769 days ago

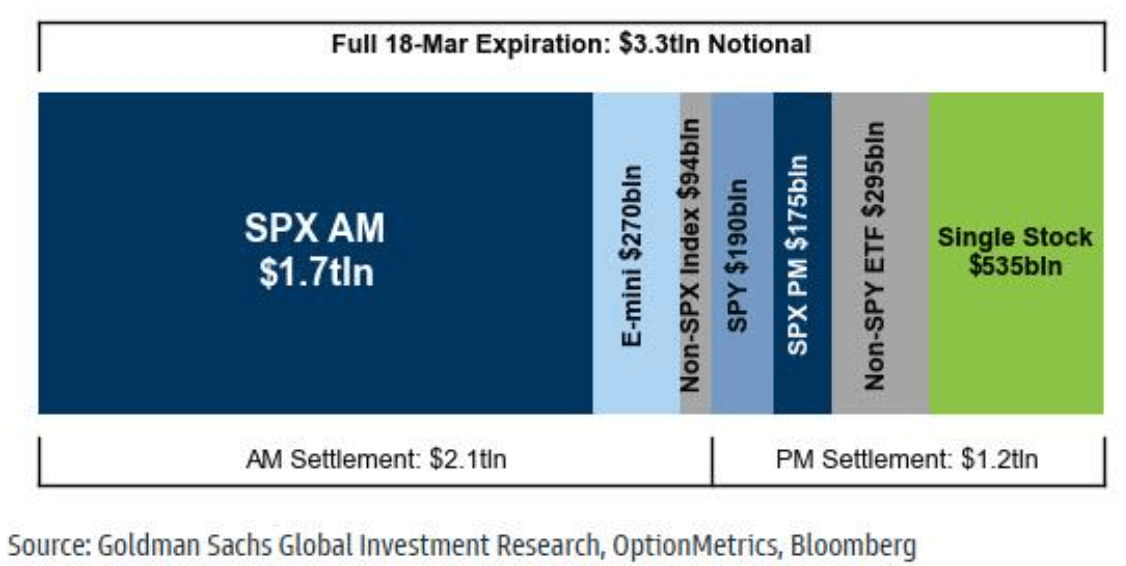

USD3.3 trillion of options notional exposure to expire today #optionsexpiry #stocks #S&P500 $spy

This afternoon, the S&P500 is swinging between gains and losses as traders are bracing for volatility on a triple-witching expiry day and rebalancing of benchmark indexes including the S&P500. During the last hour of the stock market trading session on the third Friday of every March, June, September, and December, there are three kinds of security expiration: stock market index futures, stock market index options, and stock options. The option expiration date and the portfolio rebalancing activity usually bring very large size volumes and drive market volatility higher, erasing the advantages of technical analysis. The key takeaway: expect volatility to remain high and more importantly; it is best not to draw any conclusion from today's price action.