464 days ago

No change in #BoJ policy #fx #USDJPY

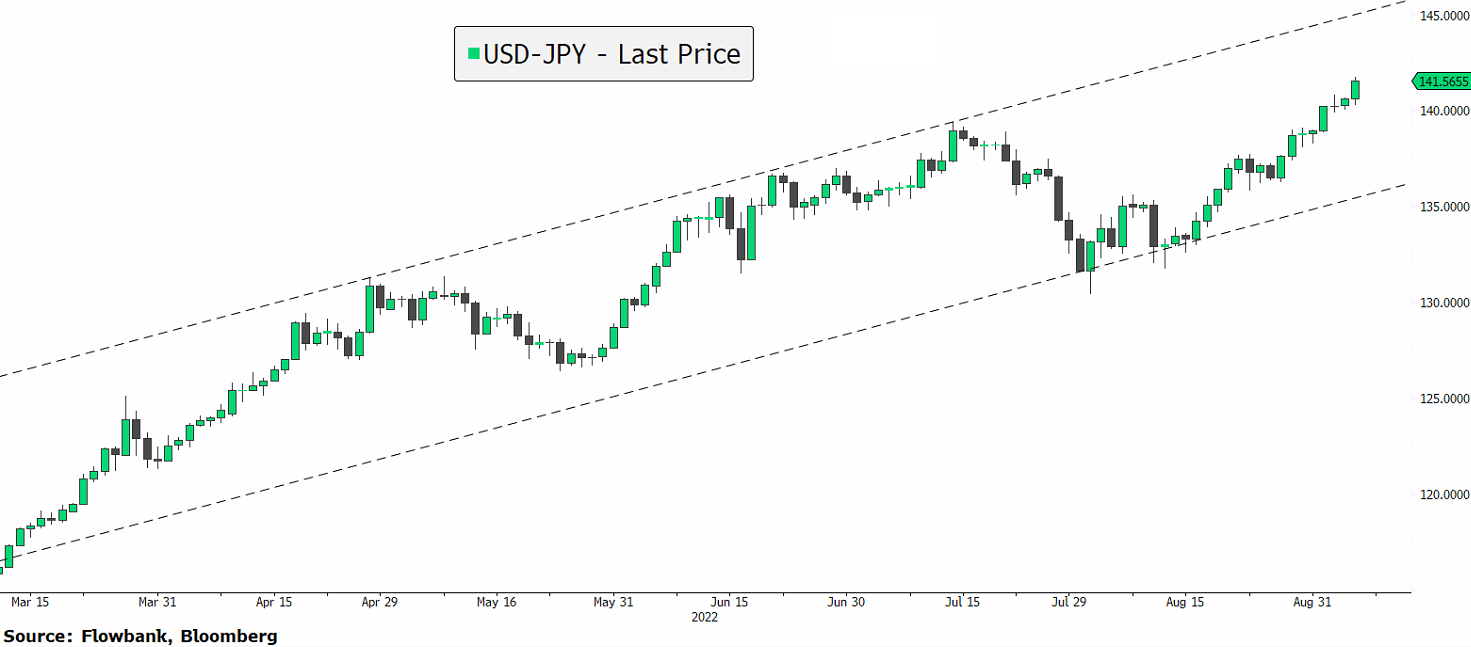

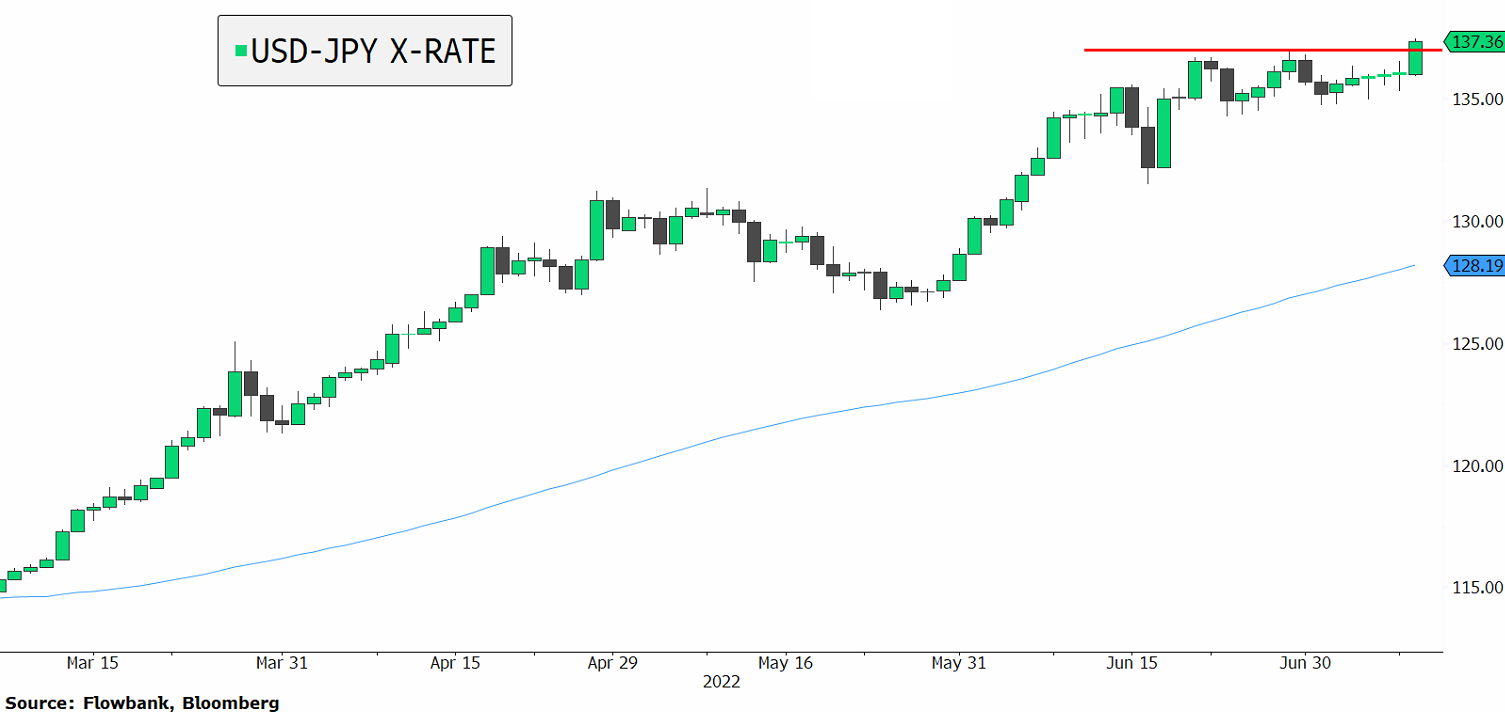

This morning, we had news that the Bank of Japan is not considering yet changing the yield-curve control policy. Japanese stock rose, and the yen tumbled 2% but it is seeing some recovery. We will be watching the USDJPY for a reversal in the trend. the support levels displayed in the chart are key levels to watch for.