750 days ago

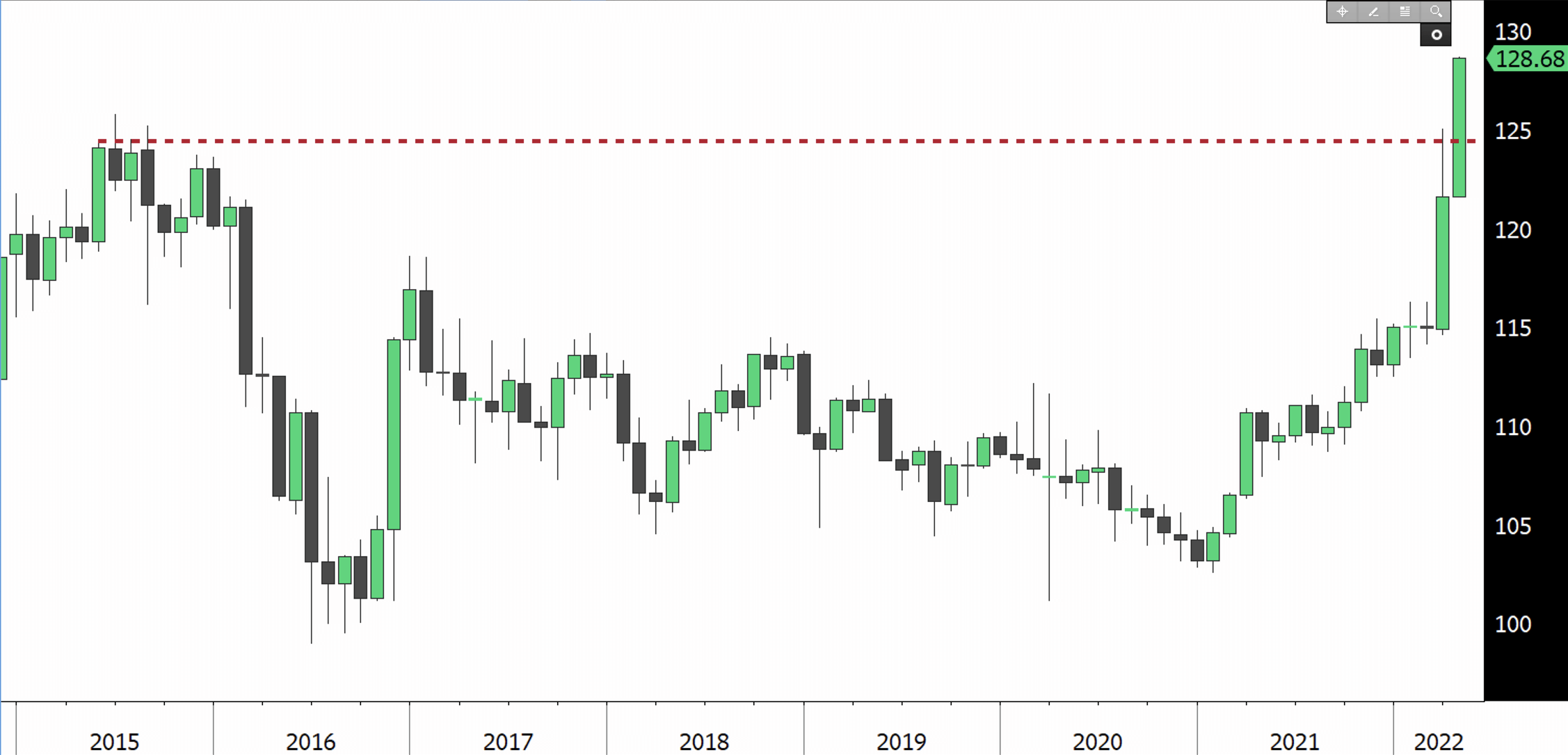

How higher can it go? #yen #USDJPY #rates #BoJ

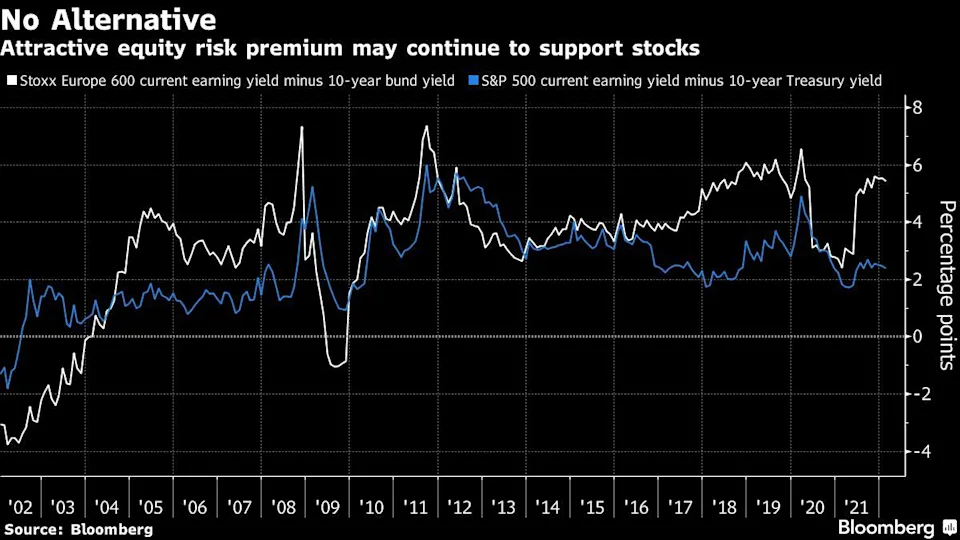

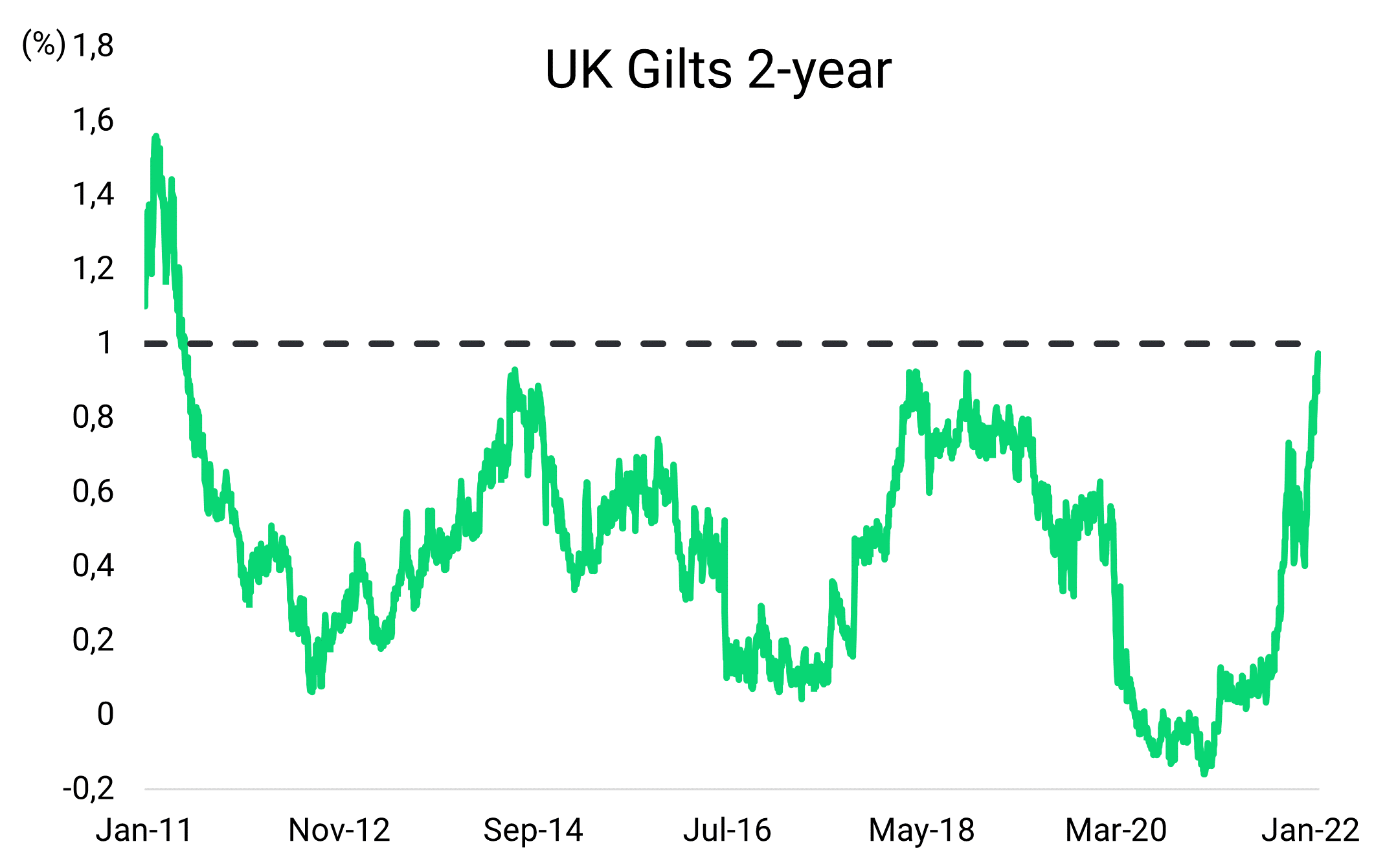

The yen's weakness is going crazy! New highs on USDJPY are the order of the day. The pair has now risen on 13 consecutive sessions, the longest since the 1970s! The ADX, a measure of trend strength, is now at its highest level since 1974. Reasons behind the weak performance: 1) slowdown in global growth is reducing the appeal of the yen, and 2) higher US yields are boosting the US dollar.