How does the Automatic Currency Conversion work?

The automatic currency conversion is not activated by default

This means that if you wish to invest in instruments which are in a currency that you do not hold, you will be debited in this currency causing you to hold a negative balance and paying negative interests on it.

For example : If you fund your account in CHF and buy instruments on the US market without having the automatic cash conversion activated nor converting CHF into USD, then you would have a negative balance in USD on which you would pay negative interests on.

The rates of these negative interests can be found on our price list.

As a rule, if you do not activate the automatic cash conversion you would need to convert your currencies manually in order to avoid these additional charges.

The automatic cash conversion allows you to be debited in the currency you have chosen in order to buy instruments in a currency that you do not hold.

By enabling this feature, the currency conversion will be done automatically given the current market rates. Please note that this feature will be applied for future transactions, but it will not convert your existing negative currency balance.

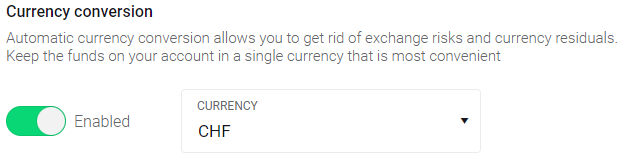

If you wish to activate the automatic cash conversion, log into your client area at my.flowbank.com, under "Account Management" and scroll down to "Currency Conversion".