875 days ago

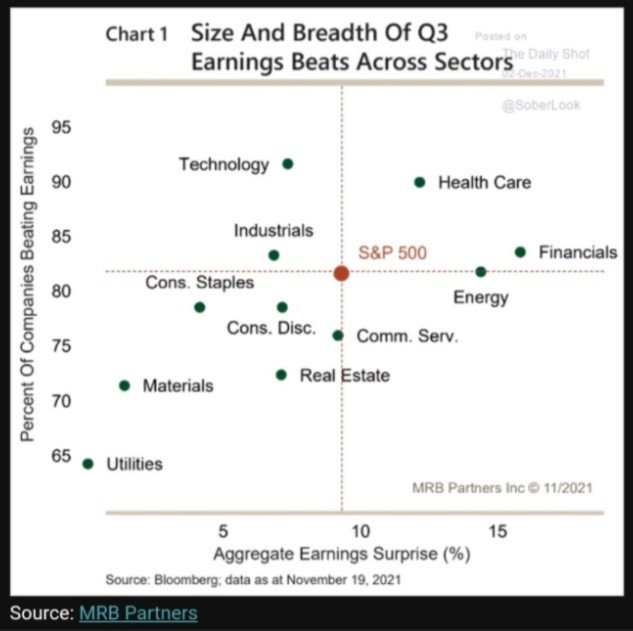

#Cyclical sectors #Energy and #Financials are seen as clear winners in #Q3 earnings on the back of a recovering economy and rallying commodity prices.

#Energy and #Financials saw record sector performances YTD amid low expectations at the start of the year. #Technology is seen as more resilient with a decent percentage of firms beating earnings for Q3. #Utilities were a clear outlier in earnings, still performing, but less so than counterparties.