If you're a little techy and you like wine, you probably know Vivino, the startup who already raised $56.3 million and helps you choose a wine from a restaurant menu or give you tips and clues at the supermarket. Winc is another startup who wants to blend modern technology to our millenary devotion to wine.

What is Winc?

Winc is like a wine club. Wait, it actually is a wine club but with personal recommendations. You first fill in a questionnaire, so that the company can assess your - poor in my case, hopefully better in yours - taste in wine. You then receive wine bottles at home and can rate them to better assess the sensibility of you pallet. Currently only available in the USA, the price of a Winc subscription starts at $39 (three bottles) + $9 (shipping) = $48 per month. For orders over four bottles, you get free shipping (more wine for your buck) and your monthly due can change based on the different quality of wine you chose.

If you happen to fancy playing the wine scholar and brag about your vast knowledge to your friends, Winc also has books on the vocabulary and terms you should be using while drinking wine. Ultra fancy.

Source: Winc website

Wine that you are creating

As from 2016, Winc has started to make wine itself, and assembled a team of five winemakers. In 2017 alone they where able to ship 100 different types of wine to their customer for them to try.

Because they are also winemakers, they can create “assemblages” that fit their client's data, like one of their biggest hit: “Summer Water Rosé”. By imputing real-time customer feedback and data back into the system, Winc has made a unique and innovative way of producing wine. Instead of playing the game traditionally by making wine they like to then propose it to customers, they do things reverse by first gathering customer feedback to then sell them bottles tailored to their taste.

Source: Winc website

Can I invest in Winc?

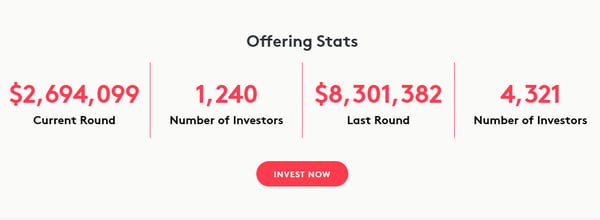

If you’re convinced by the idea, you can already invest directly in Winc, but at a price. A share is currently valued at $1.75 but there is a minimum investment of $1001.The crowdfunding round will help them expand to other beverages such as beer or sake.

The wine market in the USA is evaluated at $220 billion with the five largest companies selling 75% of all the wine in the country. Winc has shown a revenue of over $28m between March and June 2020. The investment will also help them make a strategic acquisitions, with the goal in mind to acquire one brand per year. Because the company is data-driven, it can adapt its production to trends and has just started creating a new organic line, The Wonderful Wine co. Indeed, Beverage Daily expects that 1 billion of organic wine bottles will be consumed every year in the United States by 2023.

Check out there website here for more details.

Source: Winc website

Potential risks

However, Venture Capitalist are warning retail investors that Winc has already raised a large chunk of money from institutional investors, which means that the returns for retail investors could stay average. On the other hand, if you are a wine lover, it is still a great way to be part of a wine-producing company and help with its international expansion.

Source: Winc website

Other wine investments ideas

There are sadly no wine-only ETFs but only alcohol related ETFs. If you want to invest in wine directly, you can screen some stocks like Diageo or Truett-Hurst.

Another thing you might want to have a look at are wine funds. Yes, you heard me, wine funds do exist and are managed by knowledgeable fund managers who know their business. The funds offer a different type of investment such as investments in vineyards or in bottles who are bought, stored and sold at the right time. The yearly returns have been of about 7% for the Wine Source Fund or 10% for the Vini Sileo Vineyard Fund and it is a good source of diversification.

The traditional way of investing in wine can be done at home - as in buying bottles, aging them and selling them at a higher price - but requires expertise and money.

To sum up, investment in wine could become more and more popular. You can already invest in stocks and we hope that some wine-related ETFs will show up. On the other hand, you have Winc and you can help them expand and hopefully make a return on it!

Sources:

Winc Review: The Netflix Of Wine, in Money under 30

How Winc Became One Of The Fastest Growing Wineries In The World, in Privy

Wine ETFs (What they are and how to invest in them), in Vinovest