1096 days ago • Posted by Charles-Henry Monchau

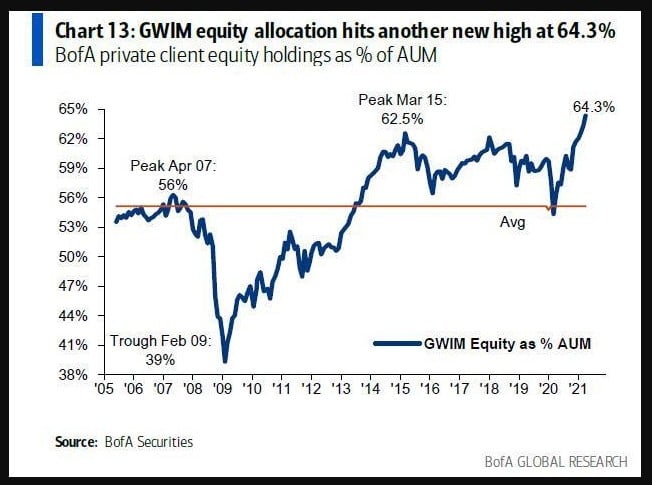

Signs of overconfidence? The average exposure of BofA's private clients to equities currently stands at 64%, the highest allocation ever

BofA's private clients to a total $3.2 trillion in AUM, of which a record 64.3% was in stocks, 18.1% debt, 11.3% cash. Of note: the bank's high net worth clients are buying financials, energy, HY, while selling healthcare and gold.

Source: BofA, www.zerohedge.com