564 days ago

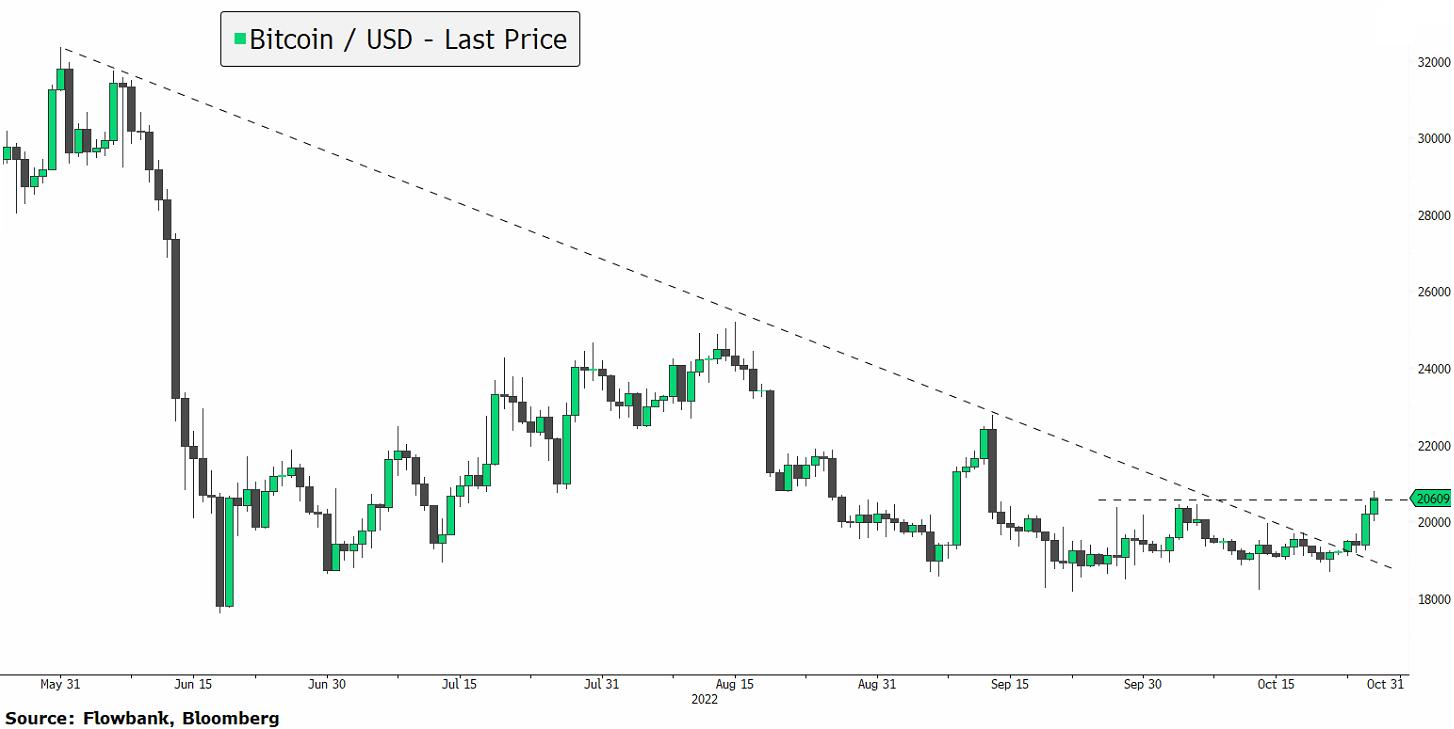

#Bitcoin breaks out on the upside! #BTC $BTC #crypto #trading #charts

Bitcoin, which had been trading in a tight range has broken out on the upside from its descending channel. The positive move comes as the dollar is quickly losing steam and treasury yields have come down from their recent highs. Bitcoin is now facing technical resistance at around USD20'600.