360 days ago

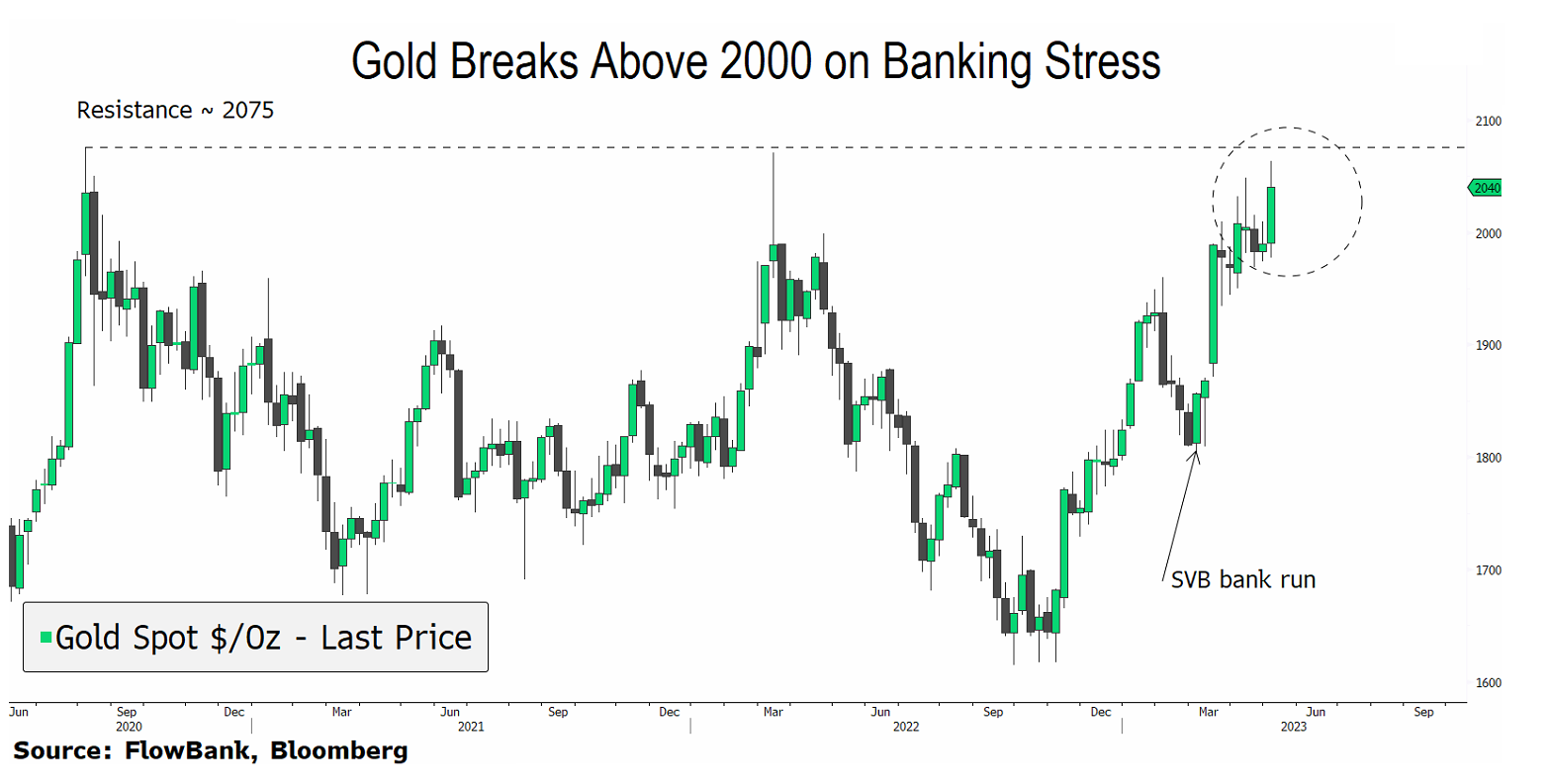

#Gold Surges on #Banking Stress $GLD #trading #fx #forex #crisis

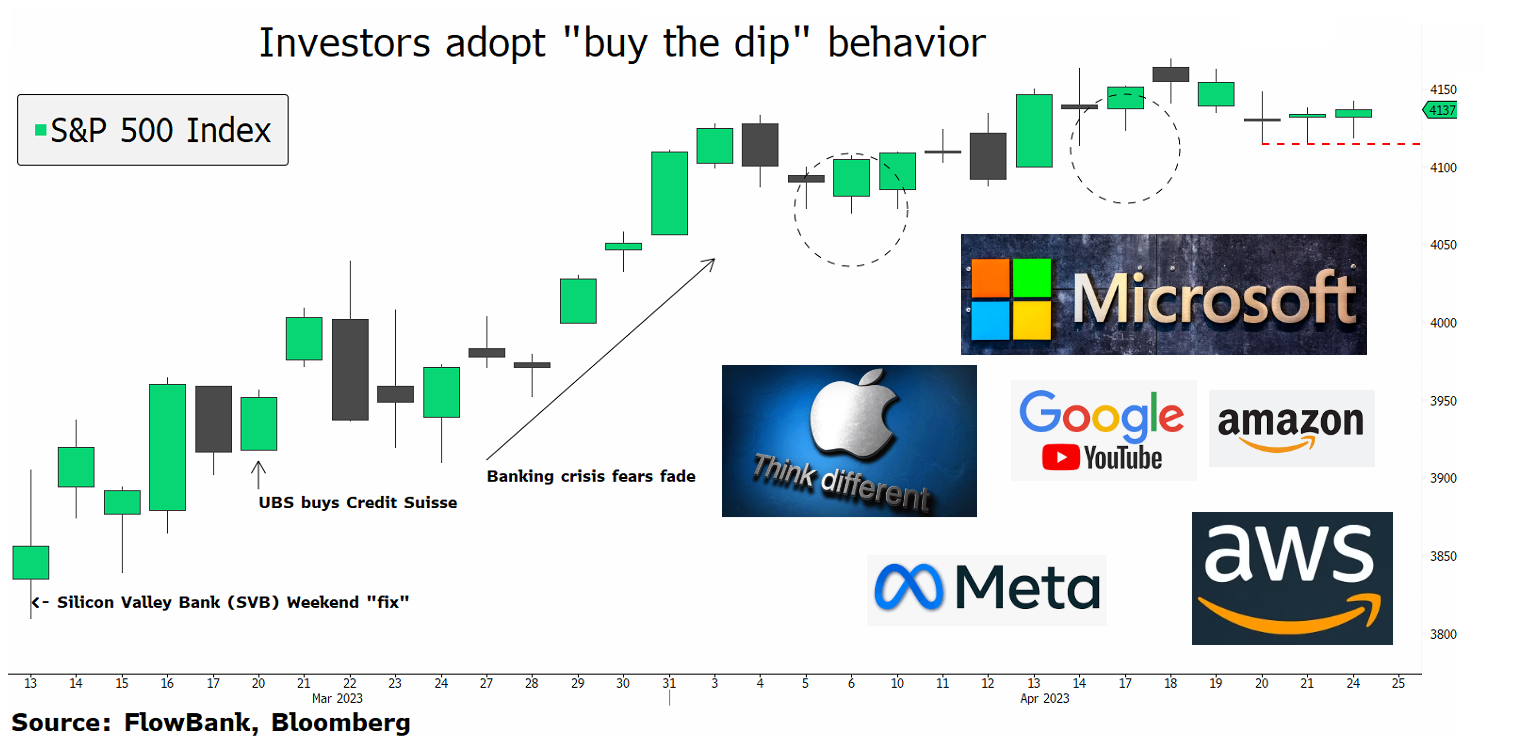

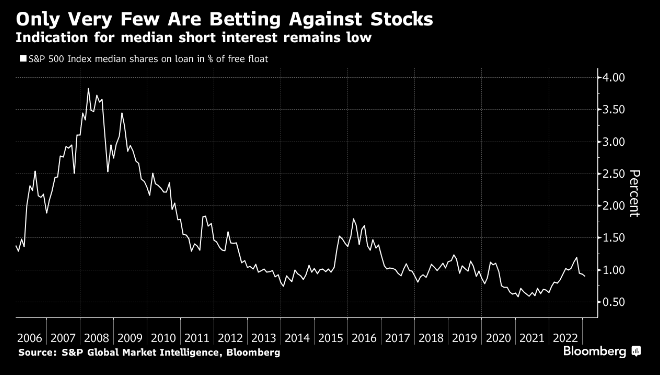

Gold traders are kept busy as gold surges on banking stress and a weakening dollar. The yellow metal is seeing persistent dip buying behavior as traders adopt the view that demand above $2000/oz will remain strong amid banking stress and overall strong investor demand, including buying by central banks globally. Will gold finally break lower or have we entered new normal where gold remains above $2k/oz?