Open and fund a FlowBank MetaTrader account and receive a USD 300 cash bonus (hereinafter called “trading bonus”.)

See more details

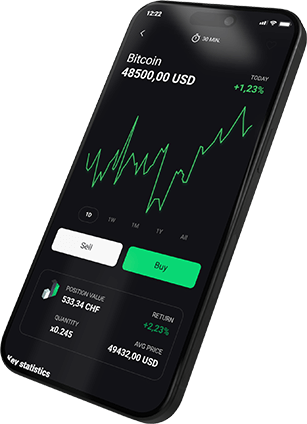

The Bitcoin Question

The news of Bitcoin ETFs being approved by the SEC, crypto digital assets are getting attention. See how Crypto ETFs, ETPs and ETNs can enhance your portfolio.

- Trade Bitcoin markets with the simplicity of ETFs

- Enjoy unmatched fees and spreads for optimal investment growth

- Experience the security and trust of a Swiss Bank

Embrace the Future of Investing with FlowBank

Offer details

Explore our products

| Name | Ticker | Underlying Crypto | Pricing |

|---|---|---|---|

| Ether Tracker Certificate USD | SETH SE | Ethereum (ETH) | 0.0 % (min 0 CHF) |

| 21Shares Bitcoin ETP | ABTC SE | Bitcoin (BTC) | 0.0 % (min 0 CHF) |

| 21Shares Ethereum ETP | AETH SE | Ethereum (ETH) | 0.0 % (min 0 CHF) |

| 21Shares Ripple XRP ETP | AXRP SE | Ripple (XRP) | 0.0 % (min 0 CHF) |

| 21Shares Binance BNB ETP | ABNB SE | Binance Coin (BNB) | 0.0 % (min 0 CHF) |

| 21Shares Polkadot ETP | ADOT SE | Polkadot (DOT) | 0.0 % (min 0 CHF) |

| 21Shares Crypto Basket Index ETP | HODL SE | Top 5 crypto | 0.0 % (min 0 CHF) |

| 21Shares Bitwise Select 10 ETP | KEYS SE | Top 10 crypto | 0.0 % (min 0 CHF) |

| 21Shares Bitcoin ETP | ABTCEUR SE | Bitcoin (BTC) | 0.0 % (min 0 CHF) |

| 21Shares Ethereum ETP | AETHEUR SE | Ethereum (ETH) | 0.0 % (min 0 CHF) |

| 21Shares Crypto Basket Index ETP | HODLEUR SE | Top 5 crypto | 0.0 % (min 0 CHF) |

| 21Shares Bitcoin ETP | ABTCGBP SE | Bitcoin (BTC) | 0.0 % (min 0 CHF) |

| 21Shares Ethereum ETP | AETHGBP SE | Ethereum (ETH) | 0.0 % (min 0 CHF) |

| 21Shares Crypto Basket Index ETP | HODLGBP SE | Top 5 crypto | 0.0 % (min 0 CHF) |

| Sygnum Platform Winners Index ETP | MOON | 21Shares Sygnum Platform Winners Index | 0.0 % (min 0 CHF) |

| BTCetc – ETC Group Physical Bitcoin | BTCE | Bitcoin (BTC) | 0.0 % (min 0 CHF) |

| COINSHARES PHYSICAL BITCOIN (BTC) | BITC | Bitcoin/CHF | 0.10 % (min 6.50 CHF) |

| COINSHARES PHYSICAL ETHEREUM (ETH) | ETHE | Ethereum (ETH) | 0.10 % (min 6.50 CHF) |

| 15 FiCAS Active Crypto ETP | BTCA | Top 15 crypto | 0.0 % (min 0 CHF) |

| COINSHARES PHYSICAL LITECOIN (LTC) | LITE | Litecoin (LTC) | 0.10 % (min 6.50 CHF) |

| 3iQ CoinShares | BTCQ | Bitcoin (BTC) | 0.10 % (min 6.50 CHF) |

| WisdomTree Bitcoin | BTCW | Bitcoin (BTC) | 0.10 % (min 6.50 CHF) |

| Bitcoin Tracker Certificate USD | SBTC.U SE | Bitcoin (BTC) | 0.0 % (min 0 CHF) |

| Bitcoin Tracker Certificate CHF | SBTC.C SE | Bitcoin (BTC) | 0.0 % (min 0 CHF) |

| The Ether Fund | QETH.U | Ethereum (ETH) | 0.15 % (min 6.50 USD) |

| The Bitcoin Fund | QBTC | Bitcoin (BTC) | 0.15 % (min 6.50 USD) |

| Bitcoin ETF | EBIT.U | Bitcoin (BTC) | 0.15 % (min 6.50 USD) |

| Purpose Bitcoin ETF | BTCC.U | Bitcoin (BTC) | 0.15 % (min 6.50 USD) |

| CI Galaxy Bitcoin ETF | BTCX.U | Bitcoin (BTC) | 0.15 % (min 6.50 USD) |

| VanEck Vectors Bitcoin ETN | VBTC | Bitcoin (BTC) | 0.15 % (min 6.50 USD) |

| Bitcoin / US Dollar | BTC/USD | Bitcoin (BTC) | Spreads from 0.3 % |

| Ethereum / US Dollar | ETH/USD | Ethereum | Spreads from 0.35 % |

| Bitcoin Cash / US Dollar | BCH/USD | Bitcoin Cash | Spreads from 0.9 % |

| Litecoin / US Dollar | LTC/USD | Litecoin | Spreads from 0.9 % |

| Eos/US Dollar | EOS/USD | Eos | Spreads from 1.2 % |

| Stellar / US Dollar | XLM/USD | Stellar | Spreads from 1.2 % |

| Neo / US Dollar | NEO/USD | Neo | Spreads from 0.9 % |

| Dogecoin /US Dollar | DOGE/USD | Dogecoin | Spreads from 1.3 % |

| UniSwap/US Dollar | UNI/USD | UniSwap | Spreads from 1.3 % |

| ChainLink /US Dollar | LINK/USD | ChainLink | Spreads from 1 % |

| Helveteq Bitcoin Zero ETP | BTC02 | Bitcoin (BTC) | 0.10 % (min 6.50 CHF) |

| Helveteq Ether Zero ETP | ETH20 | Ethereum (ETH) | 0.10 % (min 6.50 CHF) |

| BlackRock - iShares Bitcoin Trust | IBIT | Bitcoin (BTC) | 0.10 % (min 6.50 CHF) |

| Grayscale - Bitcoin Trust ETF | GBTC | Bitcoin (BTC) | 0.10 % (min 6.50 CHF) |

| The Valkyrie Bitcoin and Ether Strategy ETF | BTF | Bitcoin (BTC) | 0.10 % (min 6.50 CHF) |

| Ark Invest - ARK 21Shares Bitcoin ETF | ARKB | Bitcon (BTC) | 0.10 % (min 6.50 CHF) |

| Invesco - Galaxy Bitcoin ETF | BTCO | Bitcon (BTC) | 0.10 % (min 6.50 CHF) |

| Bitwise - Bitcoin ETF Trust | BITB | Bitcon (BTC) | 0.10 % (min 6.50 CHF) |

What is an ETF?

An ETF (Exchange-Traded Fund) is an investment fund type and a traded product, which means that they are traded on stock exchanges, just like a stock. ETFs are similar to mutual funds as they give investors the opportunity to pool their money into a fund that invests in stocks, bonds or other assets like cryptocurrencies and consequently receive participation in the investment pool. Why put Bitcoin in an ETF?

Advantages of ETFs include lower costs associated with reduced operating expenses compared with invesing in mutual funds. They are also highly liquid because you can buy and sell them as if they were ordinary shares. ETFs also provide a way for potential investors to gain access to wide range of assets or strategies.

Is Ethereum next?

Naturally now that Bitcoin has been approved, investors are looking forwards to a possible upcoming approval of an Ether (ETH) ETF by the SEC. The SEC is expected to start reviewing applications for spot ETH ETFs from May onwards. Leading financial firms such as BlackRock, Invesco, Ark, and VanEck, along with Grayscale are among the applicants awaiting approval.