323 days ago

Stocks: June seasonality in pre-election years $SPY #trading

Seasonality can be useful in assessing probabilities. Historically, June tends to be a positive month for the US stock market in pre-election years. Source: Ryan Detrick

323 days ago

Seasonality can be useful in assessing probabilities. Historically, June tends to be a positive month for the US stock market in pre-election years. Source: Ryan Detrick

324 days ago

325 days ago

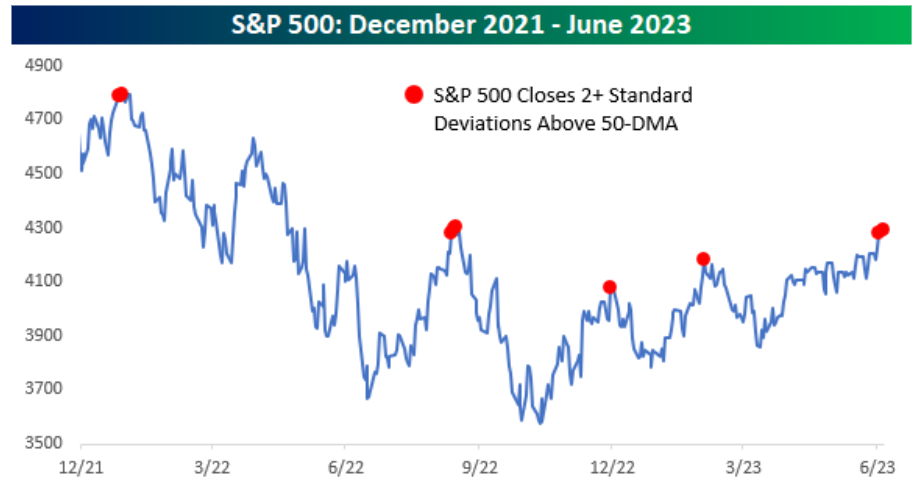

Bespoke Investment Group's graph below shows the S&P 500 closing 2.47 standard deviations above its 50-day moving average to fall into the “extreme category.” Source: Bloomberg

328 days ago

US stocks continued to advance amid debt-ceiling resolution and AI enthusiasm.

331 days ago

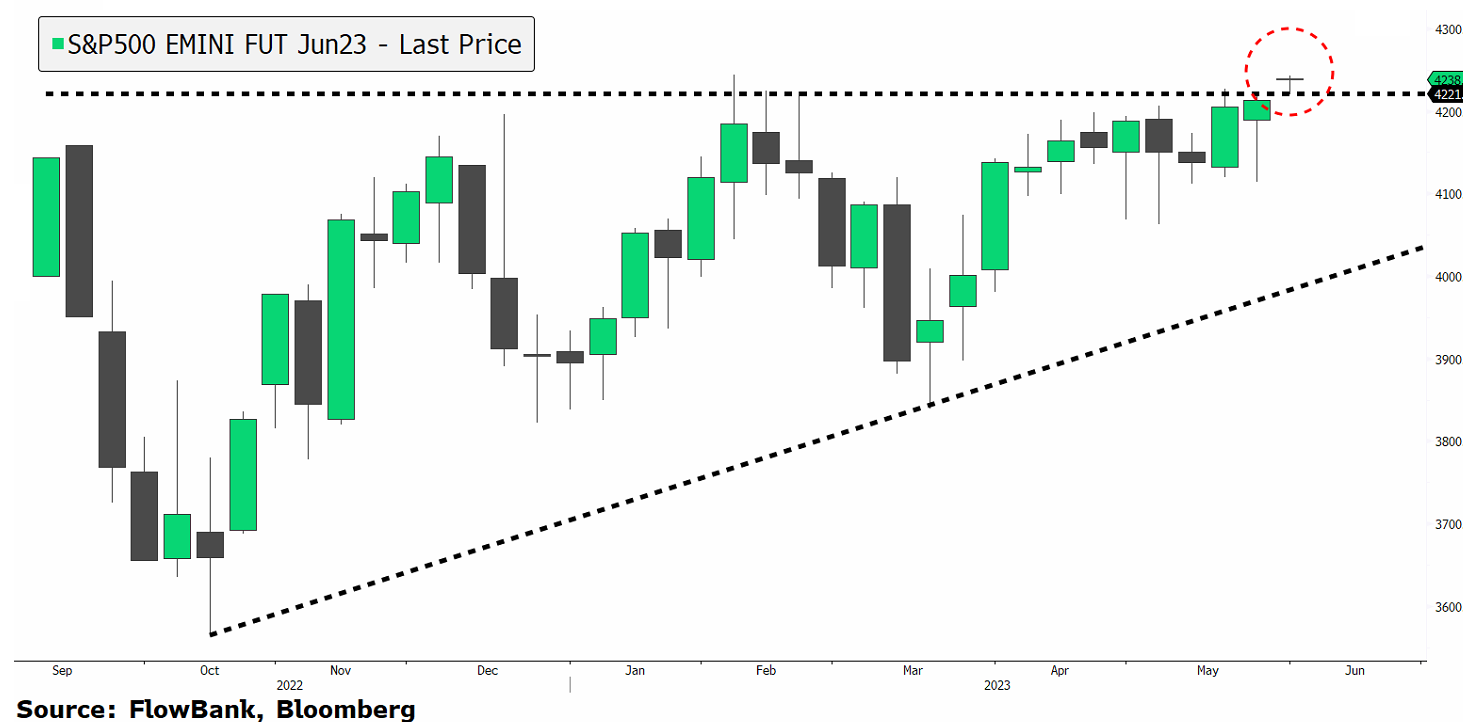

S&P 500 futures have just slipped above the area of technical resistance. A few names continue to be the main drivers including Tesla and Nvidia. As we approach the summer month, a clearer technical breakout could form, with the possibility of lagging sectors such as financials and energy rebounding.

CFDs are complex instruments and are not suitable for everyone as they can rapidly trigger losses that exceed your deposits. You should consider whether you understand how CFDs work. Please see our Risk Disclosure Notice so you can fully understand the risks involved and whether you can afford to take the risk.

This website is owned and operated by FlowBank S.A, a company regulated by the Swiss Financial Market Supervisory Authority (FINMA) and a member of esisuisse. The list of banks and securities firms authorized by FINMA can be accessed here. Depositor protection in Switzerland is provided by esissuisse for a maximum of CHF 100,000.- per client. Details concerning this protection system are explained at www.esisuisse.ch/en

FlowBank is affiliated with the Swiss Banking Ombudsman. Therefore, if you wish to initiate a mediation procedure with the Swiss Banking Ombudsman after your complaint to FlowBank, please contact the Ombudsman according to the instructions provided on its website: https://bankingombudsman.ch/en/

The information on this site is not directed at residents of the United States, Belgium, Canada, or any person in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.

Trading Forex and other leveraged products carries high risks and may not be apt for everyone. Before you consider trading these instruments please assess your experience, goals, and financial situation. You could lose your initial investment, so don't use funds you can't afford to lose or that are essential for personal or family needs. You can consult a licensed financial advisor and ensure you have the risk tolerance and experience.

Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

FlowBank S.A, Esplanade de Pont-Rouge 9, 1211 Geneva 26, Switzerland

FlowBank S.A, Seidengasse 20, 8001 Zurich, Switzerland