968 days ago • Posted by William Ramstein

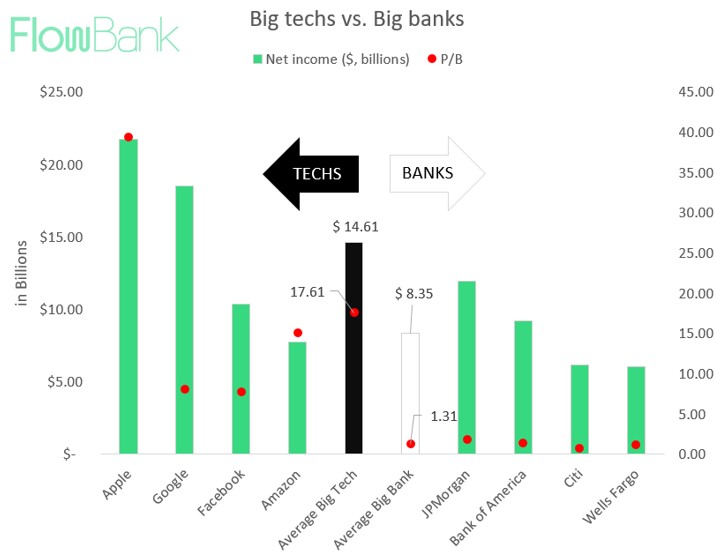

Big banks have low P/B vs big tech because ...

A low P/B ratio could just be an undervalued stock, but in the case of the largest banks, it’s probably more a question of the value investors put on what the company is selling, or owns. Cloud services and iPhones are just much sexier than car loans, and mortgage-backed securities. In financial jargon, this also translates to low returns on equity and low expectations for growth (but clearly not profitability!). Source: FlowBank