977 days ago

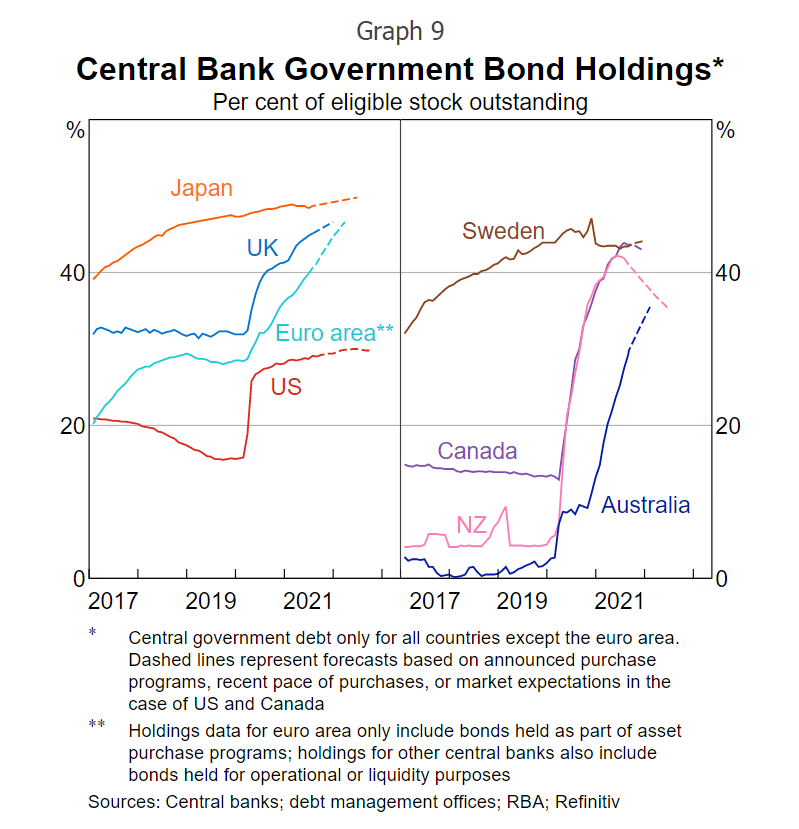

Another reason it's all about the Fed - other central banks will run out of bonds to buy...

While the Fed has bought a lot more debt on an absolute basis than other central banks - the others hold a much higher percentage of total issuance. Another crisis and/or a year of bond buying and central banks like the RBA will eventually run out of bonds to buy...