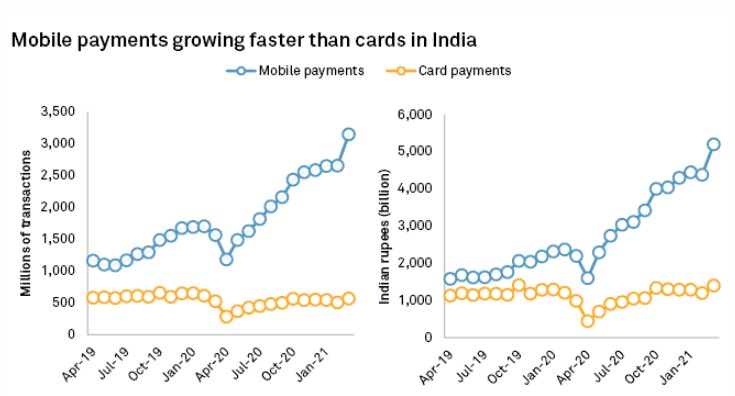

One97 Communications Ltd., set to launch what may become India's biggest-ever initial public offering, may invest more in its lending and wealth management operations to counter the thin margins in its main business of online payments, analysts say. The debut is widely anticipated as One97 operates Paytm, India's biggest online payments platform, and is 38% owned by Chinese fintech giants Alibaba Group Holding Ltd. and its affiliate Ant Group Co. Ltd. Investors are zooming in on the company's business model as online payments are rising exponentially in India, but the business itself is hardly lucrative for operators. A growing share of online payments in the country are done via a unified payments interface operated by the National Payments Corp. of India and backed by the central bank, which helps users avoid paying merchant fees. Source: spglobal