421 days ago

US inflation is cooling, #Stocks jump $SPY $QQQ

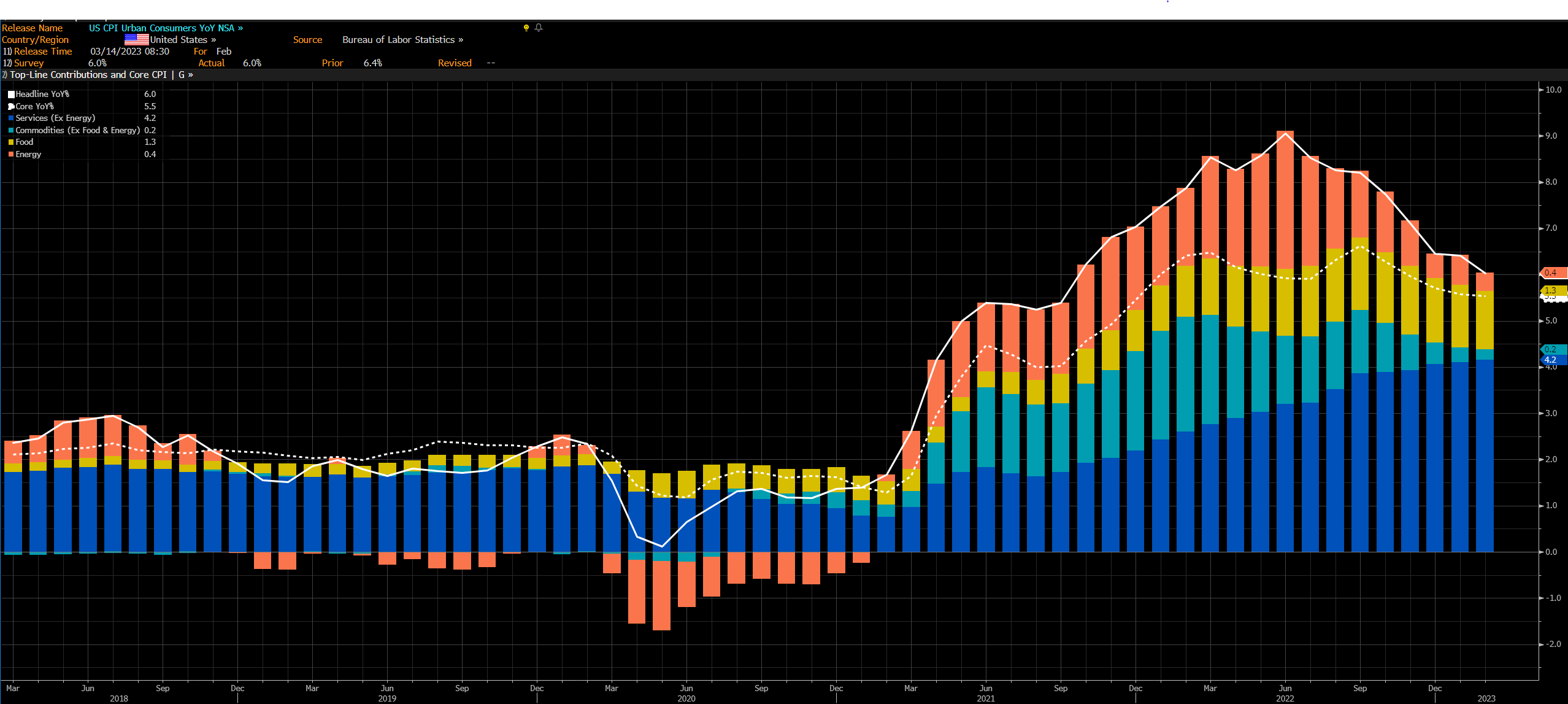

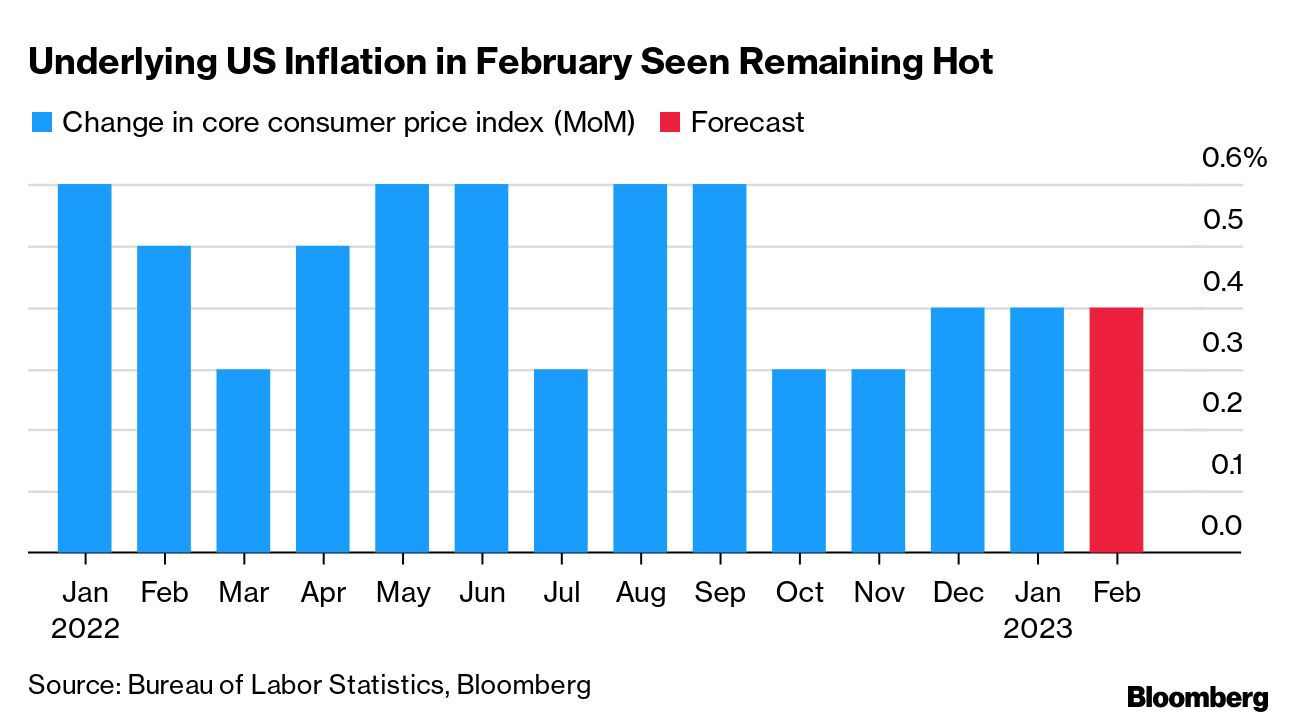

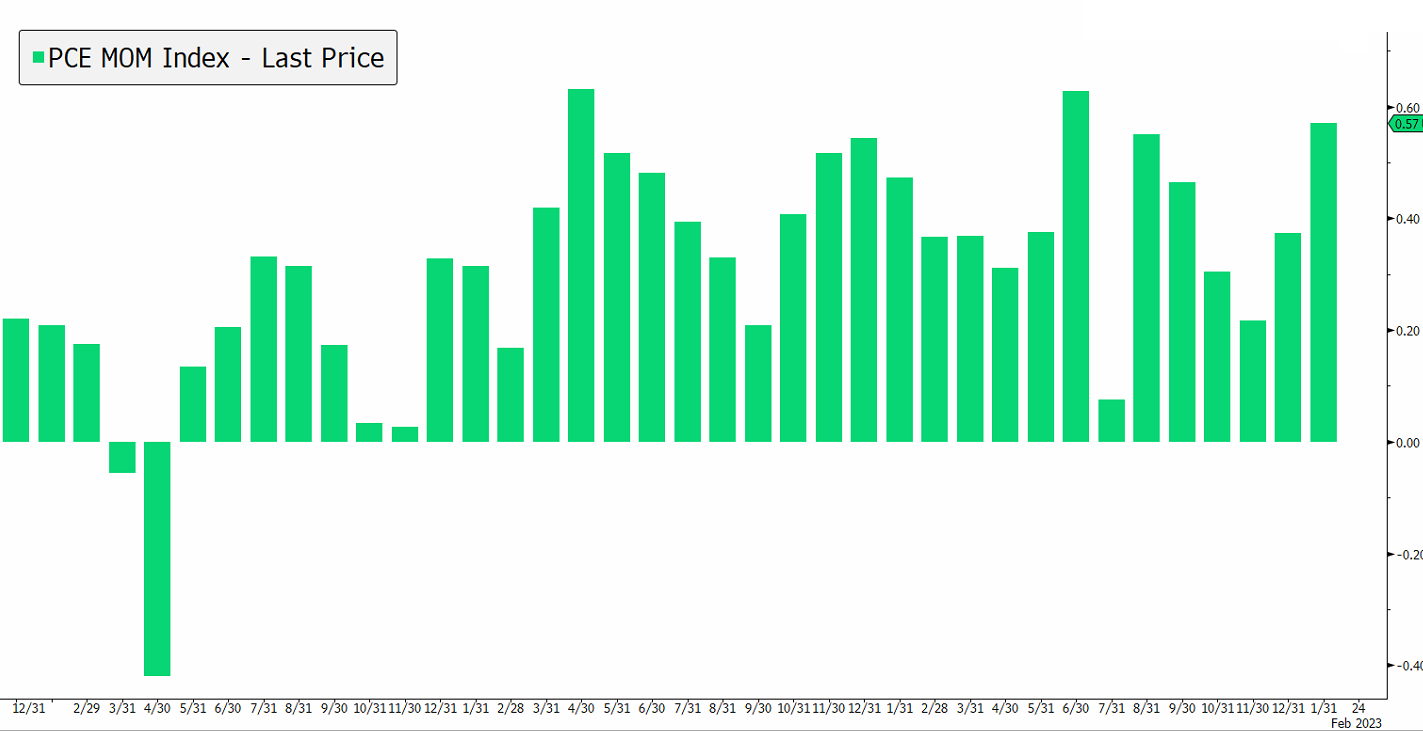

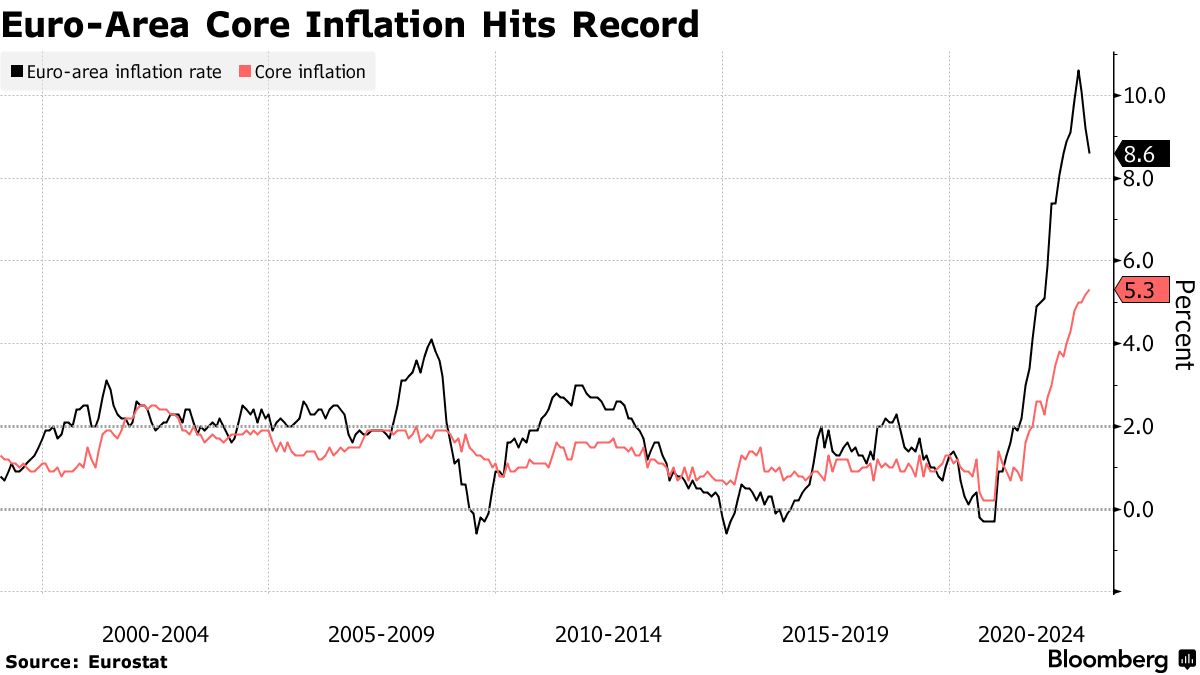

US CPI is showing signs of cooling, leaving room for the Fed to potentially 'pivot' on its rate hike cycle. Traders now turn eyes to jobless claims on Thursday, after the encouraging number last week.