582 days ago

The Fed raises rates by 75bps #fed $spy #USD #trading

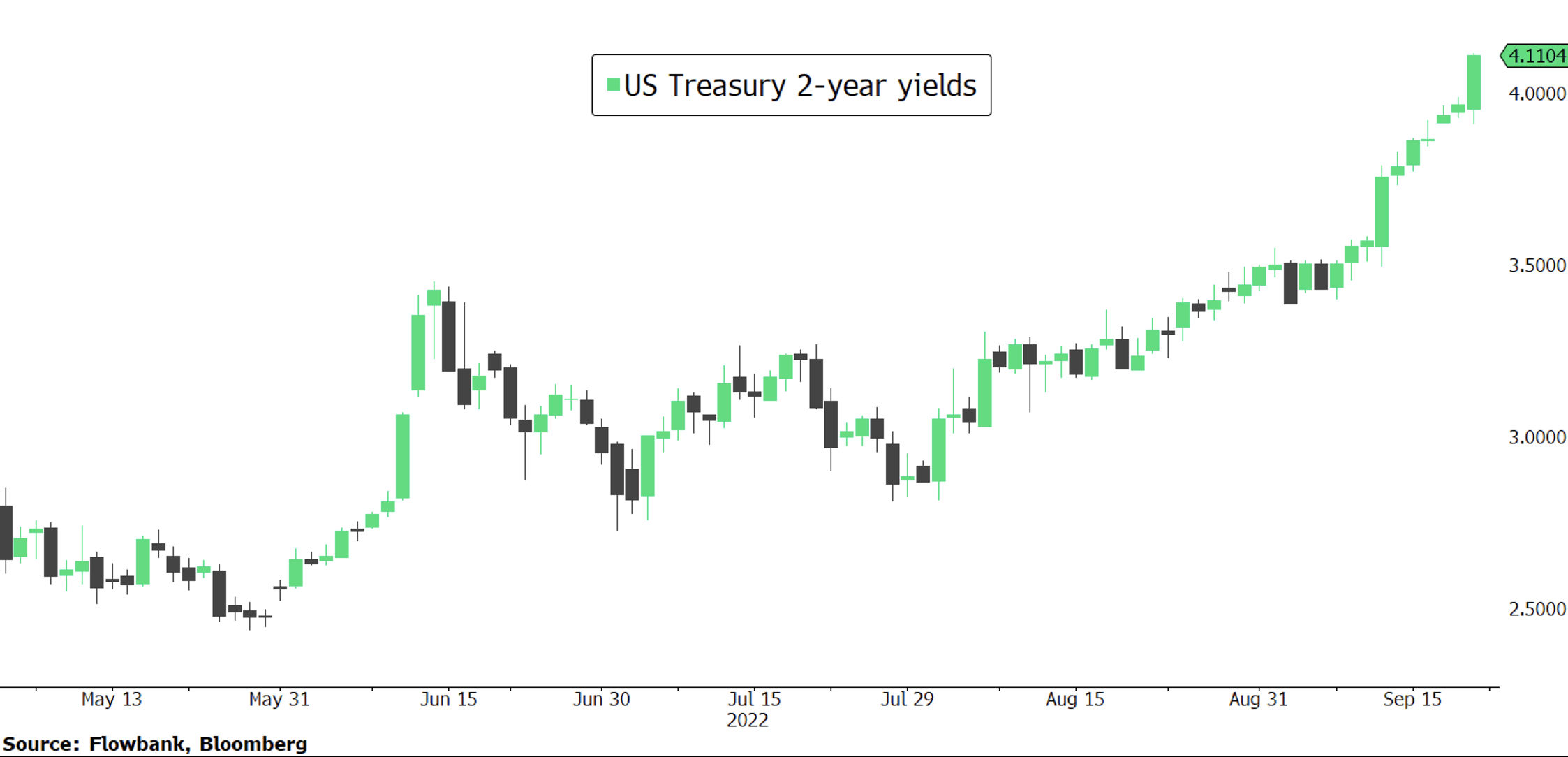

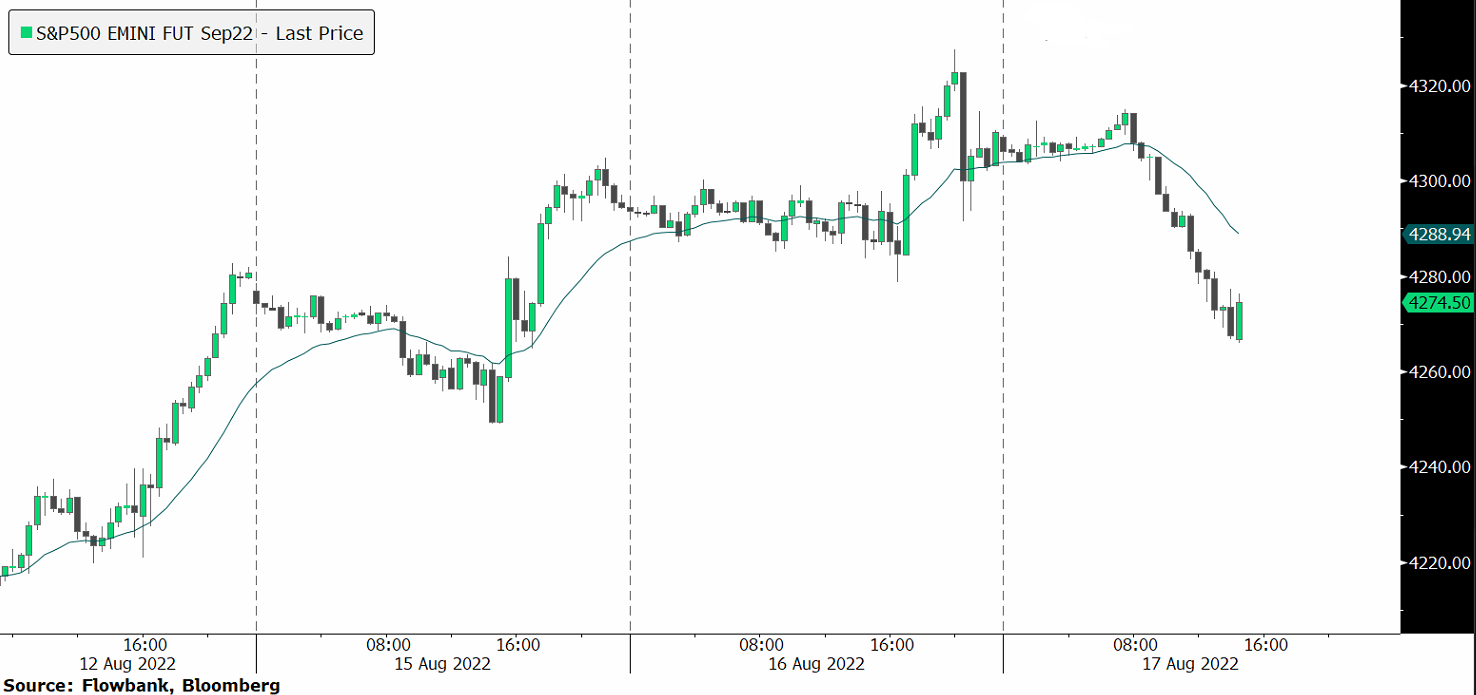

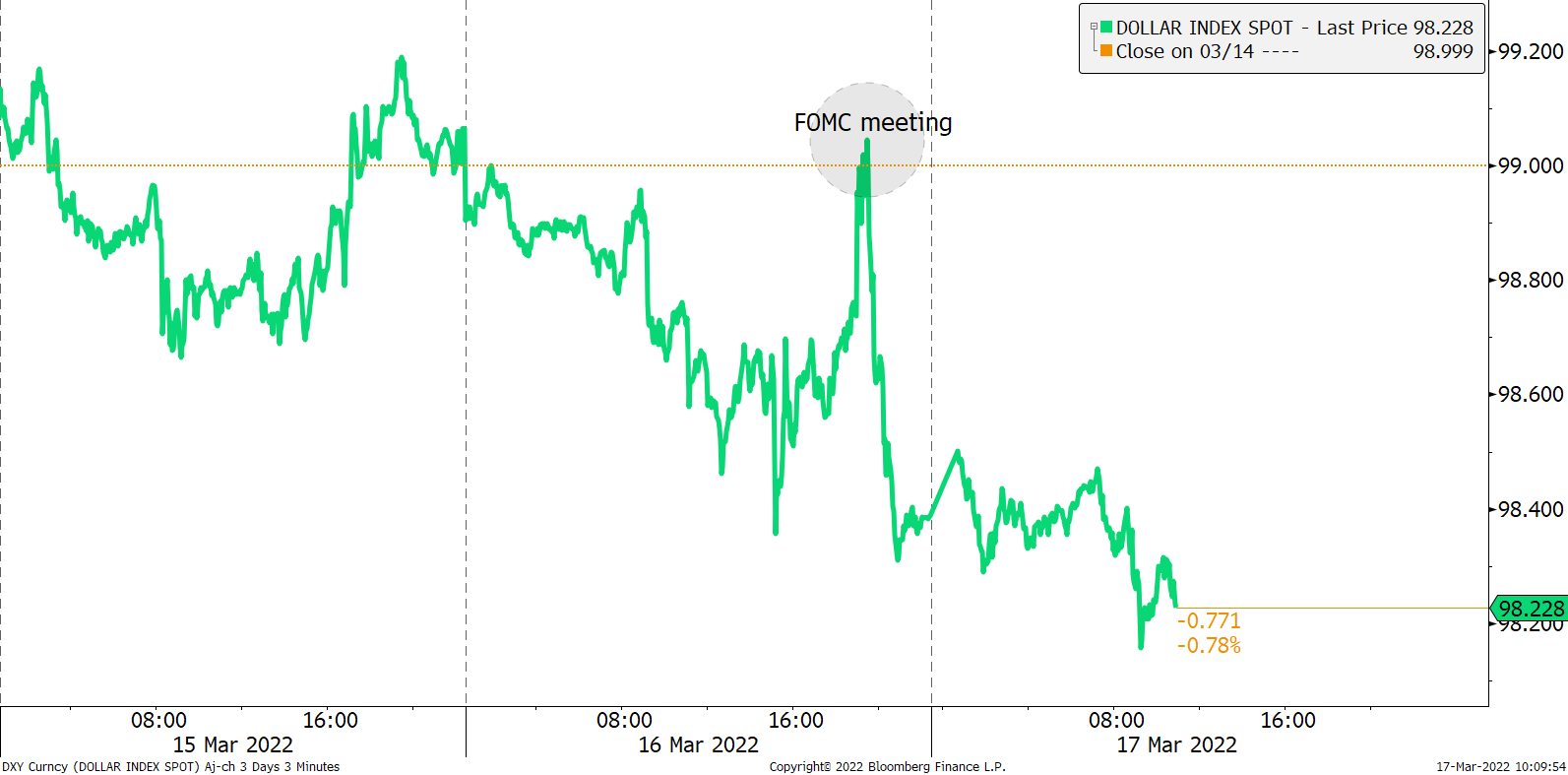

The Fed raises rates by 75 basis points and sees another 125 bps room until the end of the year. Moreover, the committee sees the terminal rate for this hiking cycle at 4.6%, up from 3.8% in the June dot plot. The dollar is roaring, while stocks and bonds are down following the release.