340 days ago

Bond #yields suggest drop in #rates . Pivotal week for week, #nasdaq. $SPY $QQQ

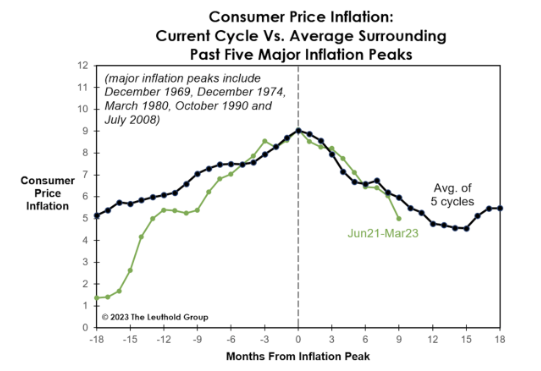

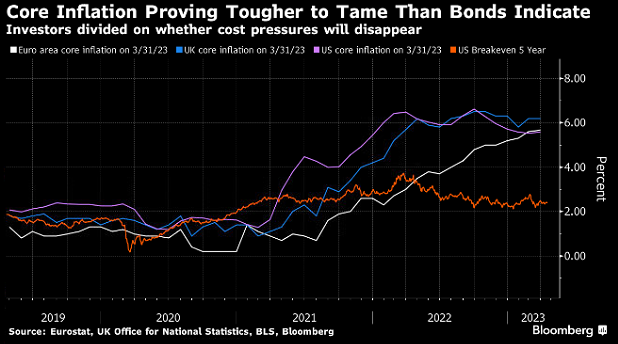

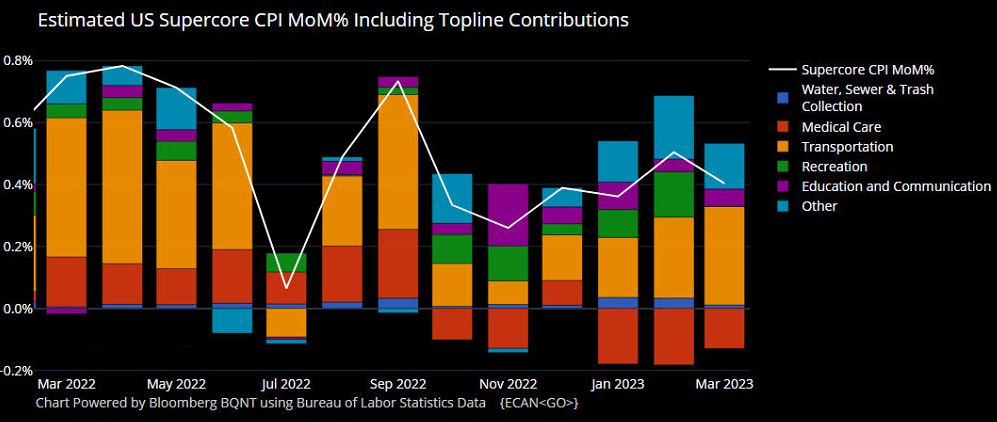

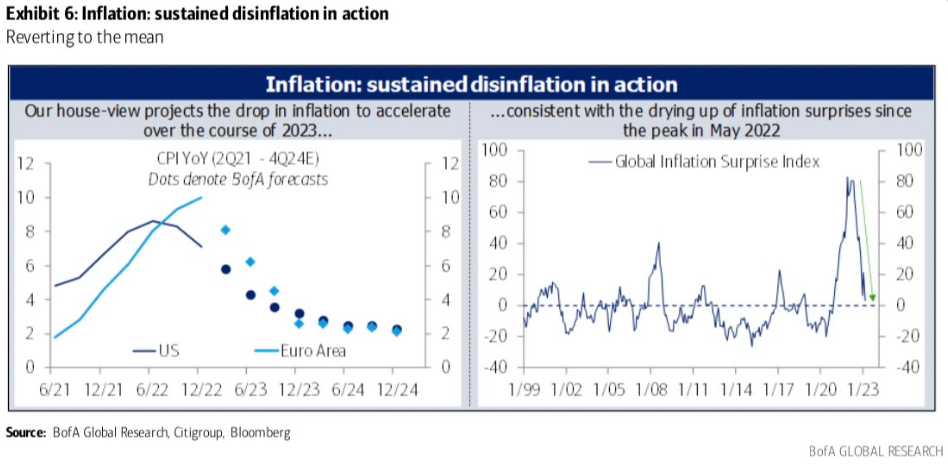

This week will be key to watch as FOMC minutes on Wednesday and inflation data with the US PCE on Friday could offer investors more clues on the Fed's next move. Currently, markets are forecasting only few chances of a June interest rate hike. But more worrying, markets expect many interest rate cuts in the next 2 years. Should core inflation and the labor market remain so persistently tight, it could be that the market switches to a view where interest rates stay higher for longer.