Zoom simply exploded during the pandemic, its stock having soared as much as 400%. However, the end of the pandemic means that the company needs to find other ways to expand to keep growing.

Key takeaways on the acquisition

- Zoom announced on Sunday that it will acquire cloud call centre company Five9 for $14.7 billion in stocks.

- It is the company’s very first multi-billion dollars deal, expanding its offering beyond video chat.

- Five9’s market capitalization as of Friday was of $11.9 billion, implying a 13% premium for the acquisition price.

About Zoom

The pandemic really shone the light on Zoom Video Communications, a video-conferencing start-up that managed to seduce the greater part of the world, competing with giants like Cisco, Skype and Microsoft Teams.

Zoom is predominantly known for its video conferencing services but it is expanding its offering to include a cloud phone system called Zoom Phone, as well as a conference software called Zoom Rooms.

About Five9

Five9 is one of the pioneers that offers call centres via cloud computing. They built a highly scalable software for cloud-based contact centre software. Their easy-to-use interface lets users manage and optimize customer interactions across many different channels.

Contact and call centres are a growing market, especially the cloud-based part of it. The pandemic has accelerated its adoption as many of the workers had to switch to remote work.

“Joining forces with Zoom will provide Five9’s business customers access to best-of-breed solutions, particularly Zoom Phone, that will enable them to realize more value and deliver real results for their business,” said Rowan Trollope, CEO of Five9.

$15 billion: their biggest acquisition so far

Zoom acquired Five9 in an all stock-transaction that valued Five9 at $200.38 a share, as they closed at $177.60 on Friday. Five9 shareholders will receive 0.5533 shares of Zoom class A common stock. The total deal will be worth around $14.7 billion.

“The trend towards a hybrid workforce has accelerated over the last year, advancing contact centres’ shift to the cloud and increasing demand by customers for customized and personalized experiences,” said Zoom CEO Eric Yuan when announcing the transaction.

It is by far the company’s biggest acquisition ever, but certainly not the first. Last year, the company bought Keybase Inc. to build the end-to-end encryption capabilities of their videoconferencing services, and last month, they acquired the translation software Kites GmbH.

The deal was approved by the board of directors of both companies, only Five9’s shareholders are yet to give their approval. If they do, the deal is anticipated to close in the first half of 2022.

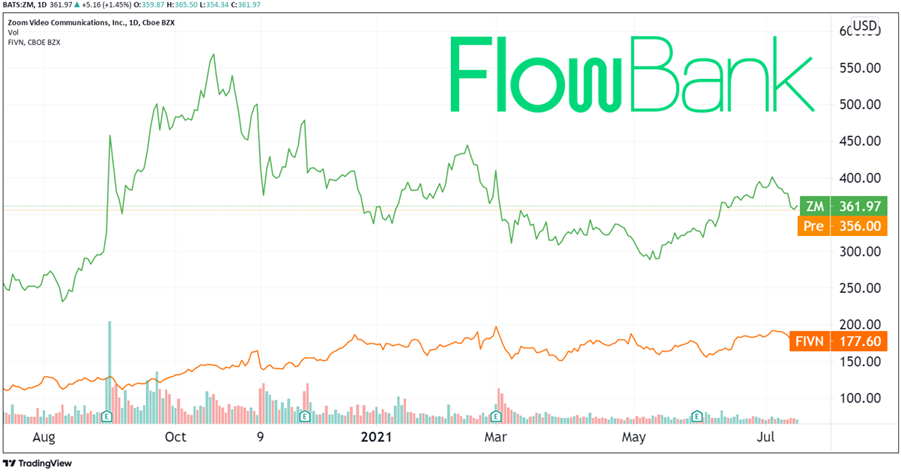

Both Zoom and Five9's stock fared well in the past year (Source: TradingView)

Where is Zoom going with this acquisition?

This deal simply helps Zoom expand their communications opening and tap into a $24 billion contact-centre market.

What Zoom fears is a reversal of their outstanding success in the pandemic when customers rush outside to make the best out of their new freedom and spend less time socializing and working remotely through screens.

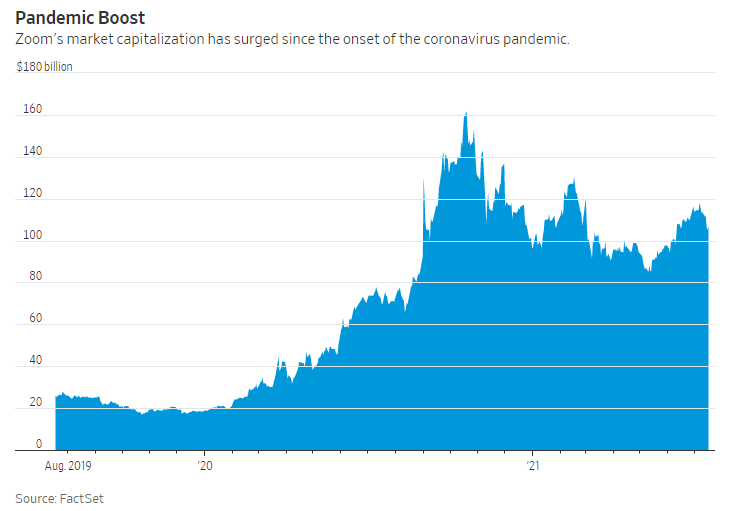

In the 12 months between January 31st, 2020, and January 31st, 2021, Zoom’s annual sales quadrupled to $2.65 billion, while at the same time, its share price rose 400%. This brought Zoom’s market value to $106.7 billion, according to FactSet. Nevertheless, we ought to note that it remains well below its October high. Their revenue in the three months to April 30th still surged from a year ago to $956 million.

The pandemic boost was immense for Zoom (Source: WSJ, FactSet)

What Zoom needs to do, according to Eric Yuan, is to capitalize on their massive new subscriber base. If not as many people need simple video conference to talk to their friends or colleagues, the company has no choice but to expand their range of communications offering. “We are continuously looking for ways to enhance our platform, and the addition of Five9 is a natural fit that will deliver even more happiness and value to our customers,” he said in a statement on Sunday.

One last interesting remark is that Five9’s software is used by many companies that Zoom is trying to challenge in the market, such as Microsoft Teams or Salesforce. The acquisition will allow Zoom to cross sell their service to Five9 customers, but as some customers are also competitors, they might not be so interested in joining and might switch to other alternatives.