453 days ago

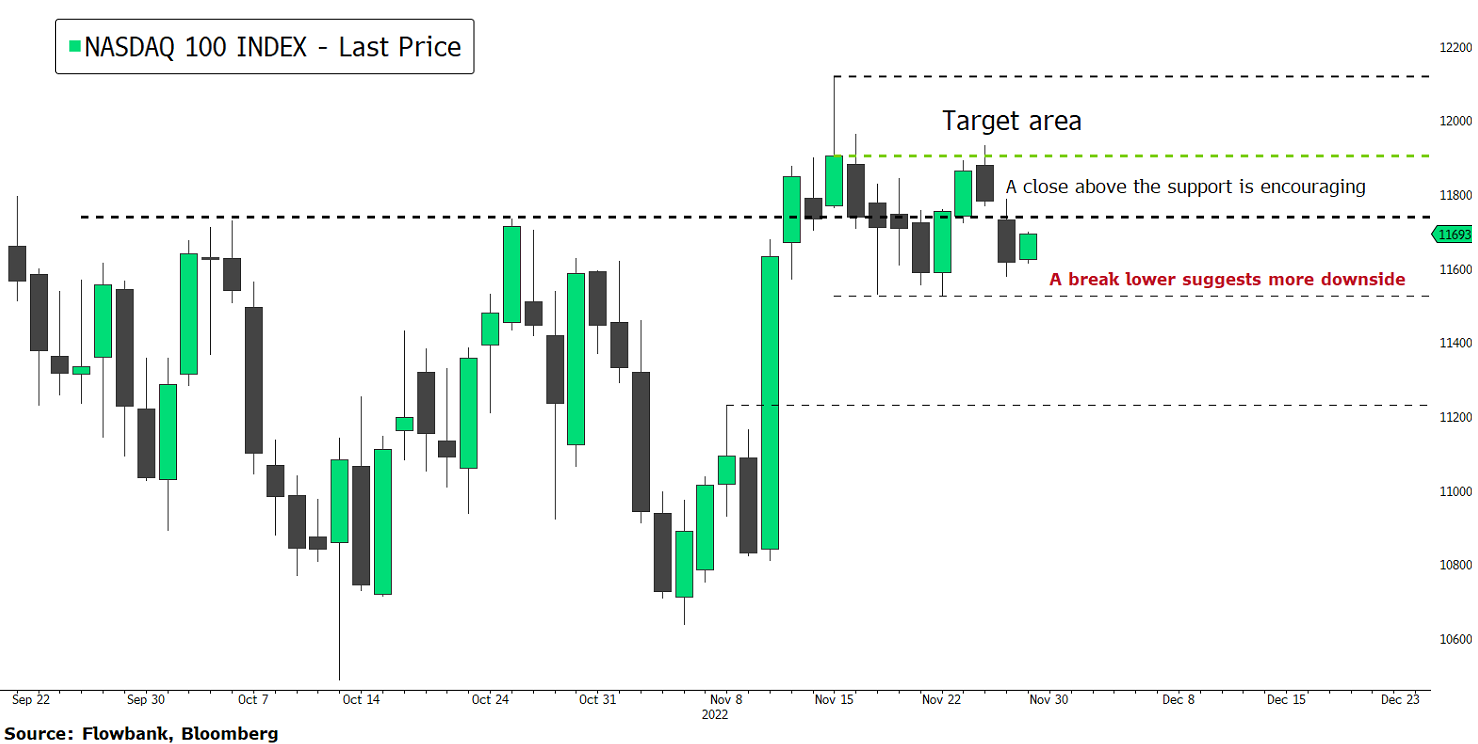

Stock Market 📆 : a Big Week for #inflation and #earnings #stocks #trading $SPY $QQQ $AAPL $TSLA $HD $WMT

This week we will have Fed minutes Wednesday, followed by PCE (US inflation) data Friday. And in Europe, German CPI on Wednesday, and Eurozone CPI on Thursday. We will also be watching GDP data, in the US on Thursday, and Germany on Friday. Earnings continue with Walmart, Home Depot, Paloalto Networks, and Coinbase on Tuesday. And semiconductor giant NVIDIA on Wednesday. Booking ✈️, Domino’s 🍕, Alibaba on Thursday. Monday is a holiday in the US, Canada, and Brazil.