325 days ago

#Gold shines amid uncertainty, weaker #dollar. #trading

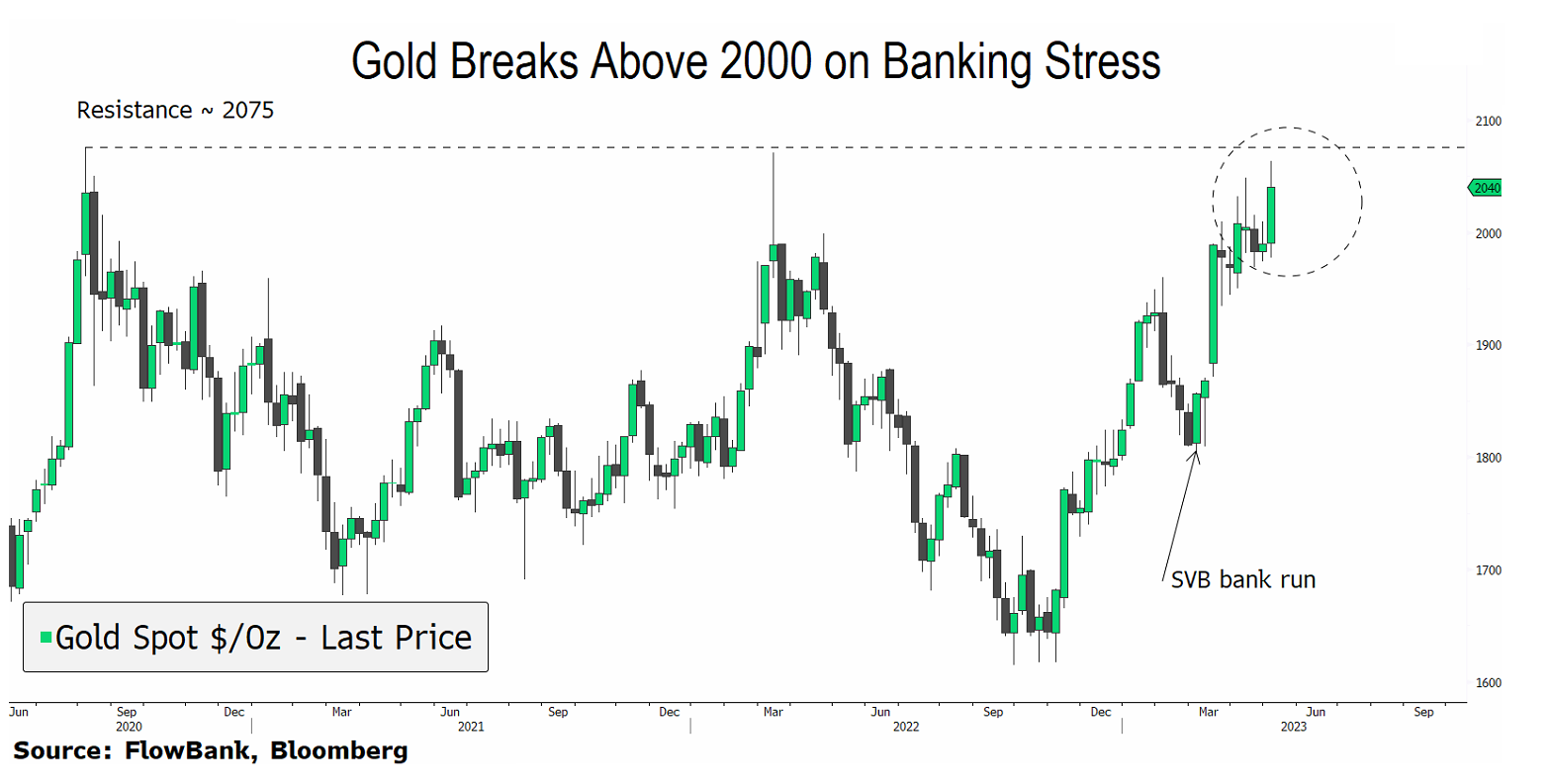

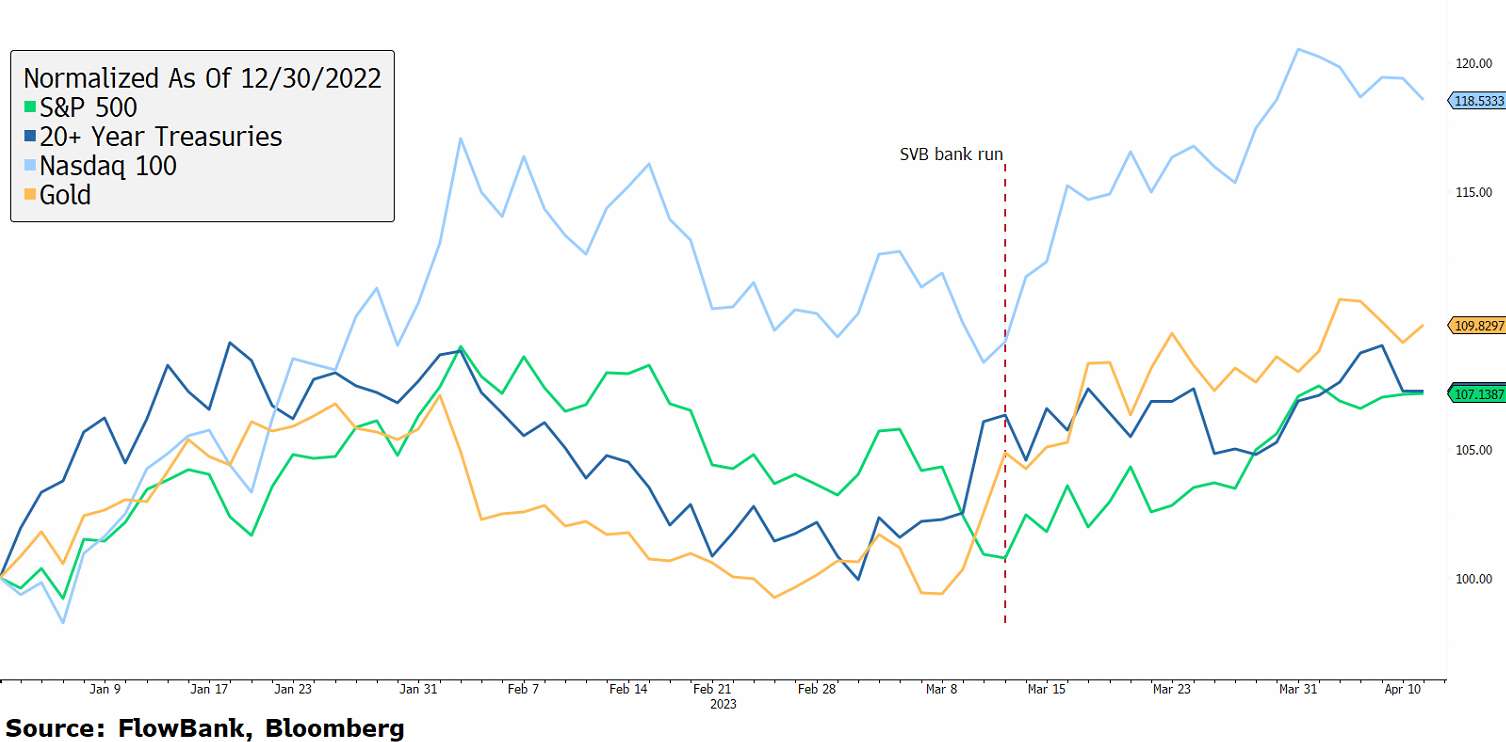

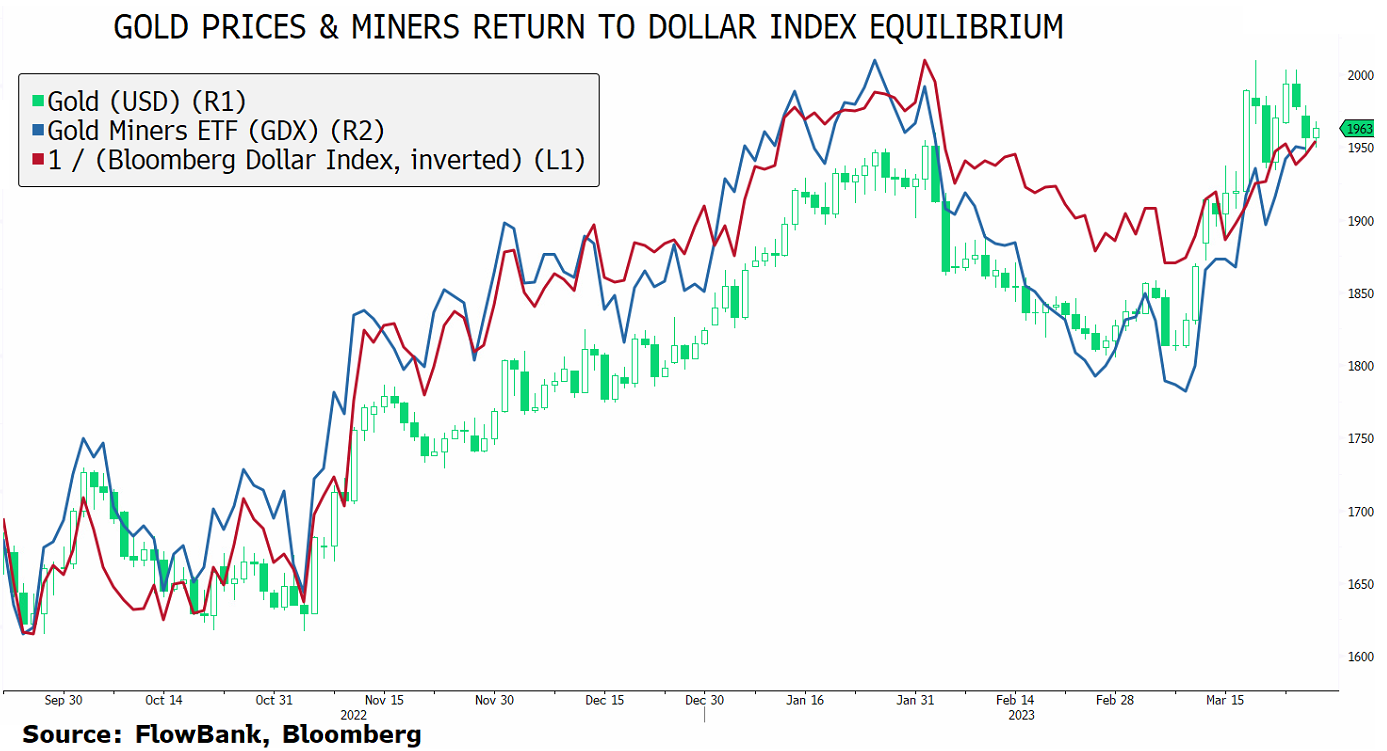

Traders see gold as hedge against uncertainty, weaker dollar. The weakest jobless claims since October 2021 sent the dollar into a tailspin, benefitting gold. But also, given stocks have rallied significantly and many are still doubting the rally, traders are betting on gold as a portfolio hedge.