969 days ago • Posted by William Ramstein

Indian bank ramps up its green bond and riskier investments initiatives

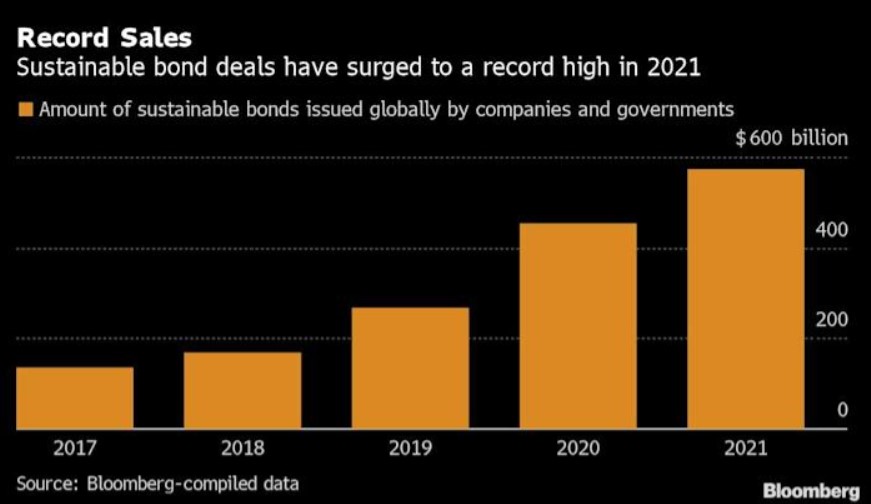

An Indian bank is planning to tap the offshore market for its debut sustainable perpetual bond amid growing demand for both riskier bank debt and sustainable investments. Axis Bank has hired banks to arrange investor meetings ahead of a potential Basel-compliant additional Tier I note sale, the proceeds of which are earmarked for green and social projects, a person familiar with the matter said this morning. The planned transaction follows a recent deal by a local peer, which sold the first offshore perpetual bond by an Indian bank since September 2016. It follows an impending rule change next year that forces Indian onshore mutual funds to cut their exposure to rupee hybrids. Source: Bloomberg