348 days ago

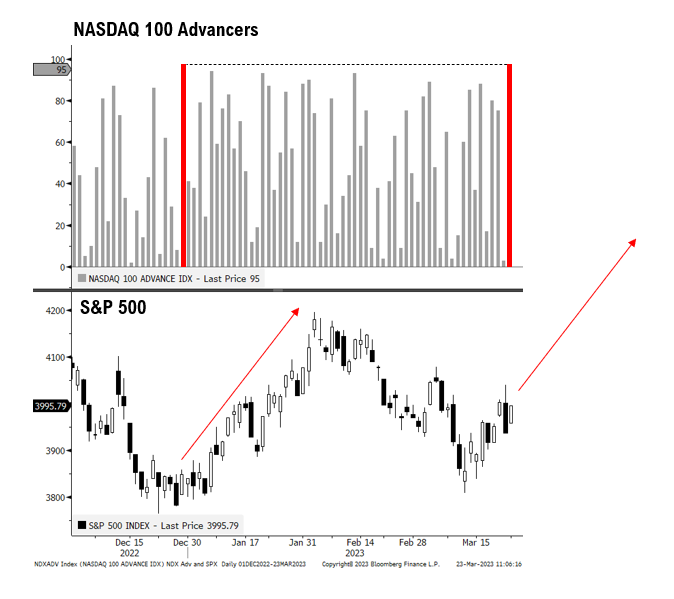

Institutional #investors have been selling #stocks ! $SPY $QQQ #trading

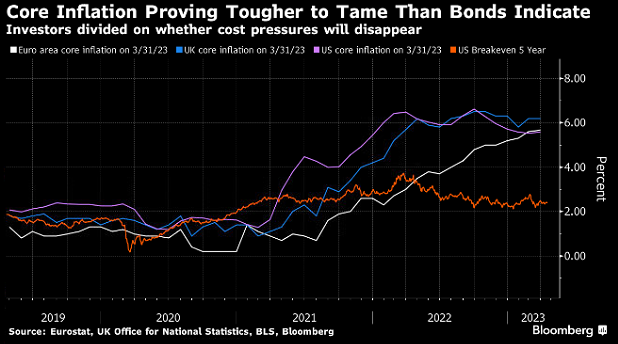

“Institutional investors have been dumping stocks for the last 12 months. You have to ask yourself some serious questions when you see this." Source: WSJ. In our view this looks relatively normal as we have quite likely emerged into a new bull market since the October 2022 lows. If this is not a new bull market it would be the longest bear market since 2000, when stocks had reached extreme bubble-like valuation. This stock rally is driven by earnings, and investors view of the end in sight of high inflation and rising interest rates.