568 days ago

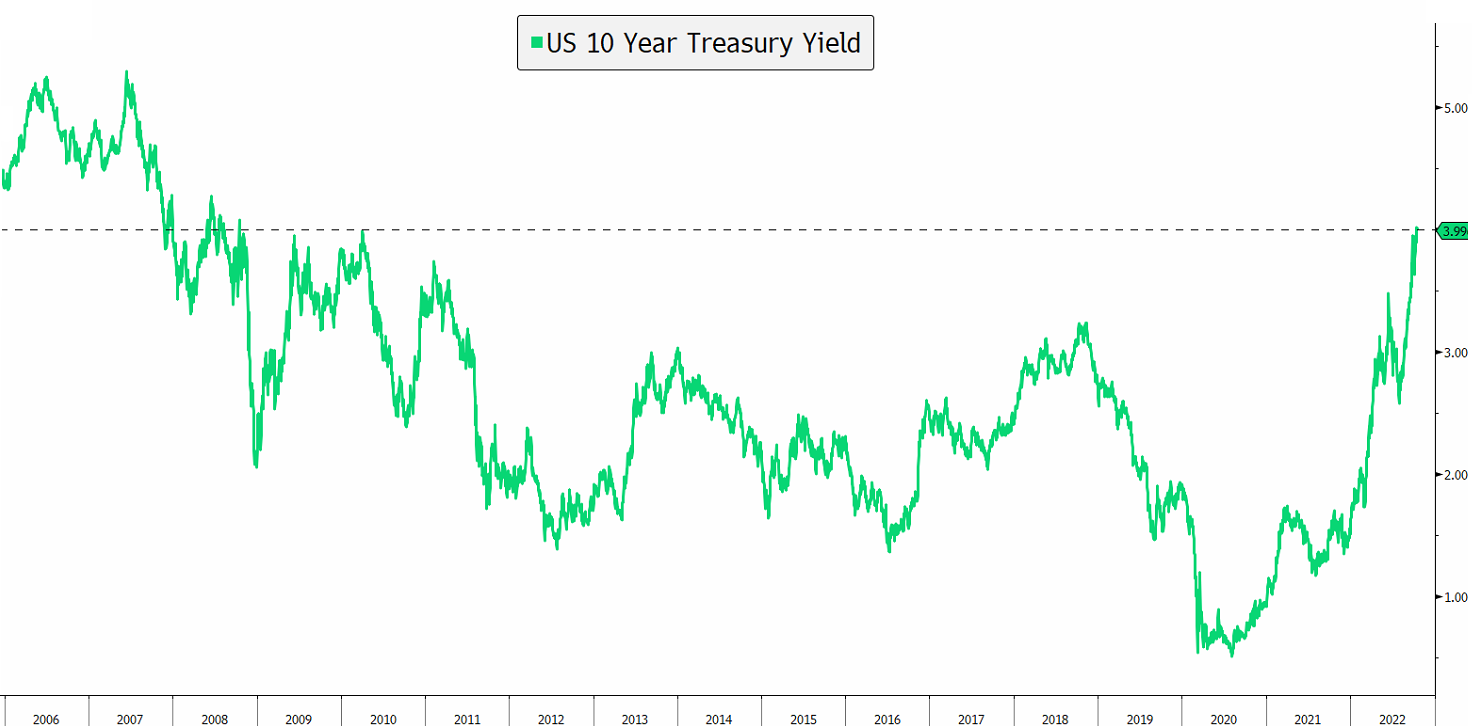

Treasury #Yields - what's next? #stocks #bonds $TLT

US Treasury yields have surpassed the 4% mark across the curve including the 10 and 30 year, worrying investors of the effect of higher rates. But not only investors are worried, as demand dried up. Treasury secretary Janet Yellen said she is worried about the lack of liquidity and that the Fed's standing repo facility could help. Momentum is also building for creating a Treasury bond buyback program, in order to provide more liquidity to the Treasury market. As opposed to quantitative easing where the Fed buys bonds, here it would simply be the issuer (the Treasury) buying back some of its bonds. In the meantime, stronger-than-expected earnings are helping lift market sentiment, despites Treasury yields holding firm near 4%.