591 days ago

#US economy shows continuous strength #markets #trading

Economic data are out and the Fed is not going to like it. Jobs market strong and PCE prices (Q2) higher. Treasury yields are ticking higher following the release.

704 days ago

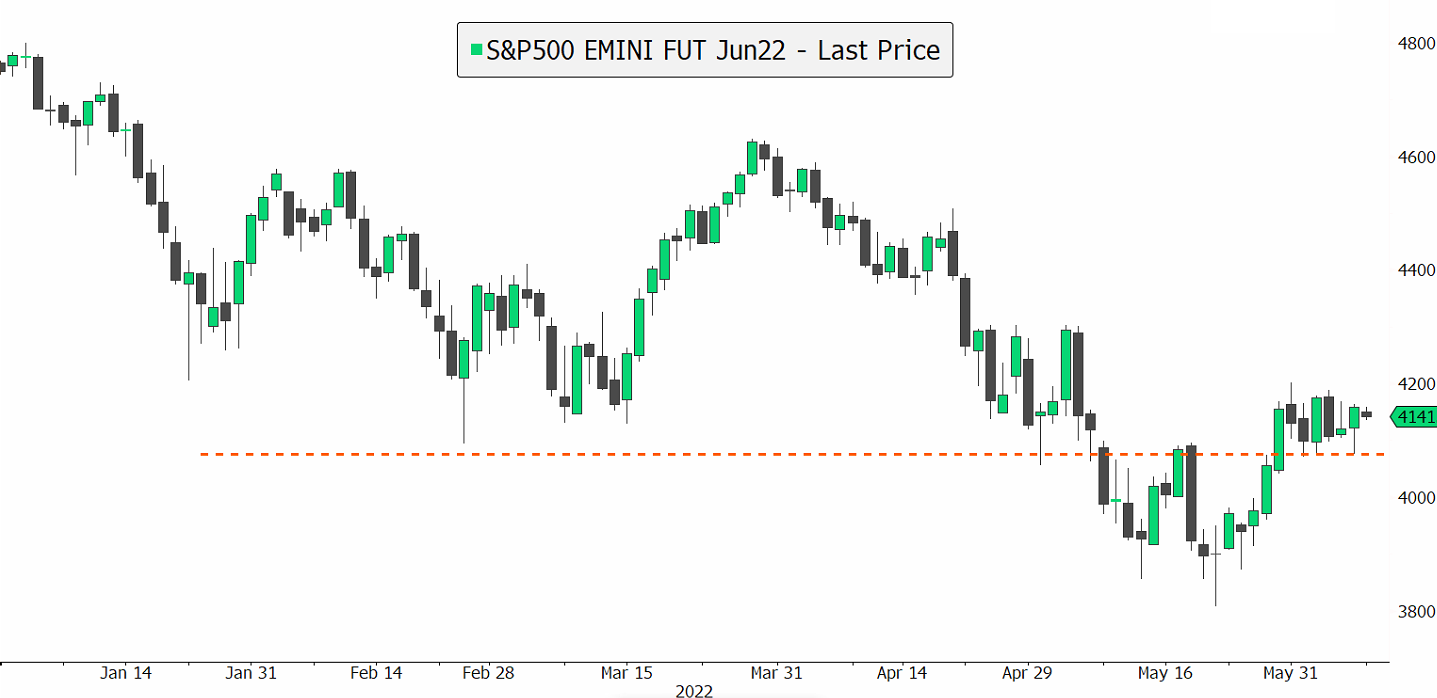

It is difficult not to be affected by the negative headline news calling for severe deterioration in markets or the economy. However, investors continue to buy dips in the markets, and volatility (VIX) has come down to 24.4, from a May 9 high of 35, but still significantly up from where it entered the year at 16.6. Near-term risks continue to be inflation data, with a key US CPI report on Friday. But just how bad is the economy? Well, earnings from Zara's owner Inditex may surprise some. Net profit surged 80% as sales surpassed pre-pandemic levels, up 36% from a year ago. Encouraging signs from China lifting restrictions could also boost sentiment and reassure investors about global growth perspectives. But inflation needs to come down, as higher yields simply pressure valuation multiples, and the yield on the US 10-year still seats at 3%, from entering the year at just 1.6%. On a technical picture, the short-term trend remains positive for the S&P500, as long as it is able to hold above its support level at 4'076. A break above 4'189 to target 4'220 would be encouraging.

726 days ago

US retail sales increased strongly, reflecting robust US consumer consumption capacity despite rising prices. Headline retail purchases rose 0.9% over the month, after an upwardly revised 1.4% gain in March. Stronger consumption means stronger GDP growth which is positive for stocks. Following the solid report, stocks are moving higher and Treasuries are pulling back.

835 days ago

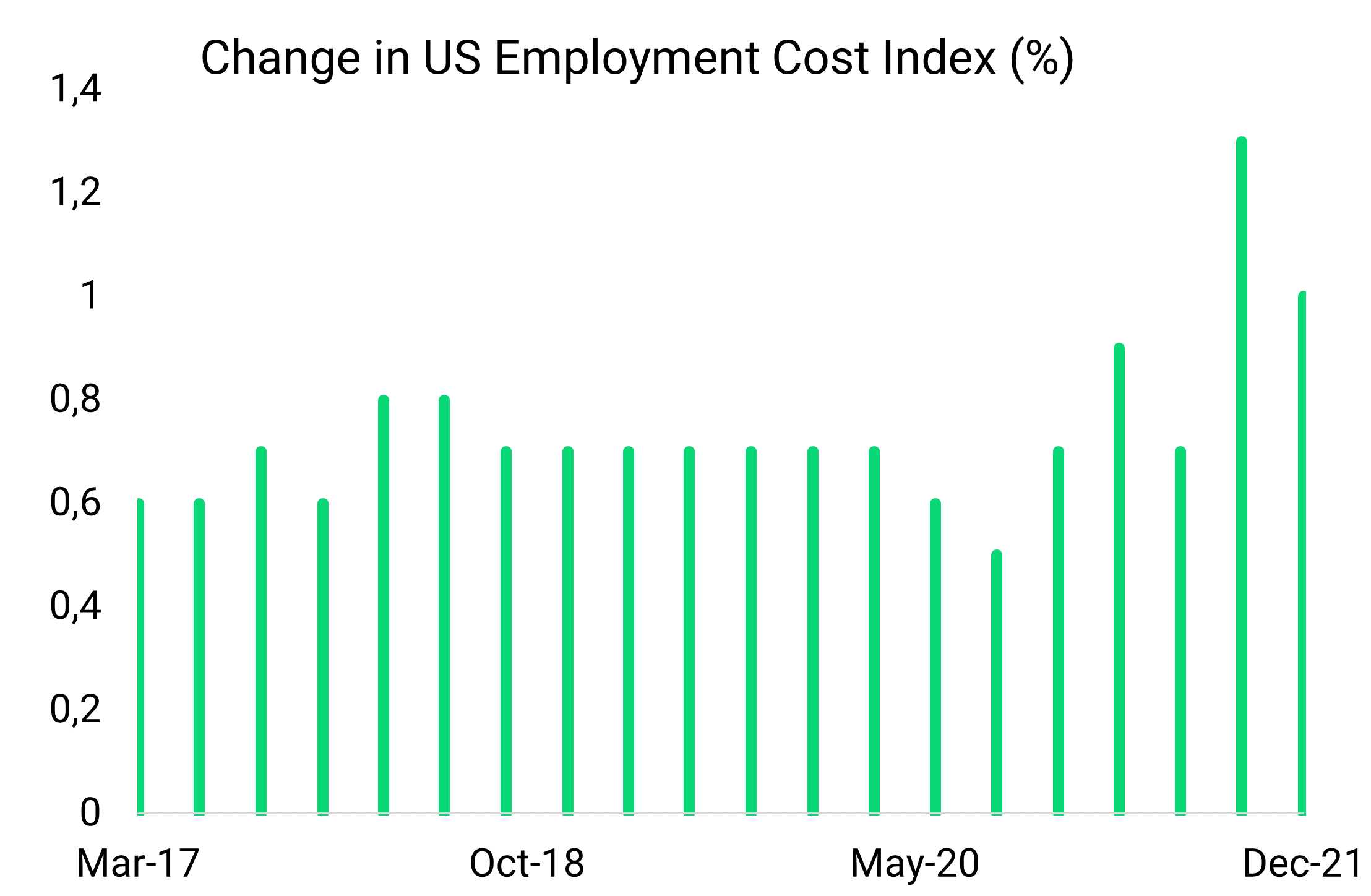

Fed's closely watched inflation gauge hit the highest since the 1980s, but in line with estimates. More importantly, the Employment Cost Index rose less than expected 1% (vs. 1.2% expected) and lower than Q3's 1.5%, providing some hope that inflation might be cooling down from here on. The yield on the 2-year fell 5bps following the report, and stock markets reacted positively, reversing morning session losses.

CFDs are complex instruments and are not suitable for everyone as they can rapidly trigger losses that exceed your deposits. You should consider whether you understand how CFDs work. Please see our Risk Disclosure Notice so you can fully understand the risks involved and whether you can afford to take the risk.

This website is owned and operated by FlowBank S.A, a company regulated by the Swiss Financial Market Supervisory Authority (FINMA) and a member of esisuisse. The list of banks and securities firms authorized by FINMA can be accessed here. Depositor protection in Switzerland is provided by esissuisse for a maximum of CHF 100,000.- per client. Details concerning this protection system are explained at www.esisuisse.ch/en

FlowBank is affiliated with the Swiss Banking Ombudsman. Therefore, if you wish to initiate a mediation procedure with the Swiss Banking Ombudsman after your complaint to FlowBank, please contact the Ombudsman according to the instructions provided on its website: https://bankingombudsman.ch/en/

The information on this site is not directed at residents of the United States, Belgium, Canada, or any person in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.

Trading Forex and other leveraged products carries high risks and may not be apt for everyone. Before you consider trading these instruments please assess your experience, goals, and financial situation. You could lose your initial investment, so don't use funds you can't afford to lose or that are essential for personal or family needs. You can consult a licensed financial advisor and ensure you have the risk tolerance and experience.

Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

FlowBank S.A, Esplanade de Pont-Rouge 9, 1211 Geneva 26, Switzerland

FlowBank S.A, Seidengasse 20, 8001 Zurich, Switzerland