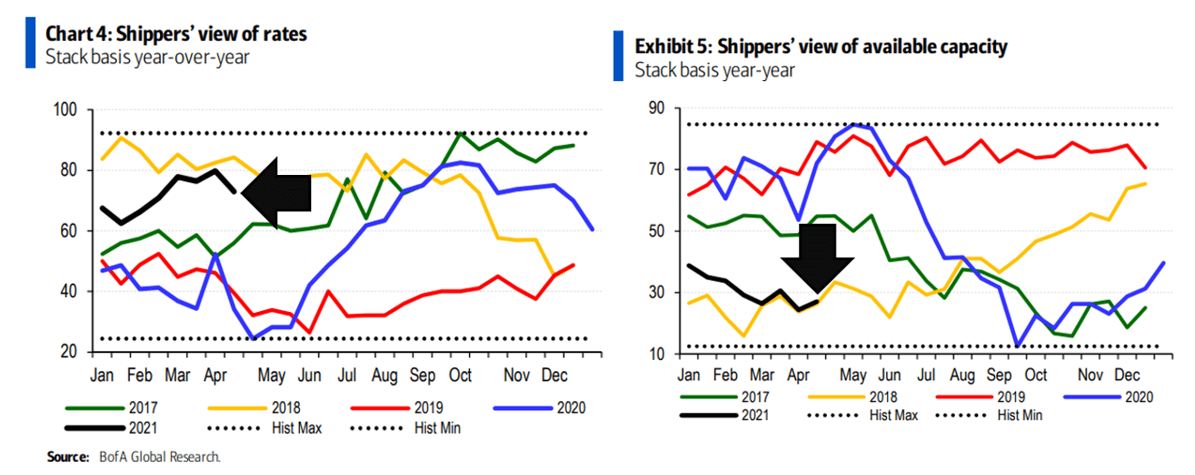

Shipping rates are quickly rising as capacity falls, much in the same way 2018 behaved. The graphs below show on the left rates that are far below historic highs, but higher than 2020 levels by a wide margin. This could be linked to the graphic on the right, a graph showing how low the capacity for shipping is, something putting upward pressure on rates.

As the shortage for truckers continues to grow, and demand for labor rises, we see a natural northward shift in the price of trucker wages. This wage growth is not inflationary per se, but is certainly linked to an environment that exhibits inflationary pressure from a demand pull.

This is good news for truckers, but harsh on consumers as freight companies offload the price hike on them. It will be interesting to see how Amazon reacts to this, and if this could hinder their net income since prime members don’t have to pay for shipping.

Some food for thought; rates remain below historic highs seen in 2014 and 2018, same thing for demand indicators for the next three months, and a lowered production of large truckload carriers could mean tailwinds for the stocks seen below.

Consequences for freight stocks

Pricing is seeing some volatility right now considering the shortages in both truckers and trucks. More specifically shipping rates, with shippers saying rates can double from day to day, are off peak levels which is a good sign going into seasonally soft Springtime.

Overall, the largest truckload carriers have being adjusting their EPS outlook north saying that demand for the over-the-road truckloads is surging, and could continue to surge well in 2022. Mid teen contract rate increases alongside the difficulty to produce more trucks because of the chip shortage, let alone the trucker shortage, could be favorable conditions for some of the firms shown below.

How to play the trucker shortage:

Gas prices could see continued upward pressure in part due to the trucker shortage. There could be an opportunity for further gains if this problem persists, so one might consider the gas stocks mentioned earlier i.e., Chevron, Exxon, Shell.

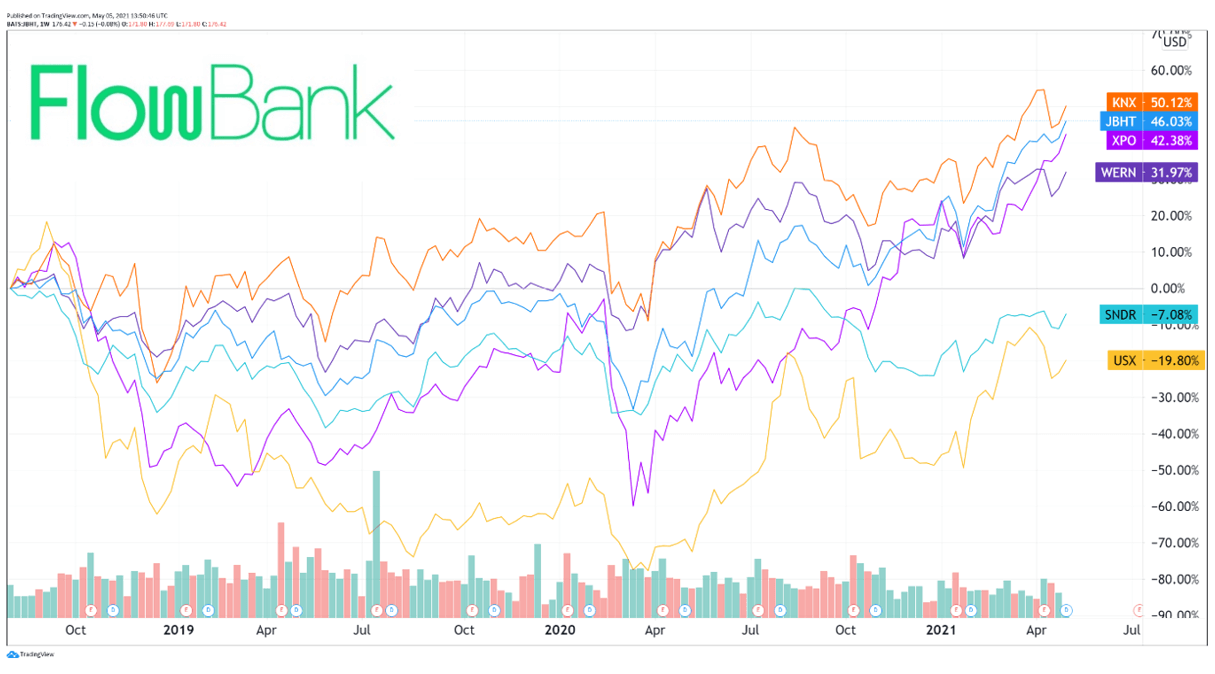

JB Hunt sees forecasted EPS growth of 37% in 2021, and 14% in 2022 going off a 28.5X target multiple.

Knight-Swift Transportation Holdings is a direct beneficiary of the truckload tailwinds, it operates the largest tractor fleet in the US and contracts third party equipment providers. It reported an 88% surge in their bottom-line YoY two weeks ago.

Schneider National increased its 2021 EPS outlook after seeing its bottom-line surge 30% in 2020. US Xpress Enterprises’ fleet consists of approximately 6,900 tractors and approximately 15,500 trailers, including approximately 2,000 tractors provided by independent contractors. It saw EPS rise in 2020 and expects it to grow in 2021.

Werner Enterprises one of the US’s largest transportation and logistics companies, reported record first quarter operating income and diluted earnings per share for the Q1, with more growth to come.

XPO Logistics reported earnings on Monday showcasing a $4.8 billion record in quarterly sales, the firm’s highest ever. CEO Bradley Jacobs said their truck brokerage business continued to outperform the market, and that they see tailwinds in the form of e-commerce, outsourcing, and warehouse automation.

Figure showing the top five freight companies share price performance.