1096 days ago • Posted by Charles-Henry Monchau

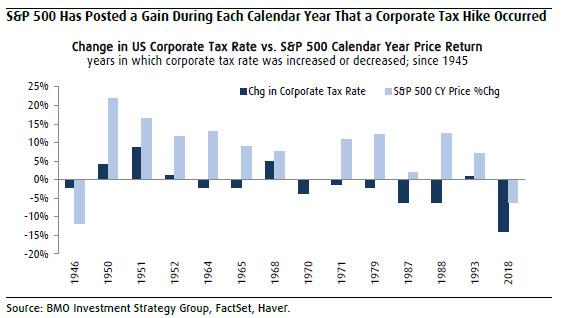

Surprise! Calendar years in which tax hikes went into effect have historically coincided with double-digit S&P 500 price returns and stronger US GDP growth, on average

During the five prior corporate tax rate increases in 1950, 1951, 1952, 1968, and 1993, the S&P 500 index posted an average calendar year gain of 12.9% with positive price returns in each instance. This gain was well above the 4.6% average return registered during the nine annual periods when the tax rate was reduced and also higher than 9% price return for all calendar years going back to 1945. The standard deviation of price returns has also been substantially lower during these tax hike periods. Increases in corporate tax rates have also coincided with stronger US economic growth as real GDP grew at a 5.7% average clip during annual tax hike periods vs. a 3.7% rate during tax cut periods and a 3.1% average growth clip in all years since 1945.

Source: BMO Investment Strategy, www.zerohedge.com