346 days ago

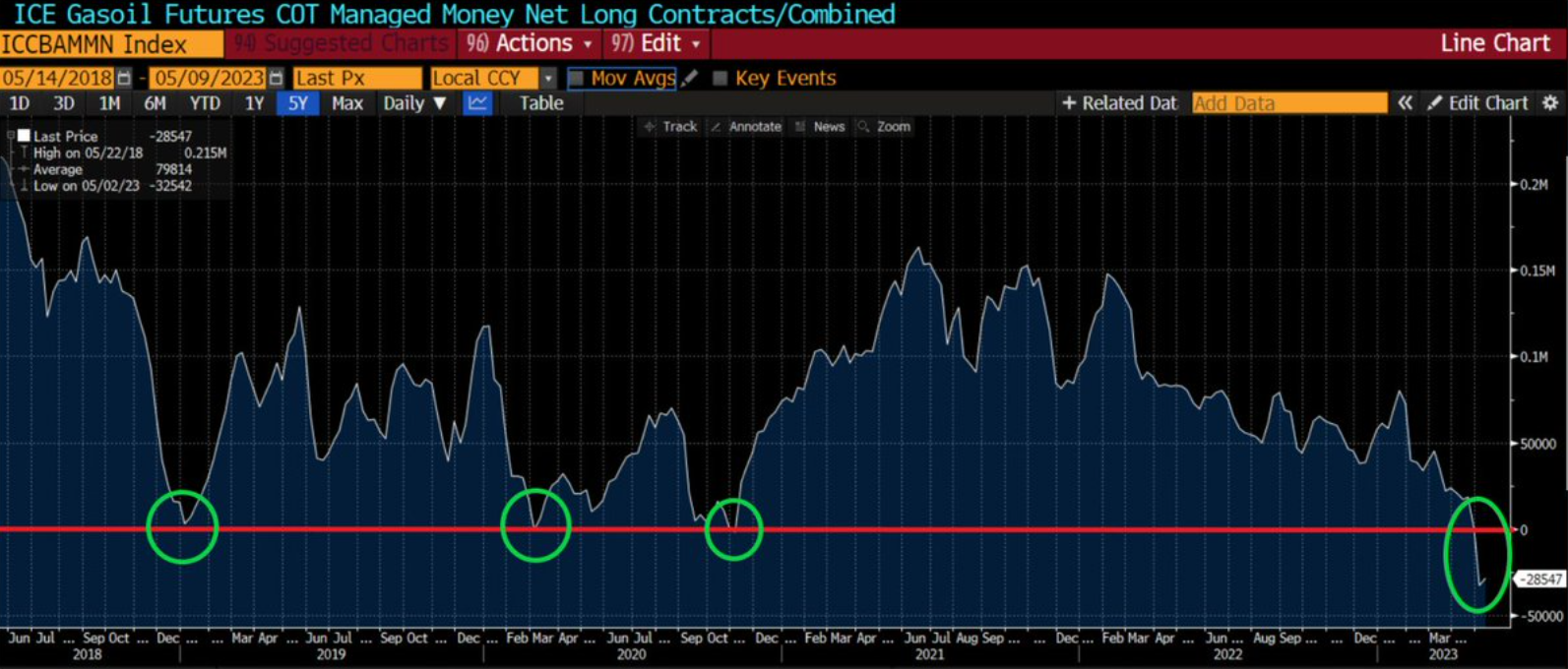

Hedge funds are now massively net short gasoil futures #oil #trading $USO $XLE $QQQ

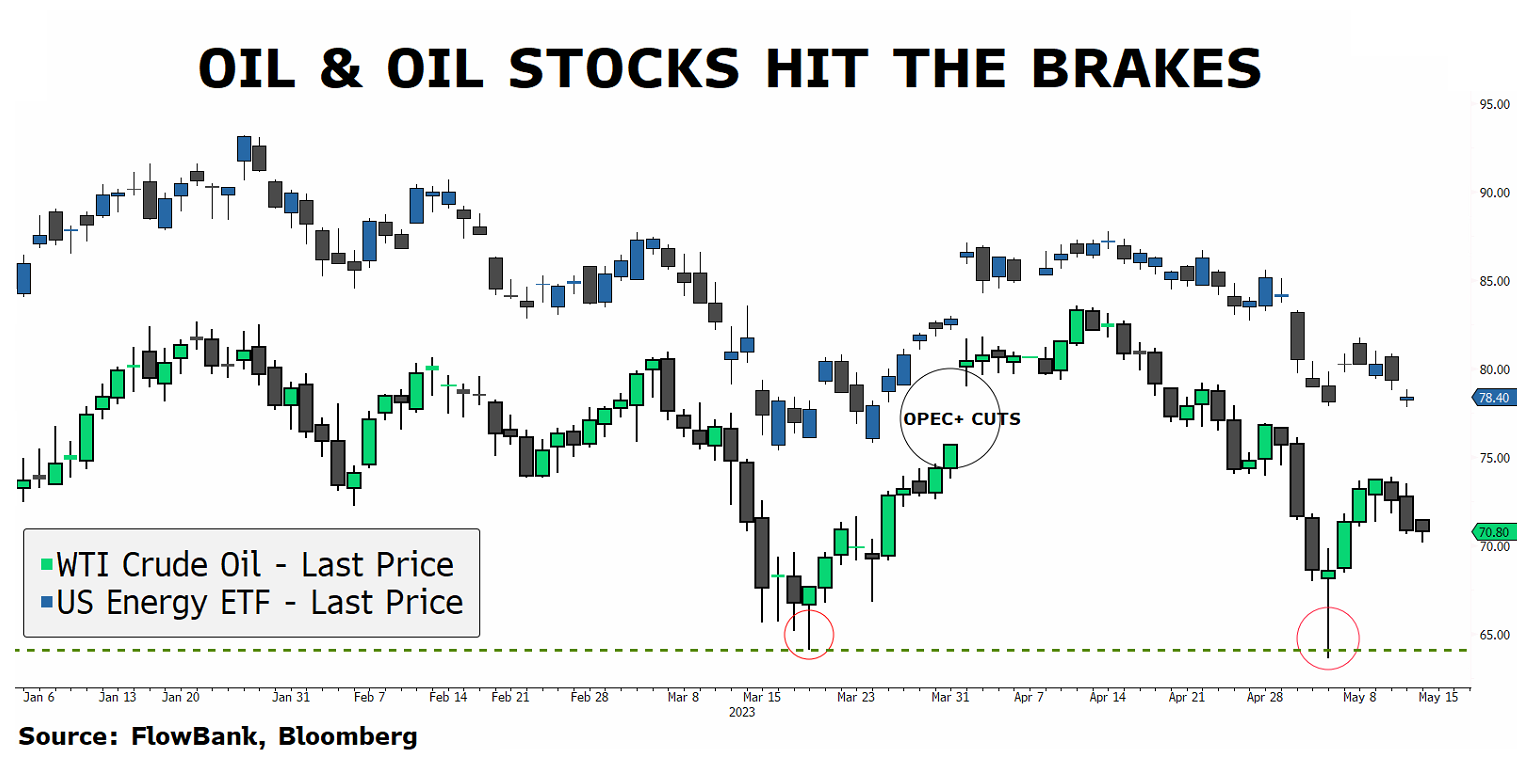

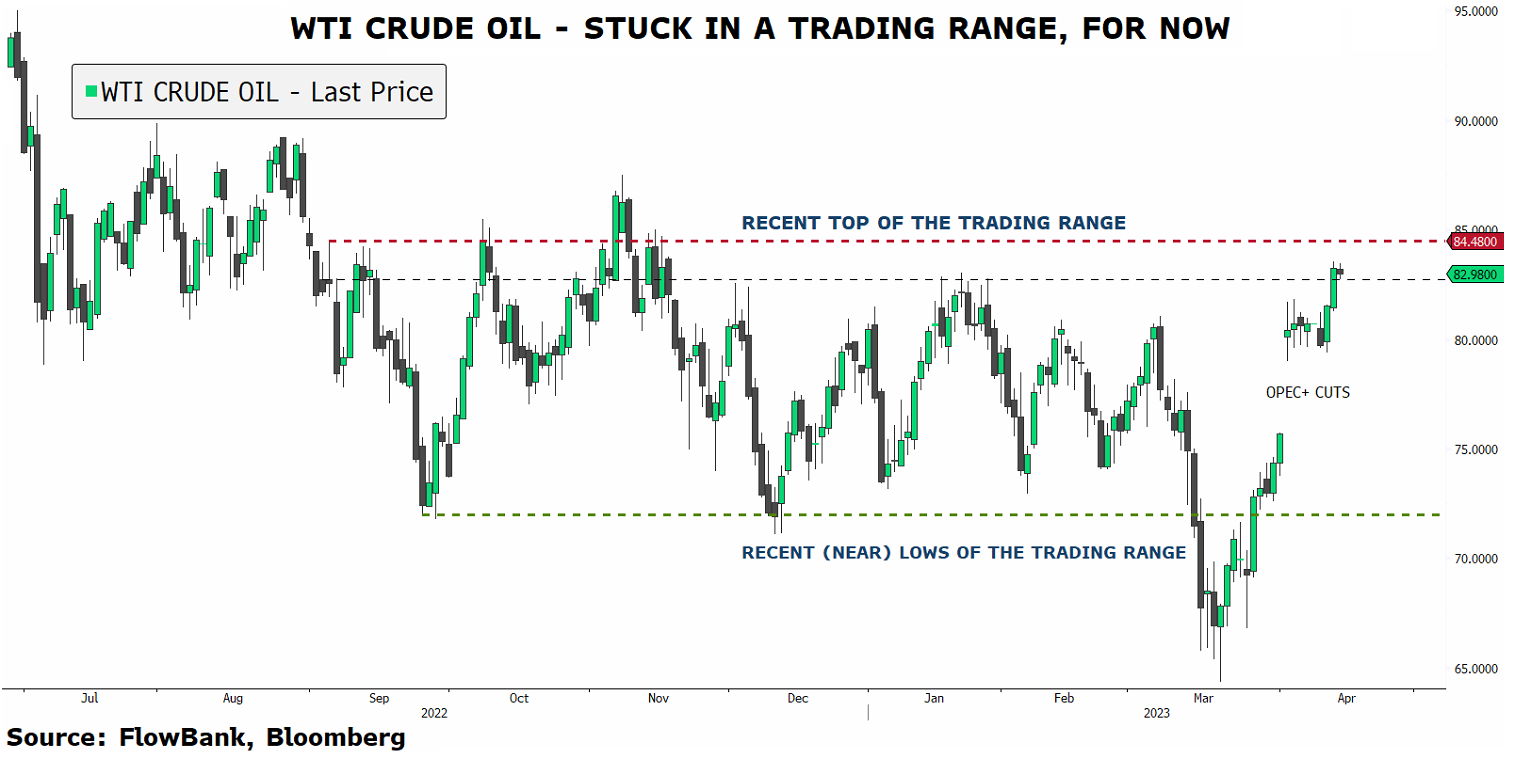

In the last five years, managed money has been net short oil only three other times by this much: Late 2018, COVID (3/20), and late-2020. In all 3 cases, a big oil rally followed. It will be interesting to monitor if this again oil rebounds. Meanwhile it does seem that OPEC+ is not looking to make further production cuts, but perhaps there could be other positive catalysts brewing on the horizon.