Wish, your favourite cheap stuff e-commerce platform just announced its initial public offering in New York (joining the planned IPOs of Airbnb, DoorDash, Affirm and Roblox).

What is Wish?

For those who may not know Wish, imagine this. It's like a dollar store full of cheap plastic stuff you have absolutely no need of but want to acquire when you see it. Socks, school material, coffee mugs, sextoys, cookingware, you name it, they have it. And for very cheap.

The company targets middle to low income customers with items directly shipped from China. (Not everyone can afford the juicy $119 a year to be in Amazon's Prime Club. Imagine being able to acquire a stainless-steel watch for as little as $4! Everything is written between 60% off and 90% off, it’s almost as if they were paying you to get their stock.

“We built Wish to serve these consumers who favor affordability over brand and convenience, and are being underserved by traditional ecommerce platform,” the IPO filing said.

About the IPO

The company recently filed a preliminary S-1 with the SEC (Securities and Exchange Commission). Wish's parent company, ContextLogic, wants to list its share on the Nasdaq under the ticker name "WISH".

The company is aiming at a valuation between 25 billion and 30 billion on the public market. It last raised money at a 11.2 billion valuation. Some bankers initially pitched the company for 40 billion.

While Wish desire to raise 1 billion dollars, they have not yet disclosed how many shares this will be, nor given any information about the timeline.

How can a store get so cheap?

As they are only the middleman connecting the factories to the clients, they do not need a fulfilment service line. This practice has become very common and is called drop shipping: you hold no stock; you just build a nice website and you become the middleman between Chinese factories and the international market. Many self-made entrepreneurs tried making it this way and some succeeded (success story example: MVMT started as an ecommerce Shop before developing its own brand).

Wish is just doing it on a massive scale, cutting margins to the maximum to get astounding prices.

In addition to simple dollar store where you'll find just about anything (that you want, and do not want) in front of you, wish has a machine learning algorithm - developed by its CEO Peter Szulczewski (a Google Alumni, a.k.a. magician) – that sorts out what you like and don't like and makes sure that you see mostly objects tailored to your preferences and that you're therefore more likely to buy and like.

Their moto: "Bring an affordable and entertaining mobile shopping experience to billions of consumers around the world."

The cheapest products ever

You have just about anything on the platform, from $2 beauty products and clothing to firearm accessories – I've seen in in the military, people were customizing their swiss rifles with Wish accessories, I swear –, video cameras for as little as $100 or survival kits.

However, what might come amiss at such low prices is – you guessed it – the quality.

“In addition, we may be subject to unfavourable publicity that would create a public perception that non-authentic, counterfeit, dangerous, illegal, or defective goods are sold on our platform, or that our policies and practices are insufficient to deter or respond to such conduct,” Wish said. (I have seen some Rolexes on there, I am no counterfeit expert, but I am not entirely sure about the legality of these objects.

In fact, the concern is so great that in 2014, PayPal had even suspended payments on the website "as a result of concerns related to products listed on our platform”. Cheap also comes with its issues, not great.

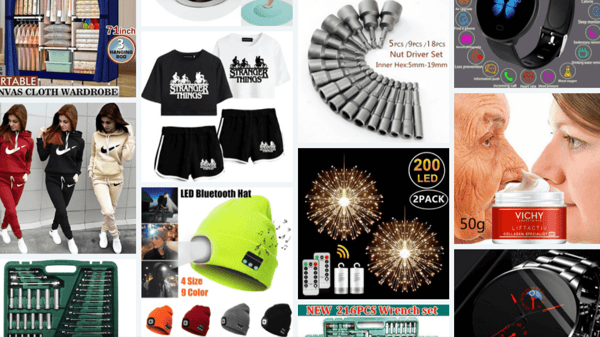

Examples of products (source: Wish's website)

Numbers that say a lot

The company had a revenue of $1.7 billion in the first 9 months of 2020, which is up 30% from last year – of course, e-commerce is doing very well at the moment as you may have heard. The company reported selling over 640m items in the last 12 months. However, its net loss grew as well, from 5 m last year to 176m in the first 9 months of this year.

Although the company has a compound annual growth rate of 90% since 2015, its revenues are only 32% higher than the same period last year, and revenue went up 10% only from 2018 to 2019. This means that Wish is showing a slower growth than other giants like Amazon Target and Walmart, with a much smaller user base – it should be the other way around: they should have less trouble nurturing more growth. Amazon reported a 38% increase in its first-party sales and +55% with its third-party sales, while Target and Walmart reported an increase of 155% and 79% respectively in their third quarter digital sales. Wish's growth remains weak in comparison.

Nevertheless, although their profits are written with red ink, we must mention that their balance sheet is solid, with $1.1 billion in cash and short-term investments as well as no debts.

The company has a presence in over 100 countries and claims to have 100 million monthly active customers for 500'000 merchants. Finally, Wish is also the most downloaded shopping app in each of the last three years. Rock solid performance on country and customer acquisition, although its growth remains a little weak according to some analysts.

A high dependence on China

One last issue is that Wish is almost entirely dependent on Chinese factories. If things go south between the Red Dragon and Uncle Sam, they might lose the entire American market.

In the Corona situation for example, many packages were delayed due to the long transit times, which showed the weakness of their "on the cheap" business model.

“We initially grew our platform focusing on merchants in China, the world’s largest exporter of goods for the last decade, due to these merchants’ strength in selling quality products at competitive prices,” the prospectus says.

Amazon and Walmart also have a growing share of China-based sellers, but this is certainly not the biggest part of their business.

In July for example, the Universal Postal Union set higher rates on inbound mail from China, which mean that Wish merchant may have been forced to raise their prices to compensate. This is just one example from the many issues that may arise with such a long distribution channel.

Further escalation of the trade tensions between the US and China could therefore be very harmful to the business.

“Trade tensions between the United States and its trading partners, especially China, could result in long-term changes to global trade, including retaliatory trade restrictions that restrict the international flow of products,” said Wish. “Any alterations to our business strategy or operations made in order to adapt to or comply with any such changes would be time-consuming and expensive, and certain of our competitors may be better suited to withstand or react to these changes.”

They are now working on diversifying their merchant base, not only focusing on China, adding merchants from other continents such as Latin America or Europe. Their US merchant base has grown 268% since 2019.

Sources:

Wish reveals $1.7bn revenue as it joins rush of tech IPOs, in Financial Times

E-Commerce Unicorn Wish Files for IPO, in the Motley Fool

Wish, the world's most-downloaded shopping app, has filed to go public after reporting $1.75 billion in revenue in the first 9 months of the year, in Business Insider

Wish releases its filing to go public, shows slow growth and steady losses, in CNBC

Wish IPO prospectus reveals heavy risks tied to e-retailer’s reliance on China, in CNBC

Read our next article: XRP price moves turn euphoric on chance Ripple will used by central banks