1236 days ago • Posted by Charles-Henry Monchau

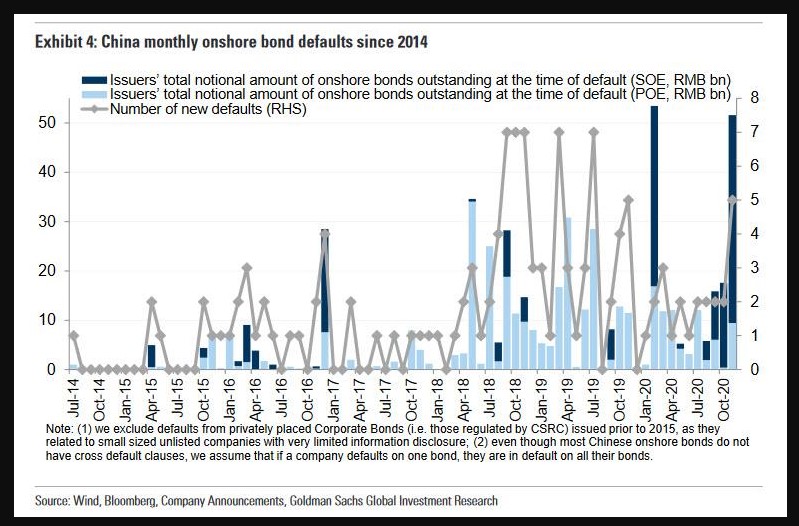

Goldman sees more Chinese Bond Defaults

Beijing is trying to break the implicit government guarantee and moral hazard of debt without triggering systemic and contagion risks. The net effect of this "credit cleanup" strategy will be more onshore defaults next year and more differentiation among weak and strong borrowers, according to Goldman. Their strategists expect the pace of new defaults to revert to the levels of 2018 and 2019, when there was an average of three to four new defaults a month. For the offshore market, strategists expect the pace of defaults to moderate because there was less forbearance this year, predicting that the high-yield default rate will drop to 4.3% next year from 4.9% this year - www.zerohedge.com