Whether you're trading trend-following strategies in your day trading endeavors or you’re simply looking at innovative methods to diversify your investment portfolio, managed futures ETFs, or Exchange Traded Funds, are certainly worth exploring. ETFs are a type of investment fund and exchange-traded product, traded on various stock exchanges. They offer you the opportunity to invest in a diversified selection of securities, including stocks, bonds, and commodities, all encapsulated within a single ticker.

These versatile financial instruments allow investors to gain broad exposure to entire sectors, commodities, or markets in a single trade, which can significantly simplify portfolio management. Understanding the basics of ETFs will give you a foundation for selecting the ones that best fit your investment style and goals. With the right trend identification approach, you can uncover the ETFs that are likely to yield the most lucrative results. Building a diversified trend-following portfolio with ETFs can help you mitigate risk and potentially generate more stable returns.

However, it's important to be aware of the risks involved in a trend-following strategy, as trends can reverse and unexpected market changes can impact performance. Lastly, regularly evaluating the performance of your trend-following strategy is essential to ensure you're on track with your financial objectives. With the right knowledge and tools, trading trend-following strategies with ETFs can be a powerful part of your investment strategy.

Contents: How to Invest in a Trend-Following Strategy Using ETFs

- What is trend following?

- Understanding the basics of ETFs

- Investing with money managers

- What are Managed Futures?

- How to identify a trend

- How to play it: ETFs

- Best Managed Futures ETFs

- ETF selection criteria for trend-following

- Building a diversified trend-following portfolio

- Pros and Cons of Managed Futures

- Risks involved in trend-following strategy

- Performance evaluation of your trend-following strategy

What is trend-following?

Trend following or trend trading is a very appealing concept because of its simplicity. You buy an asset when its price is rising and sell an asset short when its price is falling. The idea is that that momentum will carry the price further in the same direction.

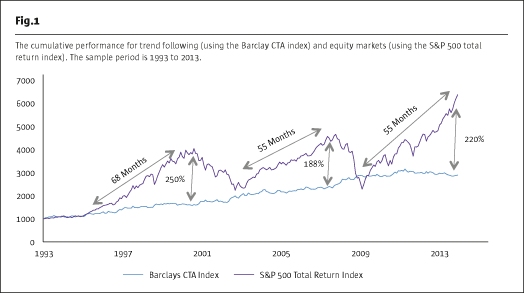

Trend following is an active investment style that involves going both long and short in financial markets. While stock markets have shown to go up over time, justifying the traditional buy-and-hold strategy, there are also a lot of uptrends and downtrends in the meantime that provide investing opportunities to trend followers.

Source: The HedgeFundJournal

With trend trading there are a lot of false starts but if you can get in early to one or two big trends and ride them, that's what can make the strategy profitable.

BUT… implementing this trading strategy is easier said than done. Beginner forex traders understand the steep learning curve involved!

It’s because there are many ways to identify a trend. Trends can be identified using different measures of price calculation, volatility and/or technical indicators like moving averages. In fact, depending on the timeframes involved, there is often disagreement about whether the price trend is up, down or sideways!

Understanding the basics of ETFs

Exchange Traded Funds (ETFs) are types of investment funds and exchange-traded products that are traded on a stock exchange. ETFs hold assets such as stocks, bonds, or commodities and aim to track the performance of specific indexes.

Here are some key features of ETFs:

- Tradability: ETFs can be bought and sold during trading hours, just like individual stocks.

- Diversification: ETFs provide instant access to a diversified portfolio, as they often track a broad-based index.

- Transparency: ETFs disclose their holdings daily, providing transparency to investors.

Investing with money managers

It’s for this reason that investors turn to trend-following experts for guidance on how to trade the trend.

Professionals who manage portfolios using a trend-following strategy for a pool of investors are known as Commodity Trading Advisors (CTAs) and the funds they manage are known as Managed Futures.

The trouble is that access to these types of risky alternative investments, which are in effect hedge funds is heavily gated. Oftentimes there are minimum investments in the hundreds of thousands of dollars. It’s understandable on the part of the fund manager because they want to attract only ‘sophisticated investors’ who understand the risks. However, the net effect is that smart retail traders and investors get left out. That’s where ETFs come in.

What are Managed Futures?

Let’s explore how these managed futures funds do their trend-following strategy. The portfolios normally consist of exchange-traded futures contracts. Futures are contracts where a buyer is obligated to buy or a seller is obligated to sell an asset at a predetermined price.

Managed futures are deliberately as diversified as possible to include almost every asset class. Usually, the largest component of the funds is either long or short forex (foreign currencies), fixed income (bonds), and commodities.

These funds invest in all these different asset classes to be exposed to as many potential price trends as possible. The huge advantage to investors is that the returns in these funds are typically non-correlated with the stock market. Therefore investors use them to hedge their portfolios and add another layer of diversification.

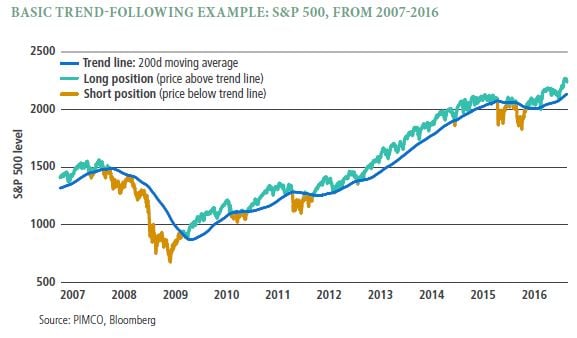

Source: Pimco

Source: Pimco

The funds use a pre-defined set of mathematical rules and formulas to determine when to buy and when to sell their investments. These rules have been devised by backtesting past price action and measures of volatility.

The fund managers won’t ever give away proprietary information on how their strategies work but they are not so-called ‘black-boxes’. All trend-following CTAs use the same premise of trading momentum with diversifcation and strong risk management. Common techniques include buying at multi-day highs or selling at multi-day lows and closing the position when realised volatility rises beyond a certain measure.

How to identify a trend

Identifying a trend is crucial for successful trading. A trend is the general direction that a security or market is taking over a specified time. They are typically categorized into uptrends, downtrends and sideways/horizontal trends.

- Uptrend: This is characterized by higher-highs and higher-lows. In simpler terms, an uptrend occurs when the price of an asset is moving higher over time.

- Downtrend: This trend is characterized by lower-highs and lower-lows. It occurs when the price of an asset is moving lower over time.

- Sideways/Horizontal trend: This happens when the forces of supply and demand are nearly equal, so there is little movement up or down in the price.

One common way traders identify trends is by using trendlines and moving averages. Trendlines are lines drawn over pivot highs or under pivot lows to show the prevailing direction of price.

How to play it: ETFs

Managed Futures ETFs are a way to passively invest using exchange traded funds into a managed futures fund or index.

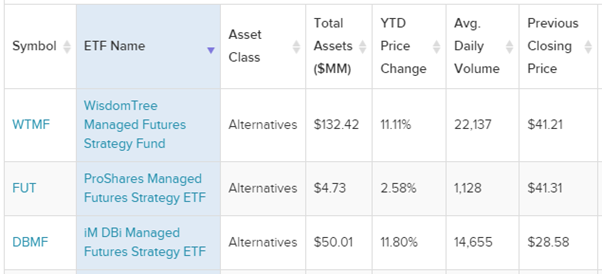

The following tables shows 3 of the largest managed futures ETFs by assets under management (AUM).

Source: ETFSdb.com

Source: ETFSdb.com

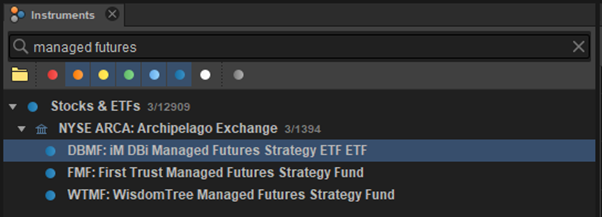

The search box in the instruments panel of the FlowBank trading platform makes it very easy to find ‘managed futures’.

Source: FlowBank Pro trading platform

Source: FlowBank Pro trading platform

Best Managed Futures ETFs

Buying managed futures EFTs is an easy way to gain exposure to trend-following and the world of managed futures. Like all ETFs, the instruments can be bought and sold during regular trading hours just like ordinary stock. Here are 3 well-known managed futures ETFs available through FlowBank:

WisdomTree Managed Futures ETF (WTMF)

The fund normally invests at least 80% of its net assets in "managed futures". It is actively managed and seeks to achieve positive total returns in rising or falling markets that are not directly correlated to broad market equity or fixed income returns. The fund is managed using a quantitative, rules-based strategy designed to provide returns that correspond to the performance of the WisdomTree Managed Futures Index. It is non-diversified.

First Trust Managed Futures Strategy ETF (FMF)

The fund is actively managed and seeks to achieve positive returns that are uncorrelated to broad market equity or fixed income returns. Under normal market conditions, the fund and a wholly-owned subsidiary of the fund organized under the laws of the Cayman Islands, invest significantly in a portfolio of exchange-listed futures.

iM DBi Managed Futures Strategy ETF (DBMF)

The fund seeks to achieve its objective by: (i) investing its assets in a managed futures strategy; (ii) allocating up to 20% of its total assets in its wholly-owned subsidiary, which is organized under the laws of the Cayman Islands, is advised by the Sub-Adviser, and will comply with the fund's investment objective and investment policies; and (iii) investing directly in debt instruments for cash management and other purposes. It is non-diversified.

ETF selection criteria for trend-following

The trend-following strategy is an investment strategy that tries to take advantage of long-term moves that seem to play out in various markets. The key with trend following is to understand the ETF's trend and to ensure the trend continues. Here are some criteria to consider when selecting ETFs for trend following:

- Liquidity: ETFs with high trading volumes are preferable because they can be bought or sold quickly without causing a significant price change.

- Cost: The expense ratio of the ETF is vital as it affects the overall returns. Lower expense ratios are generally preferable.

- Volatility: ETFs that are less volatile are typically preferable for trend-following strategies.

- Trend Strength: ETFs with strong, consistent trends may offer better trend-following opportunities.

- Underlying Index: The index that the ETF tracks also plays a vital role. It should ideally be broad-based, offering exposure to a diverse range of sectors and industries.

- Fees and Expenses: Lower expense ratios can help improve net returns over time.

- Performance History: An ETF's past performance can provide valuable insights into its potential future returns.

Building a diversified trend following portfolio

One of the primary goals of trend following is to build a diversified portfolio. This means investing in a variety of assets to reduce risk. Here are some steps to build a diversified trend following portfolio:

- Asset Allocation: Allocate your assets across various asset classes such as stocks, bonds, commodities, and real estate to reduce risk.

- ETF Selection: Select ETFs that meet the criteria for trend following, as discussed above.

- Regular Monitoring: Regularly monitor your portfolio to ensure that the trends of the ETFs are still in place.

- Position Sizing: Determine how much to invest in each asset based on its volatility and correlation with other assets.

- Risk Management: Implement stop-loss orders and other risk management tools to limit potential losses.

- Portfolio Rebalancing: Regularly update the portfolio to maintain the desired level of diversification and risk exposure.

Pros and Cons of Managed Futures

|

Pros |

Cons |

|

Low correlation with equities makes them good for diversifcation |

Often lower or negative returns when stock market is rising |

|

Useful for hedging |

Higher volatility of profits / losses |

|

Access to a professional hedge fund type investing strategy |

Potentially higher fees to pay for the active management |

Risks involved in trend-following strategy

While trend following can be profitable, it's not without its risks:

- Market Volatility: Significant price swings can lead to false signals, causing premature entry or exit.

- Lagging Indicator: Trend-following strategies are inherently lagging, meaning they might not always reflect real-time market conditions.

- Dependency on Trends: In a sideways or range-bound market, trend-following strategies can underperform.

Performance evaluation of your trend-following strategy

Performance evaluation is crucial for any trading strategy. For a trend-following strategy, you should consider:

- Return on Investment (ROI): This measures the profitability of your strategy.

- Maximum Drawdown: This measures the largest single drop from peak to bottom in the value of your portfolio.

- Sharpe Ratio: This measures risk-adjusted performance, considering both the return and volatility.