374 days ago

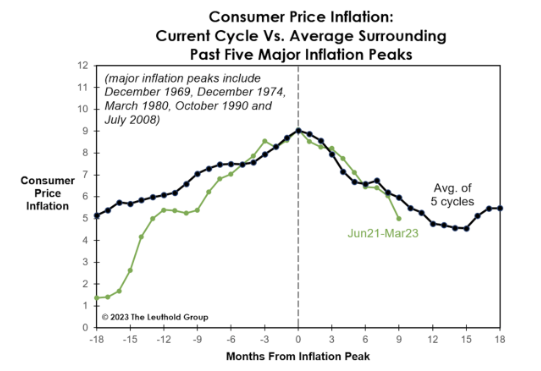

Perspective: #Inflation vs average cycle $SPY $QQQ #stocks #trading

Today is US CPI day. So here is some perspective, even though markets do expect a hot inflation print. Source: Chart from The Leuthold Group

374 days ago

Today is US CPI day. So here is some perspective, even though markets do expect a hot inflation print. Source: Chart from The Leuthold Group

375 days ago

This chart from Barron's is suggesting "Big Money" sentiment is still very much anchored on the low end, from a historical perspective. The chart suggests that stocks tend to recover after an initial market shock that leads to very bearish sentiment. There are a lot of other factors to consider, but that is the historical perspective. Some other indicators do point to a more "neutral" sentiment though. Do you agree about the bearish feeling or has overall investor sentiment recovered by now?

380 days ago

Oil prices tumbled as traders fear the perspective of rapidly falling global demand and ample supplies as traders speculate that Russia didn't reduce output as planned. The market is pricing uncertainty around the OPEC+ cuts given there are some signs Russia seems to have not followed through on the pledged output cuts. So, for oil traders, this should add volatility and make it more difficult to find a market equilibrium. For opportunistic equity investors, it could also offer buying opportunities as stress potentially comes back to oil-related stocks. However, the oil&gas sector may continue to underperform because of the weakening macro backdrop.

381 days ago

The US Federal Reserve is expected to proceed with its last interest rate hike Wednesday. Here are the average returns for the S&P 500 one year after last hike, in the past. The biggest hurdle in our view is valuations are now expansive. As a result, it is more of a traders's market, perhaps.

382 days ago

The VIX index, which measures the stock market's expectation of volatility based on S&P 500 index options hit its lowest level since November'2021. This is typically a sign that markets are COMPLACENT again. Markets can still climb higher and volatility can sink further, but it is telling investors are not so fearful now. Volatility picks up when traders are nervous, can't decide, and want to only take short-term positions or hedged. That's typically when there are more opportunities for active investors building positions or active traders. (think Mid-march, SVB crisis as an example).

CFDs are complex instruments and are not suitable for everyone as they can rapidly trigger losses that exceed your deposits. You should consider whether you understand how CFDs work. Please see our Risk Disclosure Notice so you can fully understand the risks involved and whether you can afford to take the risk.

This website is owned and operated by FlowBank S.A, a company regulated by the Swiss Financial Market Supervisory Authority (FINMA) and a member of esisuisse. The list of banks and securities firms authorized by FINMA can be accessed here. Depositor protection in Switzerland is provided by esissuisse for a maximum of CHF 100,000.- per client. Details concerning this protection system are explained at www.esisuisse.ch/en

FlowBank is affiliated with the Swiss Banking Ombudsman. Therefore, if you wish to initiate a mediation procedure with the Swiss Banking Ombudsman after your complaint to FlowBank, please contact the Ombudsman according to the instructions provided on its website: https://bankingombudsman.ch/en/

The information on this site is not directed at residents of the United States, Belgium, Canada, or any person in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.

Trading Forex and other leveraged products carries high risks and may not be apt for everyone. Before you consider trading these instruments please assess your experience, goals, and financial situation. You could lose your initial investment, so don't use funds you can't afford to lose or that are essential for personal or family needs. You can consult a licensed financial advisor and ensure you have the risk tolerance and experience.

Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

FlowBank S.A, Esplanade de Pont-Rouge 9, 1211 Geneva 26, Switzerland

FlowBank S.A, Seidengasse 20, 8001 Zurich, Switzerland