530 days ago

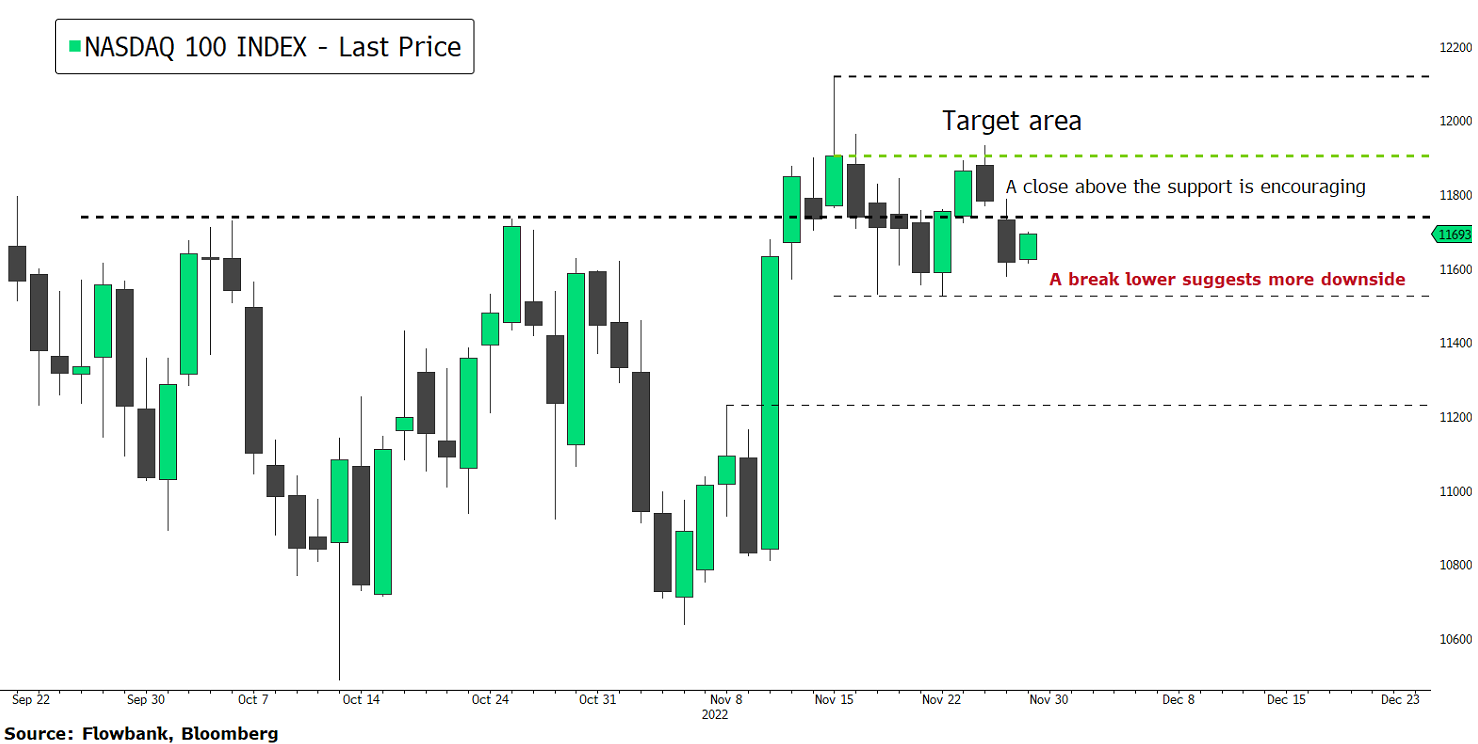

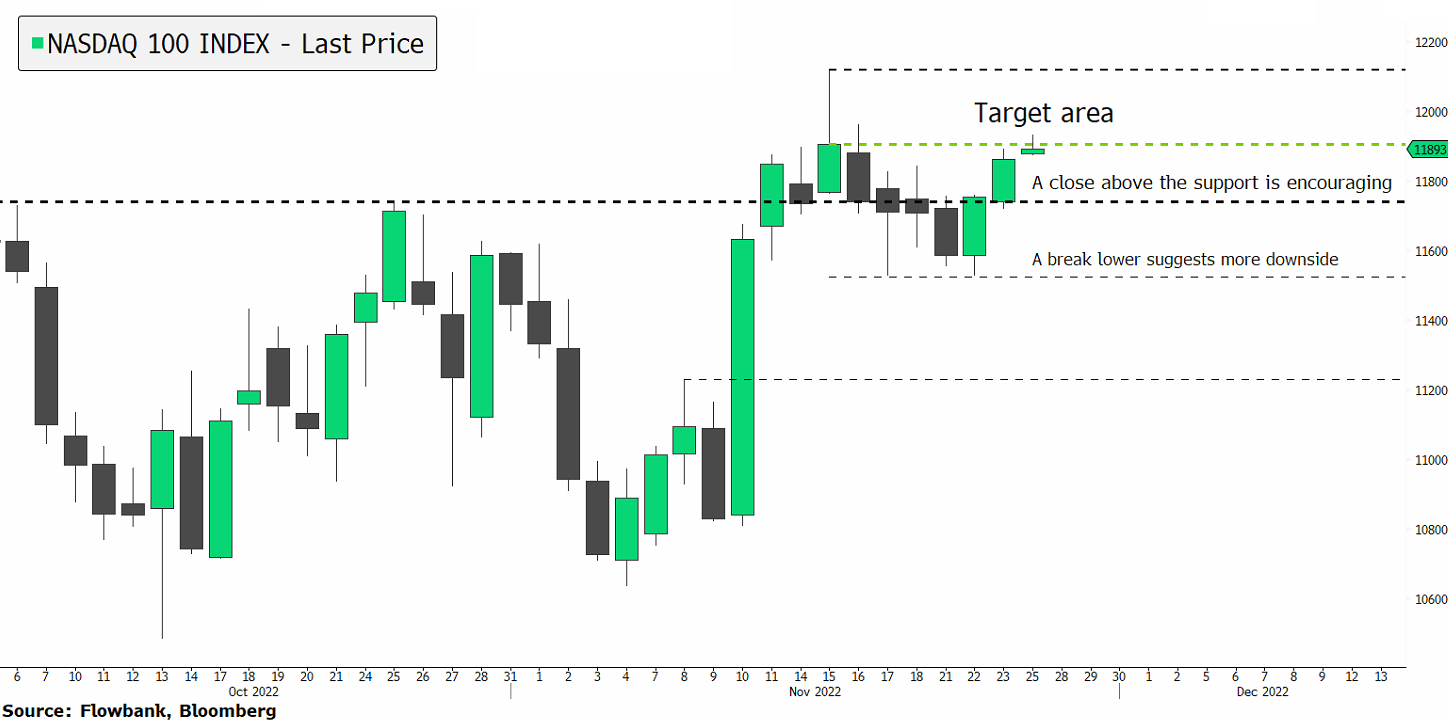

#Stocks recover on signs #China #reopening. #Nasdaq #trading $QQQ $SPY #markets #forex

Stocks are attempting to recover after yesterday's steep losses, led by Apple as traders worried protests in China could weigh on growth and cause further supply-chain bottlenecks. The Nasdaq is recovering with futures contracts up 0.7% in light of increasing signs China is clearing the path towards reopening and continues to boost Covid-19 vaccinations of its population.