337 days ago

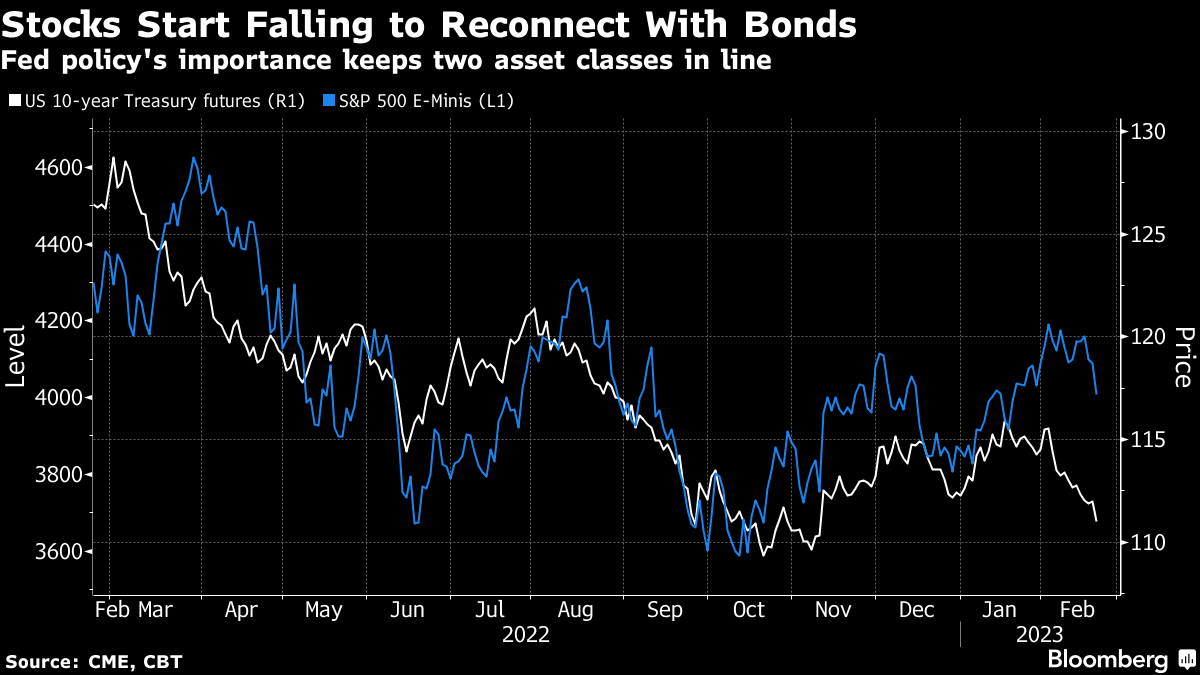

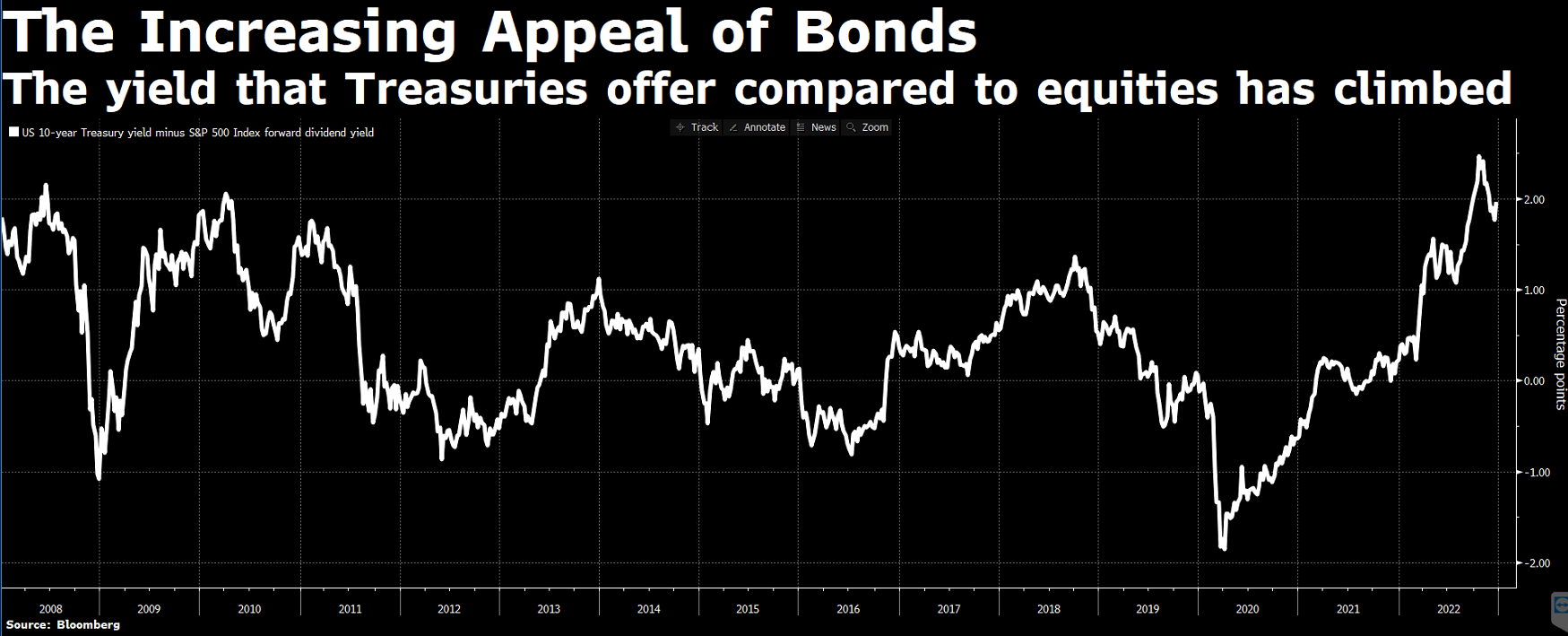

Treasury yields are rebounding, calling for caution $SPY $QQQ

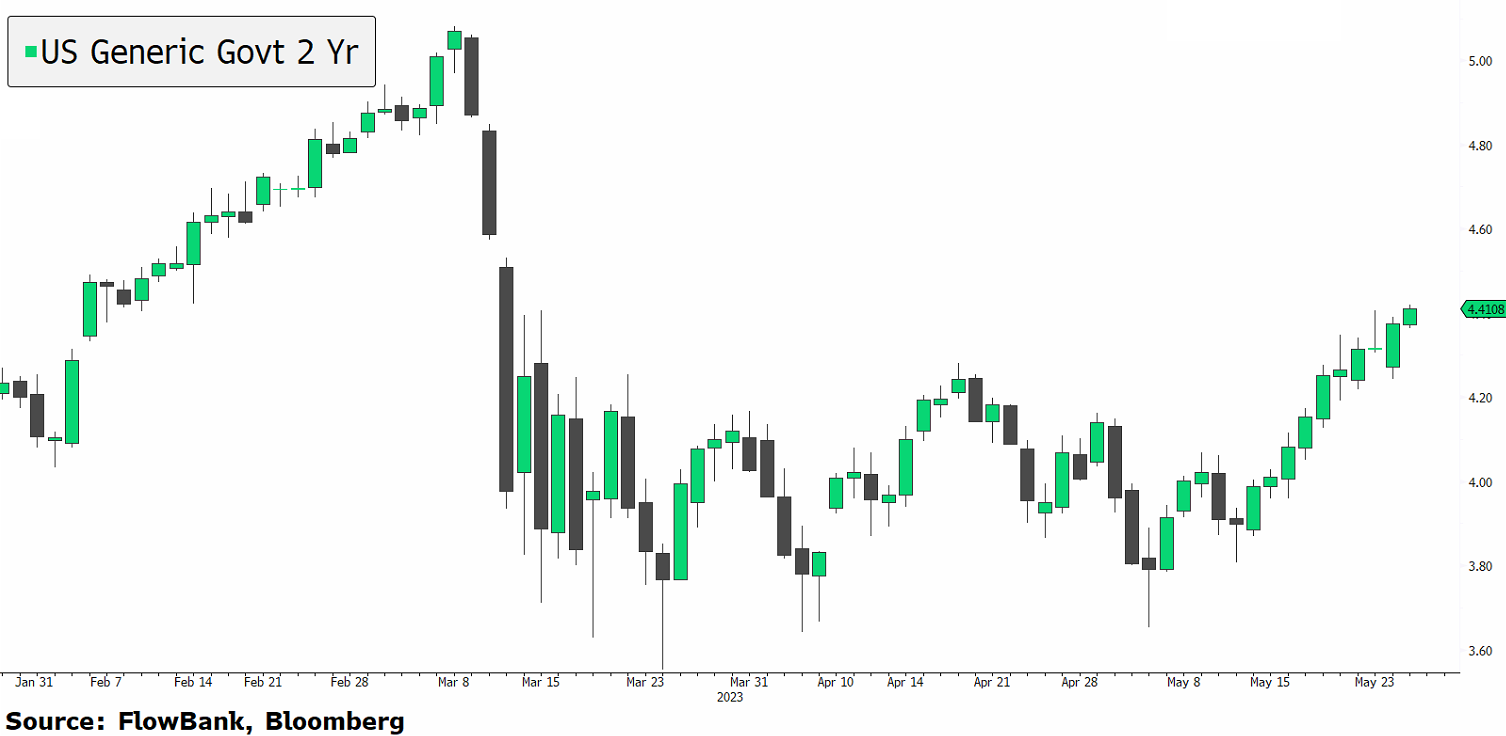

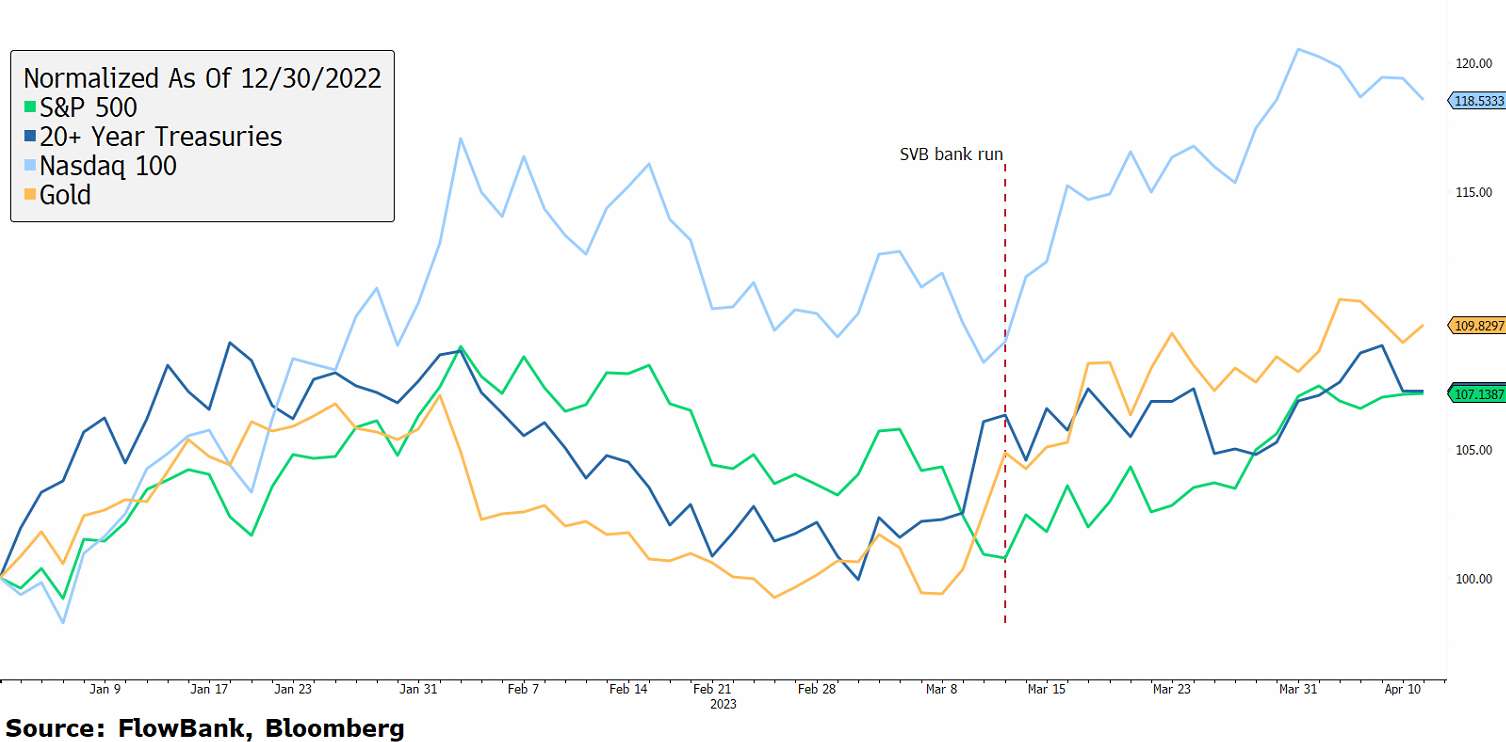

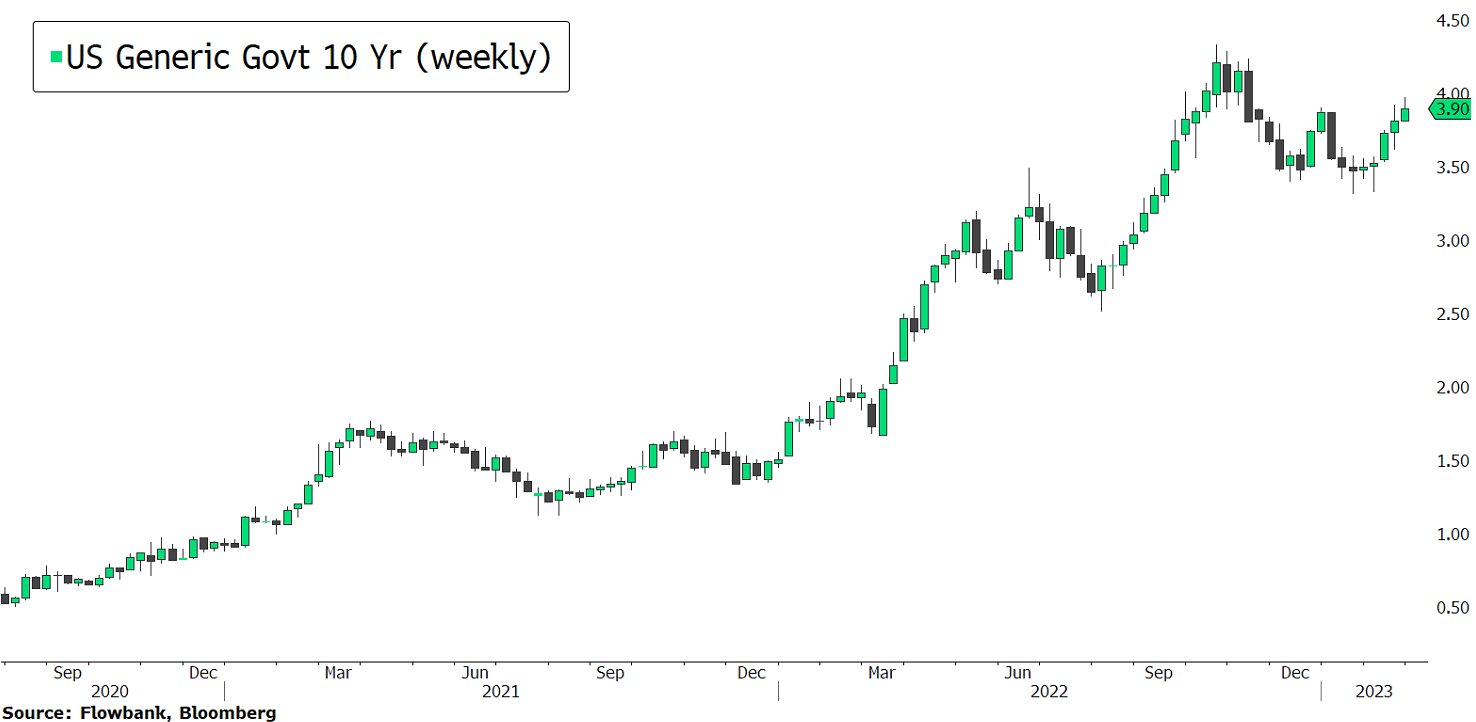

US Treasury yields have rebounded with the 2-year rising for 10th sessions in a row. Markets are concerned about: the path of inflation and labor, the Fed, and the debt ceiling. Traders may also lighten up positions as we approach the long weekend, but for now, at least in the Nasdaq, investors are cheering Nvidia's massive jump post-earnings.