391 days ago

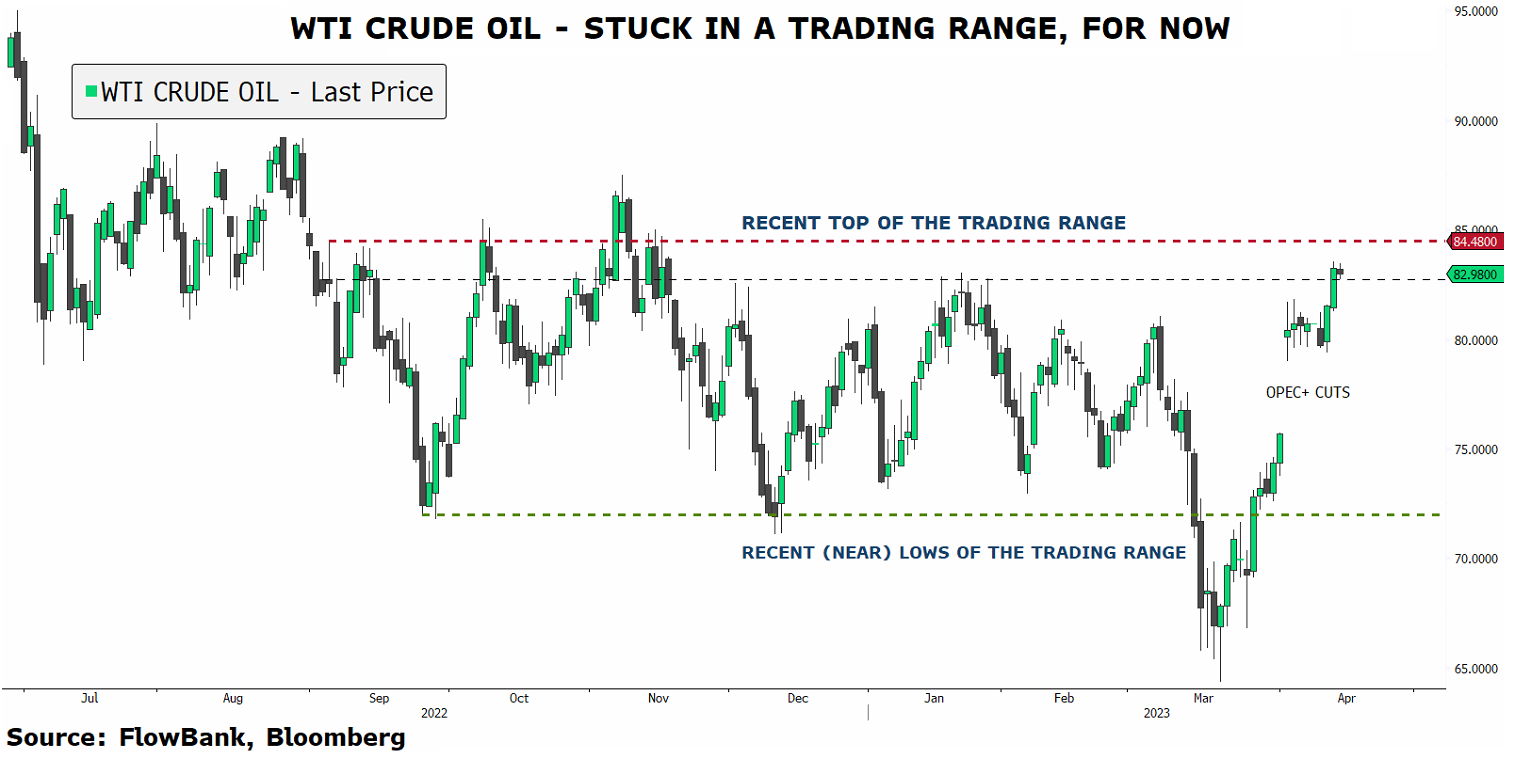

#Oil is stuck in a trading range. Here are the catalysts #trading #fx $USO

WTI Crude oil has rebounded strongly for 3 reasons. (1) First, supply is restricted in the medium term given OPEC+ vowed to cut further production. This comes on top of the reduction by Russia. (2) Secondly, global demand is not coming off track and we would need to see a sustained downward path in economic growth, which is not the case. (3) Third, the dollar has lost so much since November 2022, that the lower dollar is helping support oil prices. This should be a net negative for the overall stock market as it stimulates inflation. For instance, average retail gasoline prices climbed 8% since the end of February. April data could be worst given the recent surge.