1095 days ago • Posted by Charles-Henry Monchau

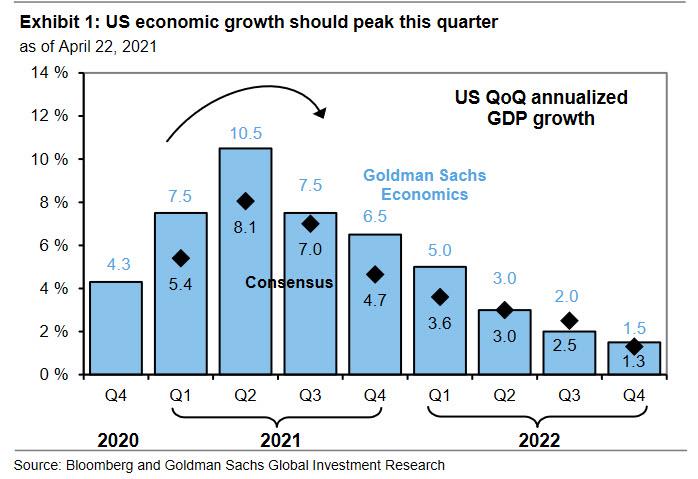

Goldman is the last big bank to turn cautious on US equities as they see US GDP growth peaking in Q2

After JP Morgan, Morgan Stanley and Deutsche Bank turning bearish, it is now the turn of Goldman Sachs (the most bullish bank) to capitulate on the bearish side. Here's an extract of Chief strategist David Kostin note: "This week, attention shifted again. First, we received many inquiries about sector and style rotations and peaking economic growth. Second, questions abounded about the impact the potential capital gains tax rate hike could have on stock prices. Our answers: Domestic growth is peaking and forward equity returns are likely to be modest with a 3% gain in the S&P 500 to our year-end 2021 target of 4300. And historical experience suggests equity selling later this year ahead of a possible capital gains tax hike will be short-lived and reversed in subsequent quarters". Goldman Sachs economists expect US GDP growth will peak in 2Q 2021 at an annualized rate of 10.5% - see chart below. As Kostin highlighted, equities often struggle when a strong rate of economic growth first begins to slow. Kostin explicitly reminded readers that the bank's mid-year 2021 target remains 4100. Translation: stocks are set to drop from here over the coming 2-3 months... (source: www.zerohedge.com, Goldman Sachs).