699 days ago

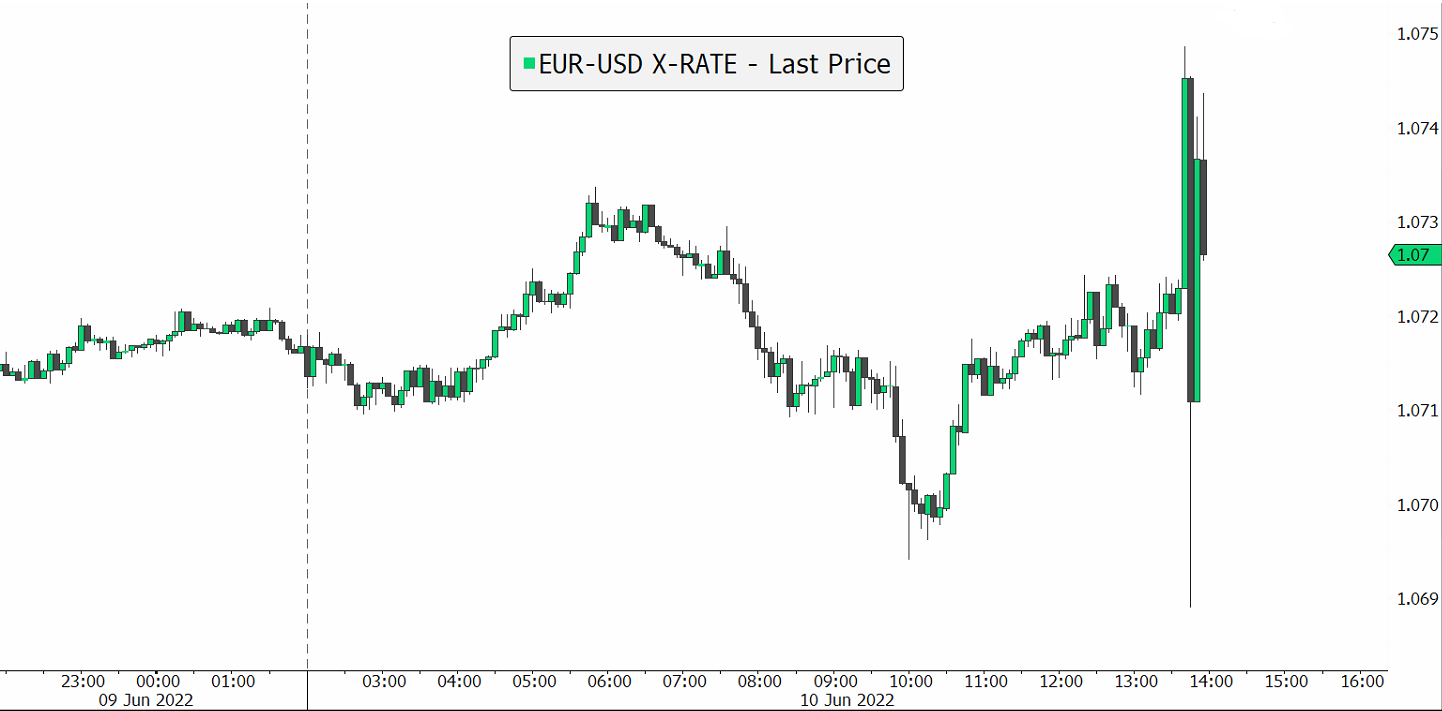

#ECB ends APP, announces rate hikes #EURUSD mixed

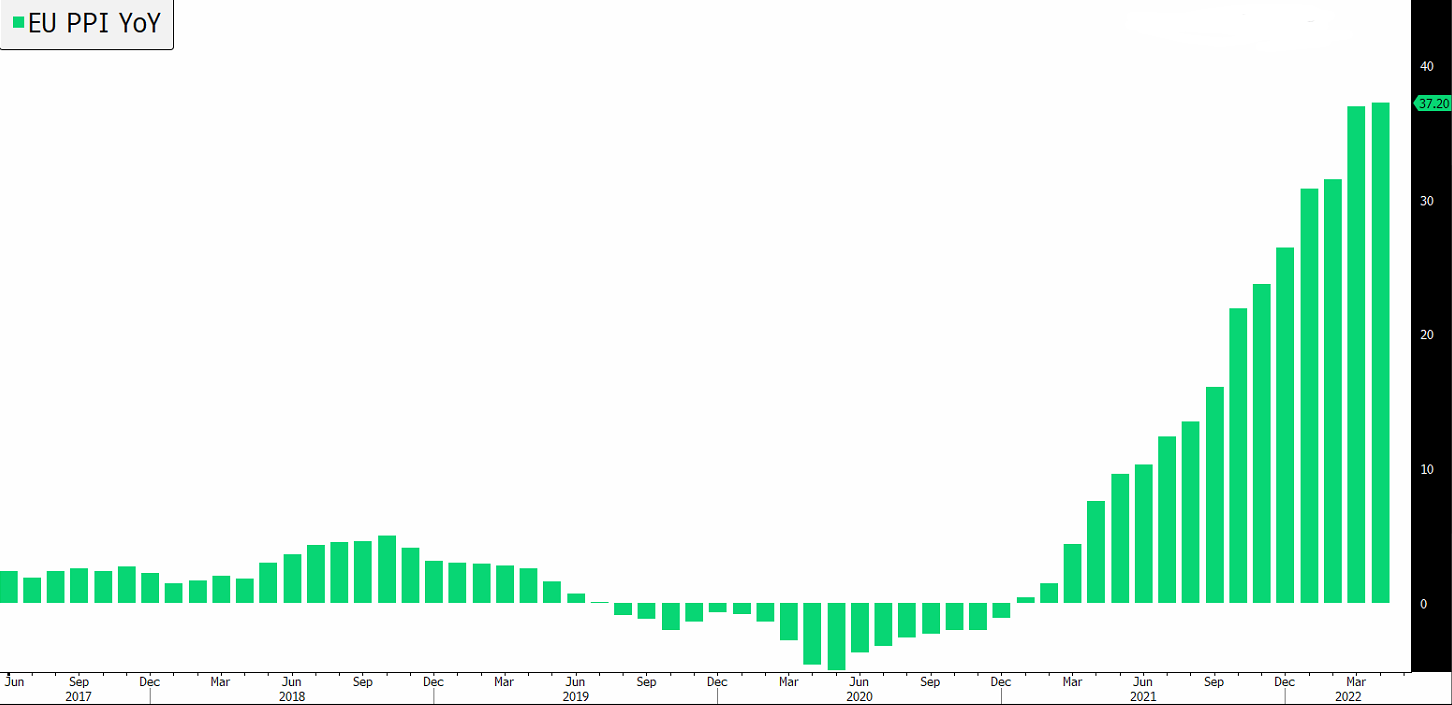

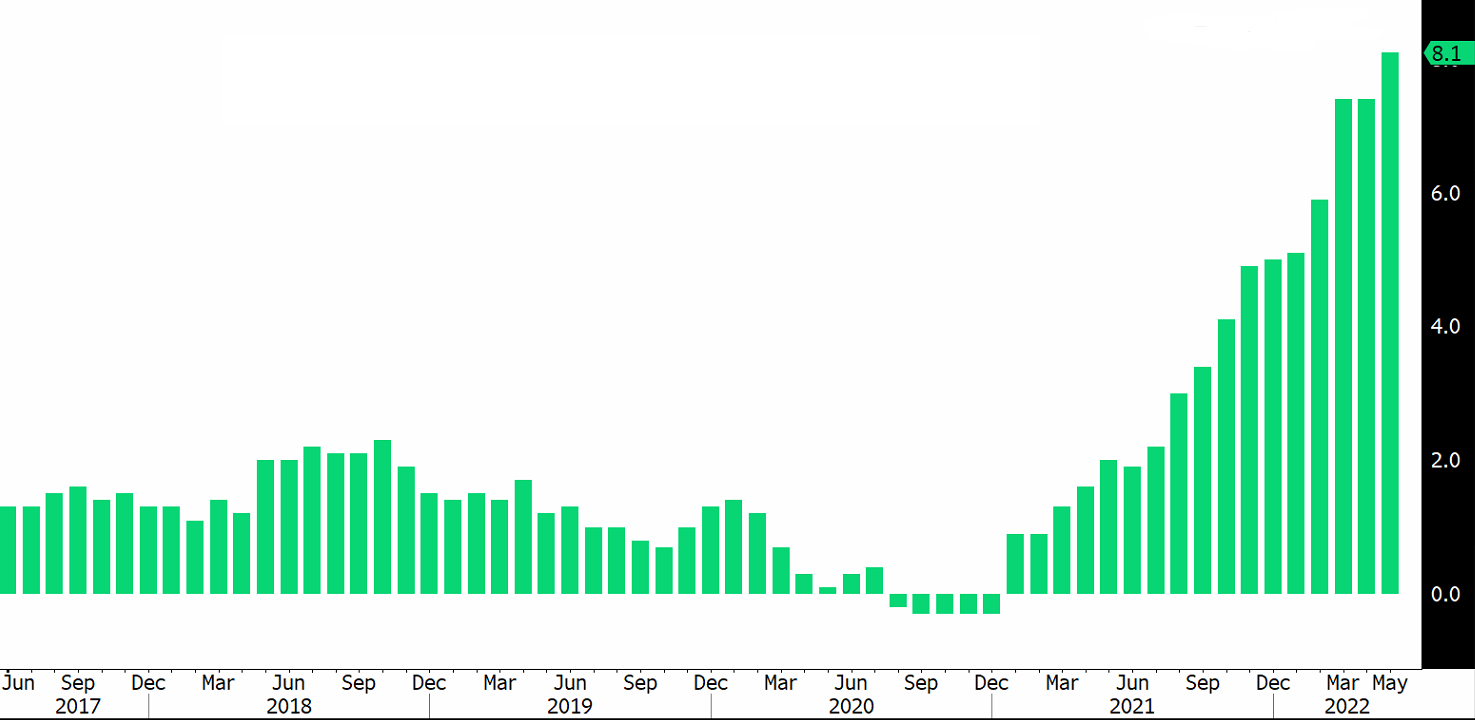

ECB just released its monetary report; ending net asset purchases as of July 1st, raising key interest rates by 25bps next month, and expects to raise rates again in September. There are also cuts to the growth outlook, 2022's forecast was lowered to 2.8% from 3.7% and 2023's to 2.1% from 2.8%. The calibration for the September hike will depend on the medium-term inflation outlook; a larger raise (50bps) is on the table should the inflation situation deteriorate.